2/28/25 Recap

Fairly insignificant day so far, I know everyone gets excited when you see some green after the brutality of the last week but look at the chart below. It is a small inside candle forming well below most of the key moving averages. The 21 ema is now sloping down and this just is not bullish. I wish I had better news to tell you. The big number to watch today is 589.8 on the SPY, a close below that is our first close below the 21 ema on the weekly since October 2023, that would not be good. So while everything is bouncing today I think it is a good opportunity to unload some of your risk and settle in. Until the market is back over the 21 ema, you don’t want to be super heavy on your risk and that is just below 600 right now(light blue line). If I were to guess, we seem to have a date in our near future with that 200 day(green line) below as we start building multiple closes below the 100 day.

Recent Trades

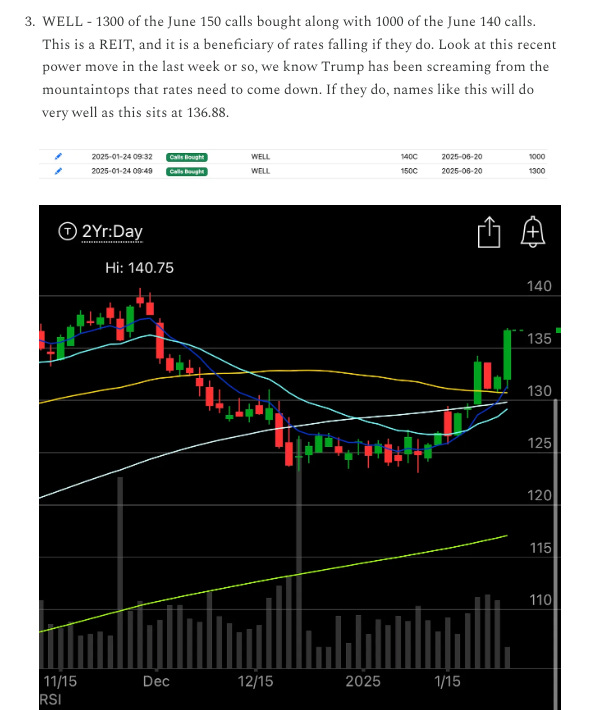

WELL - In the 1/24 recap here I flagged these 2 call buys on WELL, it was a REIT I had never heard of and there was nothing else in my data on the name. It has since rallied 11% to 151.90 and these obscure call buys continue to be great alpha.

My Open Book

You’ll notice I took quite a hit yesterday afternoon in that drawdown with my short puts, not really a concern to me, as I said in the note last night, I’m going for long term capital gains on these leap short puts, unfortunately what the market does day to day impacts them, but they’re nowhere near being assigned. I added some more TLT yesterday as I mentioned and trimmed some of the short tech puts I had that were eating up my margin. So far that is going well for me today, monday is the ex-div so by friday next week I should have a nice payment sent my way. Otherwise I only added a small put sale on MSTR for next week where I’d be assigned below the 200 day. For most names, they will bounce off the 200 and that is where I want to take shares and begin to sell juiced up calls vs it. I’d had to trim a little TLT if it looks like I’m going to be assigned, but that is fine with me.

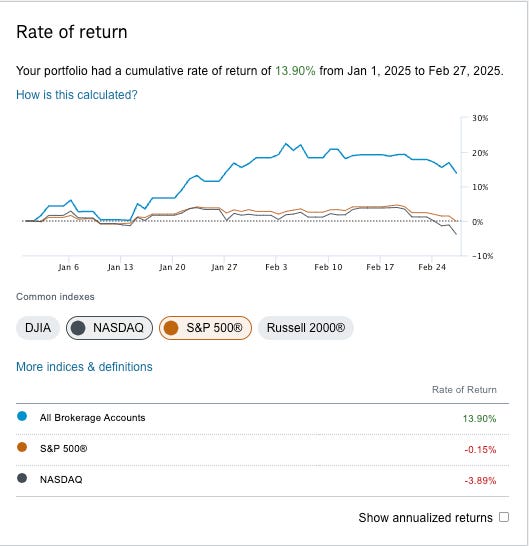

Coming into today I’m happy with how the year has gone so far for me, I’m up around 14% and both indexes are negative.All you can do is the periods of weakness is fight to stay alive and if you can stay flat or even outperform those periods, you’re doing well for yourself.