2/1 Recap. What A Rally.

I’m going to make today’s post public because I had so many ask questions after my thread today, so for today only, last time I will do this so you can see what I post, I couldn’t answer all the DM’s there were just too many.

Coming into today there was alot of fear about what Powell would say to crash equities and I kept telling you that the VIX wasn’t really signaling fear in any way. I mentioned that yesterday on Twitter

So what now? Well, what have I been saying in here for weeks. The economy is awful, but stocks aren’t the economy. So today we see stocks are ripping but the dollar died, this isn’t ideal, this is the ugly scenario nobody wants to discuss. Assets are soaring, the value of your dollar is in decline, rich people get richer, poor people struggle as their dollar weakens. This is the kind of stuff that crumbles civilizations, but for today, the bulls are excited. How does it play out going forward? I don’t want to find out what SPX 6000 and DXY 75 means. There are alot of unintended consequences. We need a strong dollar and today just signaled that people think more QE is coming, they want to get rid of their dollars and get long assets as the dollar is in decline.

The SPY took off, I mentioned in yesterday’s recap that for the moment stocks don’t look bearish, they just didn’t, we were over the downtrend and there wasn’t much to say. We came down and tested the 8/10 EMA again today and closed higher. This is very clearly bullish for now. While historically, these initial moves after FOMC reverse within a few days, something feels different here, like a eureka moment where people finally realize you don’t want to hold dollars because inflation, regardless of what the fed says, exceeds current rates.

IWM contineus to be the leader in this market as small caps continue to explode. This is the place to be for the moment, just remember, it doesn’t “have to make sense”. I get it, these are expensive, they’ve run alot, but they also are where all the buying has been occuring for the last few months.

Dollar continues to plummet, this is down down near 15% off the highs a few months back, so in real terms, the market rally hasn’t been as strong as most think. I’ve been pointing out for a while now that the dollar is broken and like any broken chart, it continues lower until it bases and makes a move higher, it has not.

Oil lead the way lower today, remember yesterday that large CVX put buy I noted. Oil looks busted now, that’s how quick charts turn, it looked fine very recently but look at it now, below all the moving averages, it’s just a do not touch for the time being.

