12/15 Recap. Things Are Looking Dire For Bulls.

I’m gonna make this post public which I rarely do just because so many on Twitter have asked me what is next.

What a nasty day. This should have happened yesterday when I had my puts but the market makers never let things play out as they should, once all of yesterday’s options action expired, they market plunged to its rightful spot below 390. I can’t really complain as this was what I’ve been looking at occurring for some time now. We have to face reality that earnings are set to decline, seasonality is not a thing, and the charts are the charts, they never lie. People ask me for my 2023 prediction often. In my opinion, it is going to be a rough year, we’re going lower, we probably end up here in this same 4100 range at the end and the buy and hold types will be frustrated in my opinion. Those of us who follow options flows and sell premium on directionally strong names like I try to do in here will continue to outperform. Let’s get into today’s charts.

The SPY knifed through so many key levels the last 2 days. I’ve said many times recently that under 390 is where things start to get ugly for the bulls, we closed below that today but we have tomorrow to finish out the weekly candle, for the moment things are not looking hot there either. The 8/10 EMA are broken and pointing down, the RSI is pointing down, and the MACD is rolling over. Nothing here is bullish, but I’ve been saying that for days, its just finally playing out.

The weekly on SPY shows a very concerning candle forming. IF this closes looking like this tomorrow, it won’t bode well for equities. the MACD is still green on the weekly but a nice bearish divergence is forming which should have bears foaming at the mouth. Tomorrow could be bullish still, its MOPEX day and market makers are going to move stocks in a crazy manner. Either way the following monday when all the gamma clears out we should have a big move.

