2025 Is Here

I’ll try to keep this short, I just want to say complacency is running extremely high right now. Stocks have gone straight up 27 months or so, October 2022 was the low. To say things have been easy would be an understatement. It won’t be that way forever, one thing about our incoming President that we didn’t have to deal with the last 4 years was the social media dynamic he brings. We never had to worry about a Biden tweet flushing stocks, Trump was notorious for mid day commentary that would send stocks spiraling. So add Donald Trump Twitter/Truth Social notifications to your 2025 must haves because that era is once again upon us. Will stocks go up in 2025? I don’t make long term predictions, my timeframe is one daily candle to the next. Stocks have gone up about 75% of the time the last 100 years if you’re looking at an annual basis so the odds always favor them going up.

Just remember the key to markets is pressing things in uptrends and understanding when uptrends are over and dialing it back. Where everyone gets hurt is they either press things in downturns or hold on because “it will come back”. That is why we discuss all these moving averages everyday in here, we’re trying to look at where markets are. Are we in uptrend? Are we in a downtrend? What should we be doing. Yes, long term none of this stuff matter as stocks have gone up since the beginning of time, but if you’re utilizing leverage, which I personally do, you have to be spot on with your timing. If you hang around when trends break, leverage will bankrupt you, but if used properly like I mentioned in my last post, I have returned 5x what the Nasdaq did in the last 2.5 years from when I began documenting it all here.

I assume 2025 will be a volatile year because something is not right. The economic data is horrible, we have the TLT at lows, we have the dollar near highs, and we have equities at highs. Something has to give. Is there too much money in the world chasing too few quality assets? Absolutely, but you cannot have bonds, the dollar, and equities where they are today for a prolonged period, something has to break eventually. Timeframe I don’t know, but look at these equities, their valuations are nosebleed to say the least. Apple is a $4 trillion dollar company with no growth and it is trading over 40x earnings now. Tesla is up nearly 90% since the election and trading 130x earnings for next year, no company at a $1T+ valuation has ever traded at a valuation like that. To say things are euphoric in our markets is an understatement. Can it go on longer than expected, sure, we will see the trends break the minute these names start breaking the 21 ema, then the 50 day, etc. So it won’t catch us off guard when it happens, but trust me, it will happen so don’t get complacent.

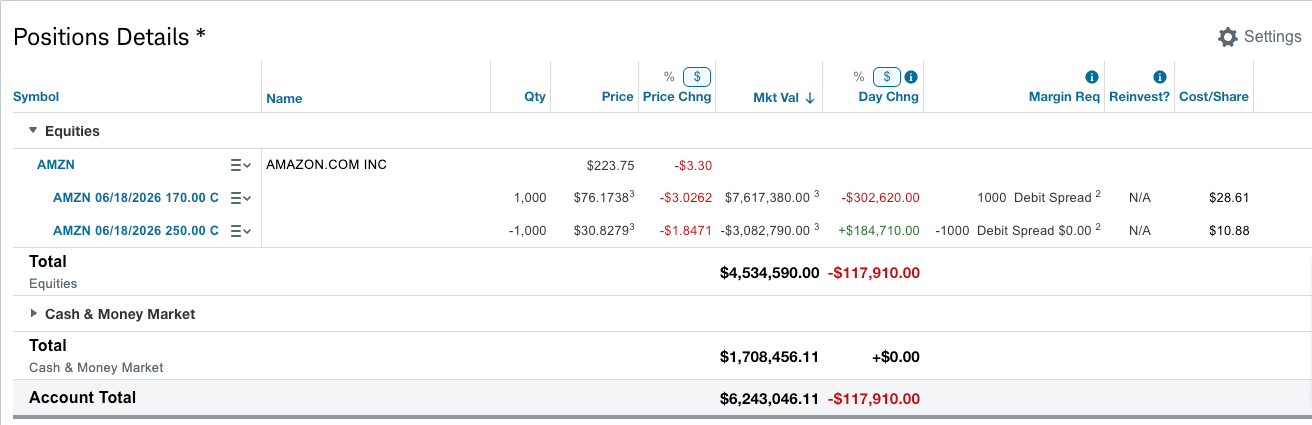

My plan for 2025 is simple, here is my book right now, I raised alot of cash now recently and I’m going into 2025 holding only my Amazon call spread I put on originally back in May 2023 and then rolled 11 months ago with a good bit of cash.

