1/24 Recap

The SPY is hitting new highs, there is nothing bearish about that. Next week we have alot of things from economic data to FOMC to some big earnings. We’ve just gone straight up almost 7% in 9 sessions. A little digestion would be normal here as the 8 and 21 ema catch up. How will the fed work with Trump, we know Powell and Trump have had their issues and Donald has wanted to fire Powell, so lots of things to see next week in this FOMC. For now though, there is no fear in market participants.

Recent Trades

NVMI - This risk reversal was placed on January 8th here. At the time the name was just under $220 and it is now up almost 15% to 250+. This trade was for a credit so there was zero cost and it is now up a ton. These risk reversals on obscure names continue to be great alpha generators.

My Open Book

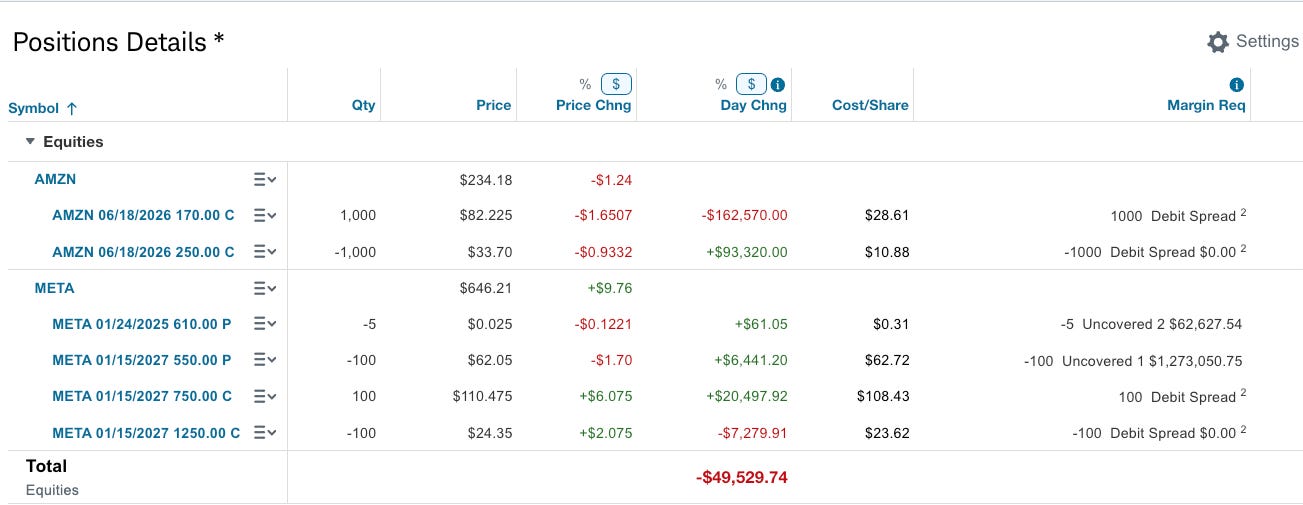

So you’re going to notice something big, I closed up almost all my positions today and added one huge one in META. Why? For starters I was running massive leverage and with earnings season and FOMC coming up I didn’t want to anymore. Secondly I’m up over 13% to start 2025, here’s the screenshot from my brokerage. I remember when 13% was a good year before we entered the everything up everyday era of stocks but the leverage I employed worked about as good as I could have hoped and now I removed it.

Another reason was I saw a trade today in META that I’m going to discuss in a whole separate post you will get after this one. I felt I could structure a trade in a manner where I had to take it. META is one of my favorite names and I wrote it up as a best idea if you remember a few weeks back. With today’s obscene call buy, I had to take my shot and unfortunately utilizing the risk reversals I love requires a ton of margin. As you can see below just 50 put sales on META ate up a huge chunk of my margin so I had to trim everything else. As I said I will write it up deeper for you in another post.

Today’s Unusual Options Activity

Here is today’s link to the database it will be open until monday morning