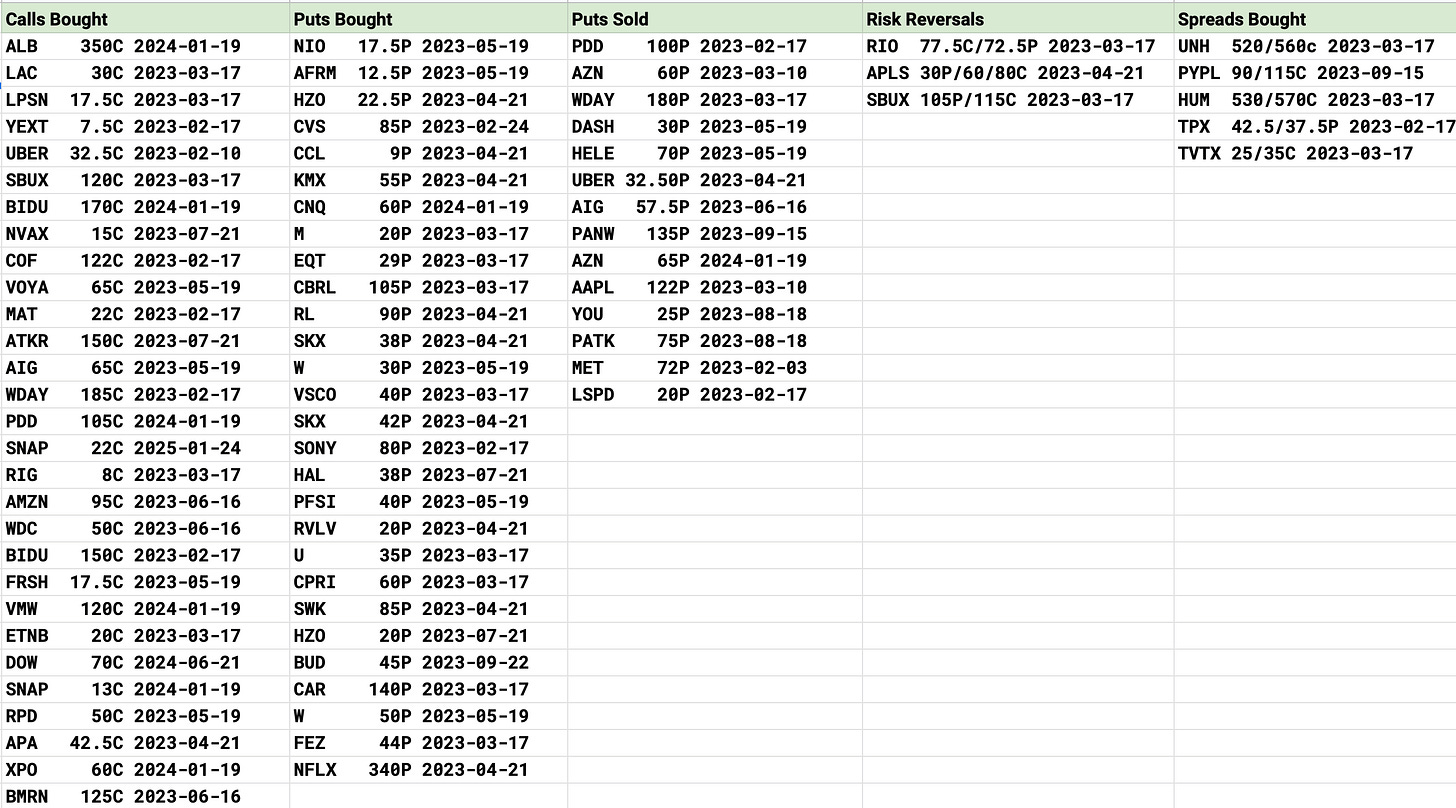

Today’s Unusual Options Activity & What Stood Out

I had alot of new people come on today, so here is where I post the trades I felt were unusual today. It’s pretty straight foward calls bought(bullish), puts bought(bearish), puts sold(bullish and levels institutions are interested in going long), risk reversals(ultra bullish or bearish), and lastly spreads bought. I use these as part of my discovery process, along with charts in deciding what I want to do. That’s it, I don’t follow all of these or anything, they’re just 1 step in the wheel of discovery.

AMZN enormous trade, someone rolled 60,000 calls in Feb to 75,000 calls in June at 95, over $100m trade, that went very well because Amazon took off.

SBUX had a couple large trades today the March 120 calls were bought and there was a large risk reversal selling 105 puts in March to buy 115 calls.

UBER saw interesting puts sold at 32.50 in Feb, they’ve been selling these for weeks on end, I first noted them in December when it was 24.xx. They also bought alot of 32.50 calls for next week, earnings play that has run hard.

UNH and HUM both had March call spreads bought today, possibly even by the same player, someone looking for a nice up move in health insurance names.

HELE had a very large put sale at 70 in May, a good name someone wants at a specific number.

APLS I do not know this ticker but this April risk reversal was interesting selling 30 puts to finance a 60/80 call spread.

MET had a big lot of 72 puts sold this week, interesting trade with short timeframe like the CZR puts I mentioned being sold yesterday or monday.

