2/27/25 Recap

The SPY continues to look terrible, 3 days in a row now we have broken below the 100 day(white line) and recovered. If you notice all recoveries remain below the 50 day(yellow line) so while we are recovering, there is nothing bullish about this. If we are honest here, this is a bear flag forming right ontop of the 100 day with the 8/21 bearish crossover overhead and the 50 day starting to slope down. None of that is good and unless we get a quick rebound tomorrow on PCE, we could be in trouble. The good news in all of this is because we’ve been flat for so long, the 200 day is now over 570, so moves down should find major support around 5% from here on any big drawdown. Today we got news from Trump that the Mexico and Canada tariffs go into effect next week and the /NQ reversed a 200 point gap up. We will see what is coming but all the megacaps have reported and as it sits right now, we just don’t have any catalysts to push us higher in tech and tech is the bulk of the market weighting. If PCE surprises to the downside tomorrow, we could get very ugly, quick.

Recent Trades

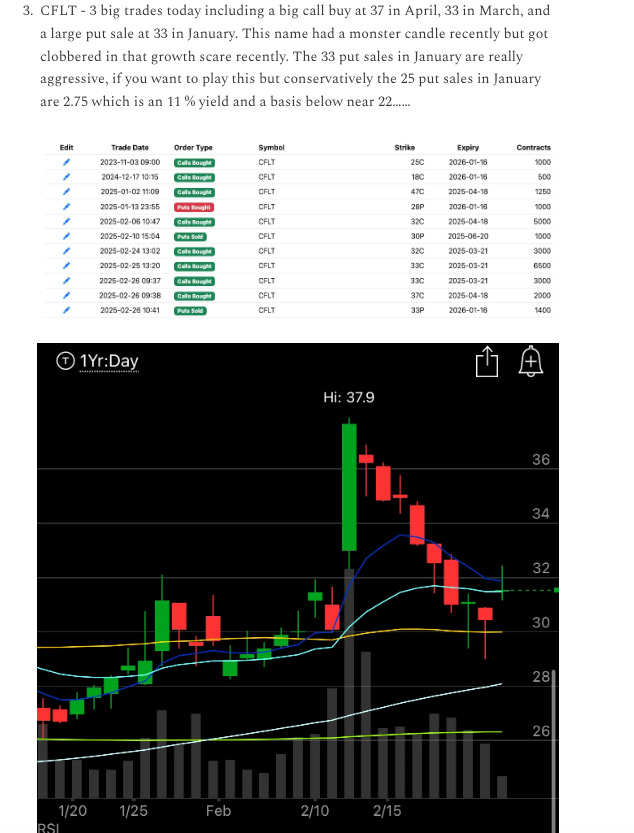

CFLT - In yesterday’s recap here I noted all those CFLT trades and this morning it goes a huge upgrade and is up around 6% right now. This name kept seeing repeated call flows through the recent market sell off.

My Open Book

I made no changes today and really probably won’t for a little while, I like how I’m positioned and I’m running thin on available margin so barring me changing something I probably won’t be adding anything soon.