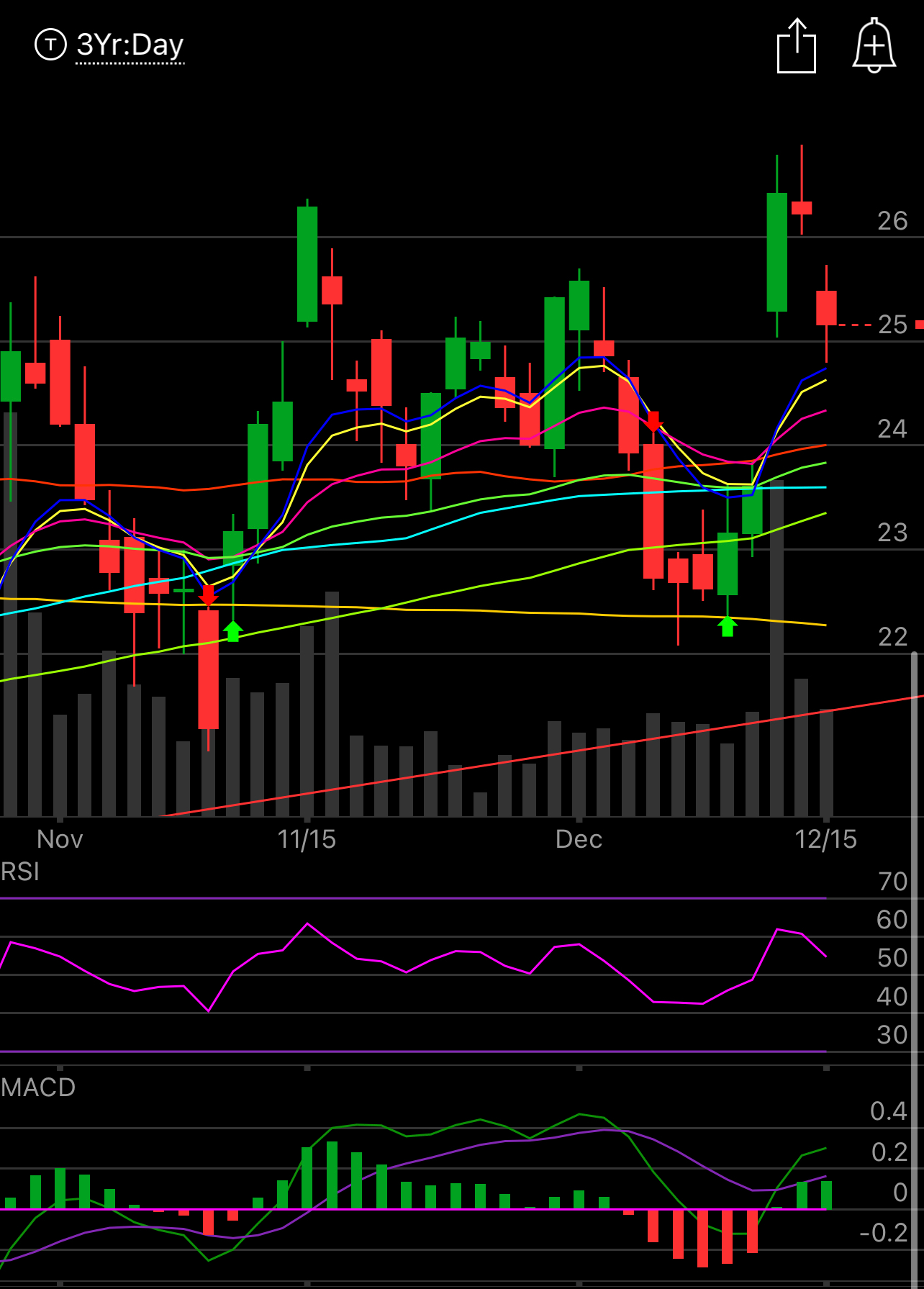

What should concern bulls more is that even with this huge dip we’ve had, the VIX is not even 23 now. We haven’t even seen real panic selling, a VIX over 30 is typically where the selling ends and the buying begins, so we have a long way to go as far as this is concerned before the real buyers step in.

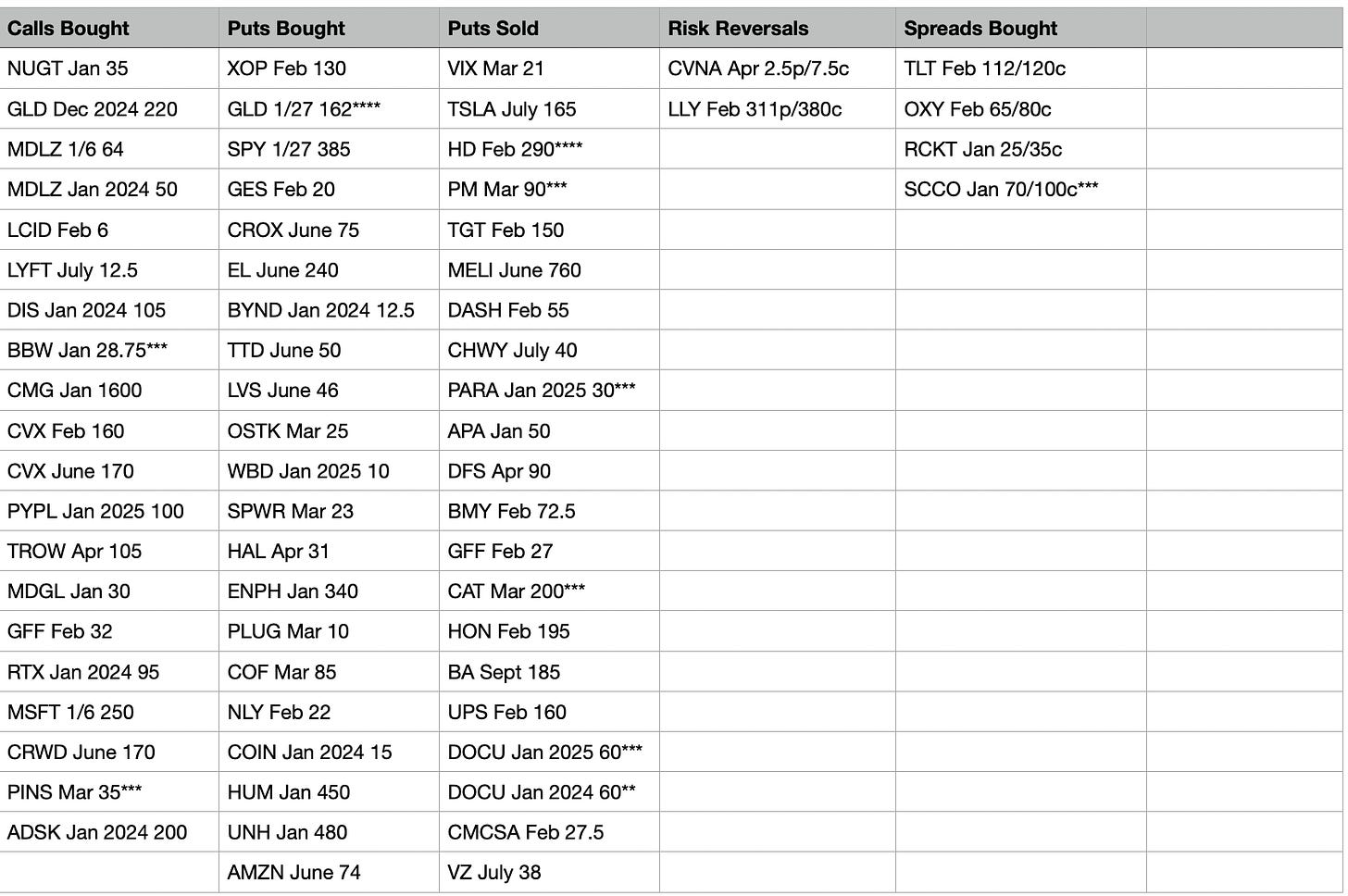

Today’s Unusual Options Flows & What Stood Out

HD saw a huge lot of 20,000 puts sold in February looking to mark a bottom at 290.