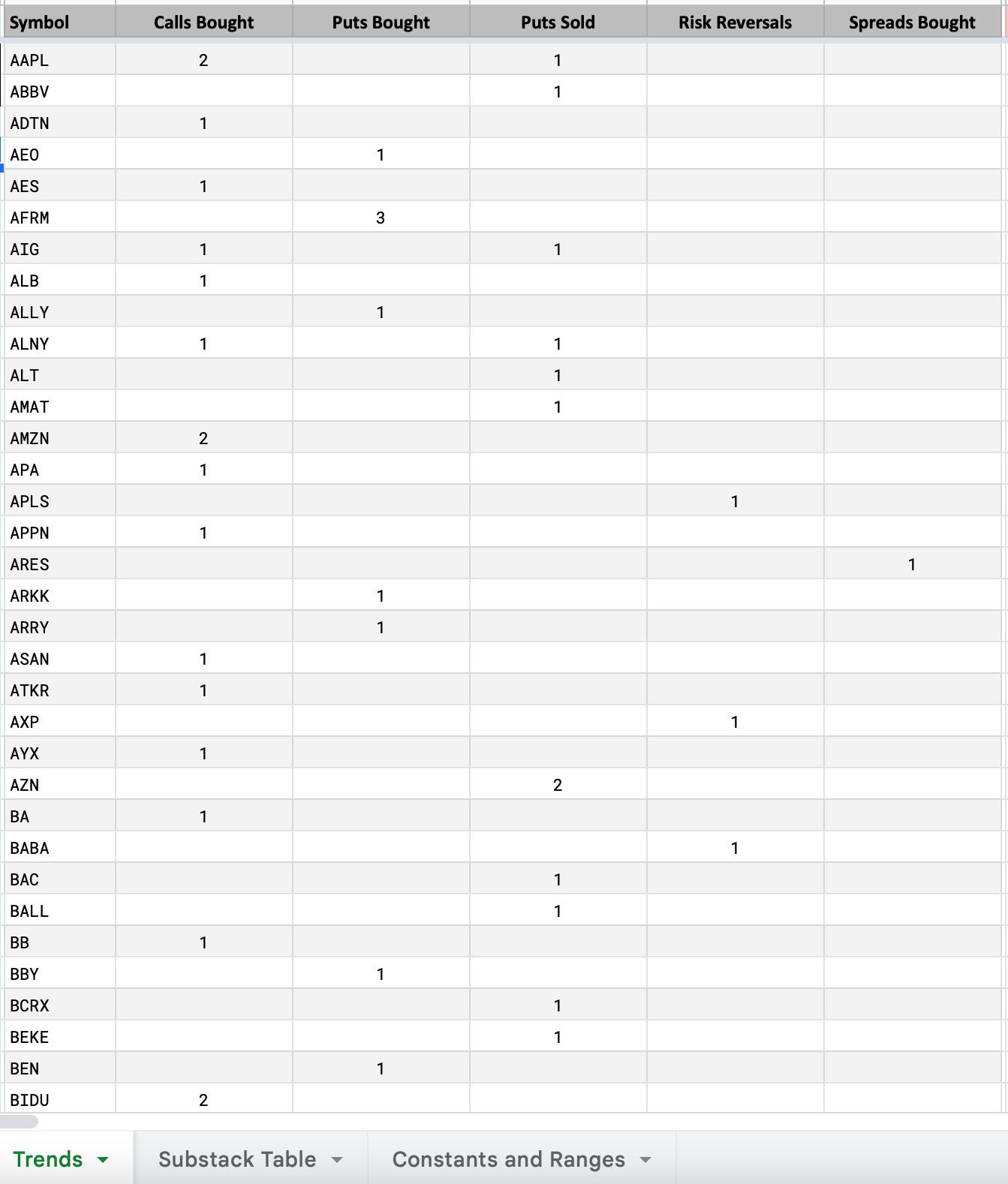

So we’re now 3 days into collecting all this unusual options data into a database and you can already see the trends developing down below where something like Affirm now has 3 unusual sized put buys in the last 3 days. I’m confident in a few weeks/months this will turn out to be a useful tool for gauging trades.

What Did I Do Today?

For those that are new, every monday I post my open book and then I add my new positions here, so if you go back 2 days you can see what i had at the moment.

I outperformed handily today, being up 3.92% vs the NQ up 2% and the SPX up 1%. As for today, I sat still.I didn’t do much because I was waiting for the Powell speech to pass and I was already so levered long going into it so I only placed 1 trade following that very odd 85 put sale for next January on DOCU while it was 60.

Trades I placed today

Sold DOCU 1/2024 40 puts for 3.97

This has been an incredible start to the year up another 4% today, after ending January up 21.5% yesterday to get this kind of start to February today was just incredible. My positioning has been about as perfect as a put seller can get the last few months by overleveraging to the smaller tech names as they looked to be in a position of leadership moving forward at the time. Even the handful of defensives I got long just for yield harvesting ie MO and VZ have both had tremendous moves the last week. That positioning has led to significant outperformance so far. For now, we’ve run so hard so fast, that I don’t plan on making many moves going forward. Being short all the puts I am for the last few weeks, I have such a cushion for them to fall into that I don’t need to make many moves to outperform here. If stocks flatten out or go down, I will likely still perform incredibly well with my positioning of being levered into short puts.

I hope you all had a great day and if you’re not in the discord you should join us because there’s like 130 people in there and it’s become a great community, the link is in the welcome email for the active members so if you don’t see it just email me jamesbulltard@gmail.com and I will send you an invite.

Great stuff as usual, James.

Re: inflation, the data seems pretty clear that it has indeed dropped precipitously. You're remarkably nimble in response to changing info, so I'm curious what you're seeing that's suggesting there remains a disconnect between a soft-landing policy stance and the actual underlying macro fundamentals. If you're relying on anecdotal evidence, could it be time to take another look and recalibrate?

(You may not agree with them politically, but I find Joseph Stiglitz and Paul Krugman to be helpful guides. Larry Summers is a jackass, but he seems to have come around to the consensus view that things are looking surprisingly okay... -ish.)

Btw, I'm the guy whose dad placed trades for John Malone in the '90s, before he (my dad) got sick. I placed my first options trades last week. Learning a lot from all your posts. Glad I subscribed.

Thx!

Grant

Thanks a lot for this summary, good stuff to keep clear mind for me. Keep the good work!