1/8 Recap

Sending recap a little early, I have to head out. The SPY continues its bearish trend after yesterday’s reversal and now the 100 day is in sight just 1.5% lower. This market is not pretty right now, if you’re buying short term calls, you’re going to get hurt. You’re better off selling puts into support here with an elevated VIX. We have a big bond auction this afternoon and some economic data coming friday as the SPX is pricing in a sizable move for friday right now. This isn’t anything crazy, we’ve gone straight up 70% for the last 24 months, a little sideways or down period is perfectly normal. Just understand we’re in a bearish trend and don’t overdo things right now. You will survive until the next uptrend which could begin as early as 2 weeks from now if earnings from the megacaps come in strong. For now, let go of all your short term trades and call buys unless you’re ok being stuck with them for a little bit because the long side of things is just not the trade until we pop back over the 50 day.

Recent Trades

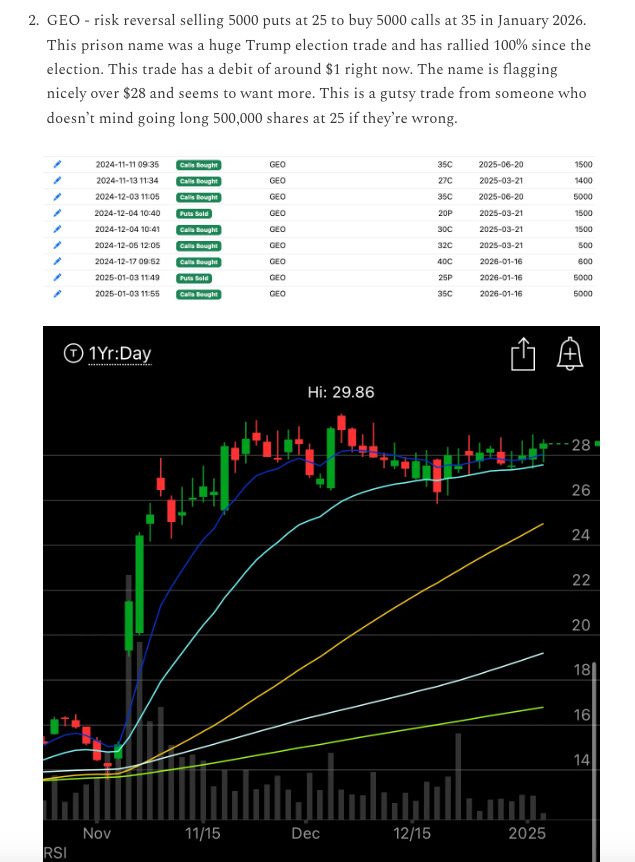

GEO - I highlighted this on in friday’s recap here after that large risk reversal below came in, it has risen nearly 10% in 3 sessions since with a very weak market. Very nice timing on this trade.

My Open Book