AMZN had an intriguing put buy at 74 next June, 4000 of these bought. I can’t think of a weaker name and although the fundamentals don’t support a valuation that low, crazier things have happened short term before.

PARA saw a large deep in the money put sale at 30 for January 2025. This is a deep value name that even Warren Buffett owns a chunk of.

DOCU had 2 very large put sales today in January of 2024 and 2025 at the same $60 strike. This has been a strong name since earnings.

SCCO saw an unusual call spread bought today in January using the 70/100 spread.

PINS saw 40,000 March 25 calls bought today. A huge trade in a name I love.

GFF Is another name I have a large position in that continues to see flows. A name nobody really discusses but today saw Feb 32 calls bought and Feb 27 puts sold. They continue to see bullish upside here.

Trade Of The Week Update

Splunk continues to hold up decently from its earnings run. For those that are new here, I am a big believer in the concept of PEAD which is post earnings announcement drift. Splunk had a fantastic quarter growing all the right numbers, it should continue to be strong throughout the following quarter. I still favor that gap to fill and that’s why I target it via put selling. It’s a rare occassion to have a gap not fill and with the market looking to roll over, this is a distinct probability.

What Did I Do Today?

I actually traded inline with the Nasdaq today which surprised me considering how much leverage I put on yesterday and today on mostly tech longs. I used today to somewhat make my final tax loss positioning trades of the year. I took trades that weren’t looking pretty for 2022 expiration and rolled them out to February.

I rolled AMZN 12/16 86 puts to Feb 2023 75 puts for 2.06

I sold META Feb 2023 puts at 90 for 2.40

I sold PINS 12/23 24 puts and 12/30 23 puts

I rolled SPLK 12/30 80 short puts to February 72.50 for 2.39

I sold VZ Feb 2023 34 puts for .21

I sold OXY Feb 2023 57.50/55 put spreads for .62

Here is what I’m seeing in all those

Pinterest for the moment has nice relative strength, it’s above all the moving averages, the MACD is positive and the huge call buy at $25 in March today was welcome support. This has had everything go right recently, so much so, even Jim Cramer’s recommendation hasn’t sent it into a tailspin. The gap fill just below 24 is a natural spot for it to correct to if it does and that’s why I’m selling $24 puts.

The OXY weekly chart lines up with the 57.5 short puts I’ve sold. 58 has been the level where Mr. Buffett continues to add and I’m going to use it as my spot to attempt to catch this falling knife. Oil hit oversold levels this week and has had a nice bounce since.

The META puts I sold at 90 in February are below the 94 level where META gapped up on the news it fired staff. 88 is the years low and that’s around the level I’d be put shares at with 90 puts I sold short. Year lows should hold for a double bottom here if it gets there.

The Amazon puts I sold are tricky. This equity looks horrible, look at this monthly chart below. The RSI on the monthly is at its lowest point in over a decade, this is so beaten down I can’t suggest a buy no matter how good the valuation is. Just sell puts and hope it falls to you but $75 should hold, aside from being sub an $800b valuation it is below the covid lows and around the next big support level.

As I’ve said all year my concern isn’t so much the day to day performance of my portfolio as is the positioning I’m setting up with my short puts for where we are headed and the overall cash in the account which keeps ticking up. When you’re short puts, worst case you roll out a few weeks/months until you get the bottom you’re looking for. At this moment I’m setup nicely to where even if the market dips 5-10% in the next few weeks, my puts are all sold at much lower levels where I would be put these good names at levels with technical and fundamental backstops. Overall, the next 2 weeks are going to be very slow, volume dries up as many are out of the office until after new years. Tomorrow’s OPEX is likely the last large volume day of the year.

I know overall we all have different balances and trading styles, me having a larger balance, I’m a premium seller, you may be a premium buyer, that’s fine, we all started somewhere, but the bottom line is as long as you utilize all the unusual options flows I post everyday, overlap them with some charts, you have the first step in your discovery process of finding a name and it’s directionality. That’s all that matters in trading, being directionally right in a shorter timeframe.

I will be back saturday with all my best ideas for the following week. I hope you all have a great day tomorrow!

Thanks again for all your research and suggestions. I think I’m calling it a year, I don’t need to be a hero in this market after the past several months. I think you’ve said you don’t like Biotech but would be interested to hear if you have any thoughts on CVRX. It was recommended to me by a few doctors who understand the tech. It is essentially a pacemaker but for regulating blood pressure. I believe it’s going through regulatory approval. Apparently it’s a risky procedure because you can hit an artery or something like that, but they say the tech is legit and game changer. RSI is 72 so just watching for now, but the chart looks incredibly strong to me. I’m interested in taking a position once it cools, but curious if this is something you would ever consider or if it’s junk in your eyes

Hey James, any reason you're avoiding January expirations?