2/26/25 Recap

The SPY ended up closing right over the 100 day yesterday and today it gapped up and is stuck right below the 50 day. It appears we are all going to be waiting on NVDA to report today for our next direction. Then of course we have PCE friday morning which is just as important in my book. If NVDA had a strong report, we would need to see a push over that 21 ema above where the 8/21 bearish crossover has just unfolded otherwise if we breakdown below the 100 day, things could get messier. The good news for bulls is the XLP which was up 1.5% yesterday is down 1.5% today which is your sign people are exiting the defensive tickers. This remains nothing but chop.

Recent Trades

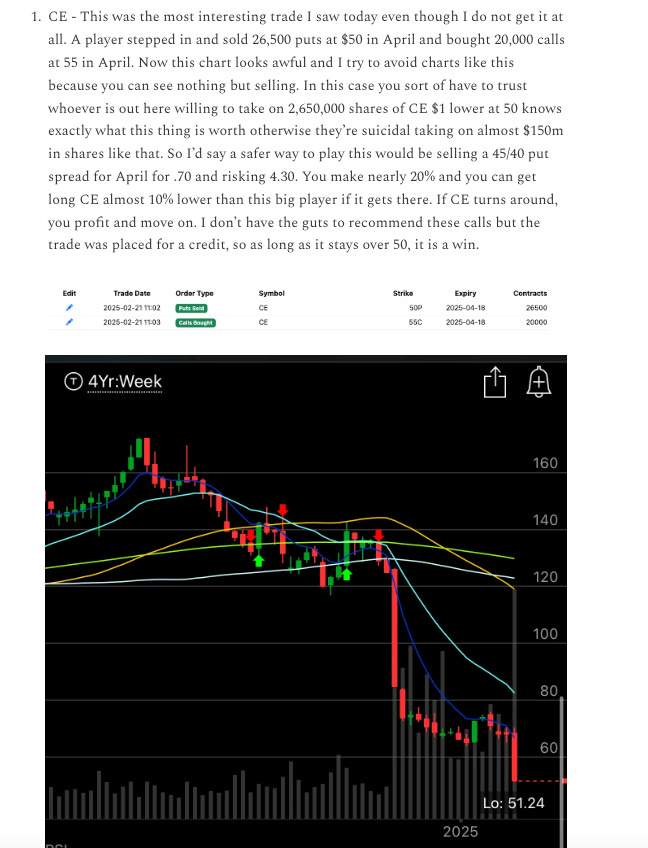

CE - in friday’s recap here I noted this Celanese trade and mentioned it being the most interesting one I saw that day because of the size. To sell 26,500 puts basically at the money and buy 20,000 calls you had better have some serious conviction and this player was dead on, that 51.24 price when I took the screenshot friday was the low basiscally and it has rallied almost 10% in 3 days since to 55 at the open and has given some back to 53.50 right now, but still up nicely from friday. Mind you that was through 2 of the nastiest days our market has seen in a while. This was an insane trade and the size and proximity to the current price was a major tell of why it should bounce.

My Open Book

2 small trades today, sold some puts on AMZN and FLR 12+ months out. So alot of you email me and ask me what my thought process is here, and I’m always honest with you when I say my book isn’t your book. We all have different goals and objectives in life and you may still be in that stage where you want to grow your book aggressively. After the last 2 years here, you’ve seen me grow this book from a little over $1M to $7m+ and I’m just not at the place in life where I care to be super aggressive on the call side anymore. For me, I think if I can grow this book say 20% a year at this size, consistently, I am doing fantastic. I don’t think the market will see 20% growth this year and I’ve already gotten to a 16% return coming into today. Let me explain my thoughts some more.