My Amazon Position

I didn’t do much the last say 18 months as Amazon just did what I expected it to do from the time I made this post in May 2023 Here and my trade of going all in with leverage paid off handsomely as Amazon has risen just about 100% since. As it sits now you can see my call spread above which had a cost of 17.73 (28.61 -10.88) and maxes out at $80 over $250 in June 2026. So I am in an incredible spot right now where my call spread is currently at a value of 45.xx and AMZN is at 223.75. All I need is Amazon to simply rise another 13% or so in the next 18 months and my call spread will go from 45 to 80. I could literally do absolutely nothing for 18 months and if Amazon just goes up $27 I would have $8m to close out in that trade and with my cash position below I’d be near $10M. Remember I started this whole substack 2.5 years ago with $1.4M in my trading book. So that would be a phenomenal outcome for me to 7x my book in 4 years or less. If Amazon hits 270 by summer this year I’d likely be at a point where I’d close the whole trade anyways, so the point is I’m looking to close this trade, but there is too much meat on the bone still to do it now and it won’t take much upside to get me there.

My Cash

My plan is simple, I’m going to trade the cash and post my book everyday going forward this year. I’m not going to discuss why I’m in each position I’m in but if you pull up a chart or the option flow in my database you will likely be able to guess why I took the trades I will take. I look for things like levels other big put sellers are using and go below them. I look for names with repeat call flow and follow by selling puts, etc. I’m going to employ the same principles I write about daily. I’m at a point where my trading book has grown so large that I don’t need to buy short term calls myself anymore, but that doesn’t mean I won’t use the options data as a guide on direction. I will of course use leverage but I won’t be reckless, there’s that old adage that you only have to get rich once in life. You can’t let greed take over, once you have a number you’re happy with, continue trading but don’t overdo the leverage, just use the information you’re seeing in the options data as a tool to see what bigger players are doing and help you in your trading process.

Why Did I Close Apple and IBIT

I put on the Apple trade in June and Apple rose 20% without really any of the things I thought happening. I was really disappointed with the product release from Apple, but the stock still managed to rise significantly to where the leaps I bought Here in the June 17th recap. Those calls went from 27.xx to 46.xx. I was happy and closed out.

As for Bitcoin, I placed that trade maybe 3 weeks before my father passed away. While I wasn’t even thinking about him possibly passing away at the time, after he did, and I had some time to think about things I decided I just wanted to trade again. I had spent the last 18 months not really taking on multiple positions as I mostly spent my afternoons taking care of him and didn’t have time to watch a book like that. Now with this newfound free time, I figured I’d spend a little more time trading. So I closed up that just to raise money, I still think bitcoin itself is going materially higher, it is the best performing asset nearly every year for the last decade. For me though, I now have this huge void in my life where I was spending hours everyday with my dad at the hospital after I sent out the recap and I’m going to try to fill that time by being more active in markets. So that’s my reasoning there just life changes, not bitcoin thesis change.

2025 will be a good year. Even if markets are flat or down, the things we talk about daily in here and in the community discord should keep you beating the market. Something is always trending, if the market is down, that usually just means large cap tech is down and due to its weighting the market is weak. There is always something trending and the goal here is to follow that space and dabble in it. Just remember a chart is a visualization of buying and selling, that is all, so a good chart just means a particular name is being accumulated and a bad chart means a name is being sold. If you stick to trading good charts, you will do great in any market.

Lastly, as I said last week, I adjusted the substack to a different price until January 2nd when I return. The market is closed on January 1. The different price will give you access to the live portion of the discord where I post all the data live, there is a separate chat, and a section where everyone posts what trades they’re taking, me included. Because Substack only allows 1 monthly option at a time, on January 2 it will go back to being an annual only option and the discord will go back to the price it has been for the last year, so if you’re on a free trial, you just have to wait till then if you don’t want the live part. So if you want to utilize the ability to have the live part but on a monthly option, you can now, and if you sign up now, even once I remove it, you have it for as long as you like. You have till Wednesday night 11 pm EST before I adjust it back.

I hope you all enjoy these last 2 sessions of the market year if you trade them, if you don’t, enjoy the break before we get back to work.

Welcome back

I joined in 2024 so I don’t have the opportunity to know how James outperformed the market especially in 2022/23. Looking forward to see how you trades in 2025! Happy new year in advance!