3/2 Recap. We Bounced Where We Had To

A textbook bounce right at the uptrend on the SPY, look at the magic line doing what it does. The bulls are back in control, for now, we put in a bullish engulfing, assuming it closes here in 30 minutes.

Look at this, a bullish engulfing is such because it tests lower and closes higher than the previous candle signaling buyers stepped in and bought up the lower prices, more of the candles telling a story thing I always mention.

Could this be like the bullish engulfing we saw a few months back? That remains to be seen, the one in October that you can see below kicked off the whole uptrend that we are in at this moment. Again the economy is awful, but the price action is the price action and until we break down, this is looking bullish, as a put seller, it makes no difference to me.

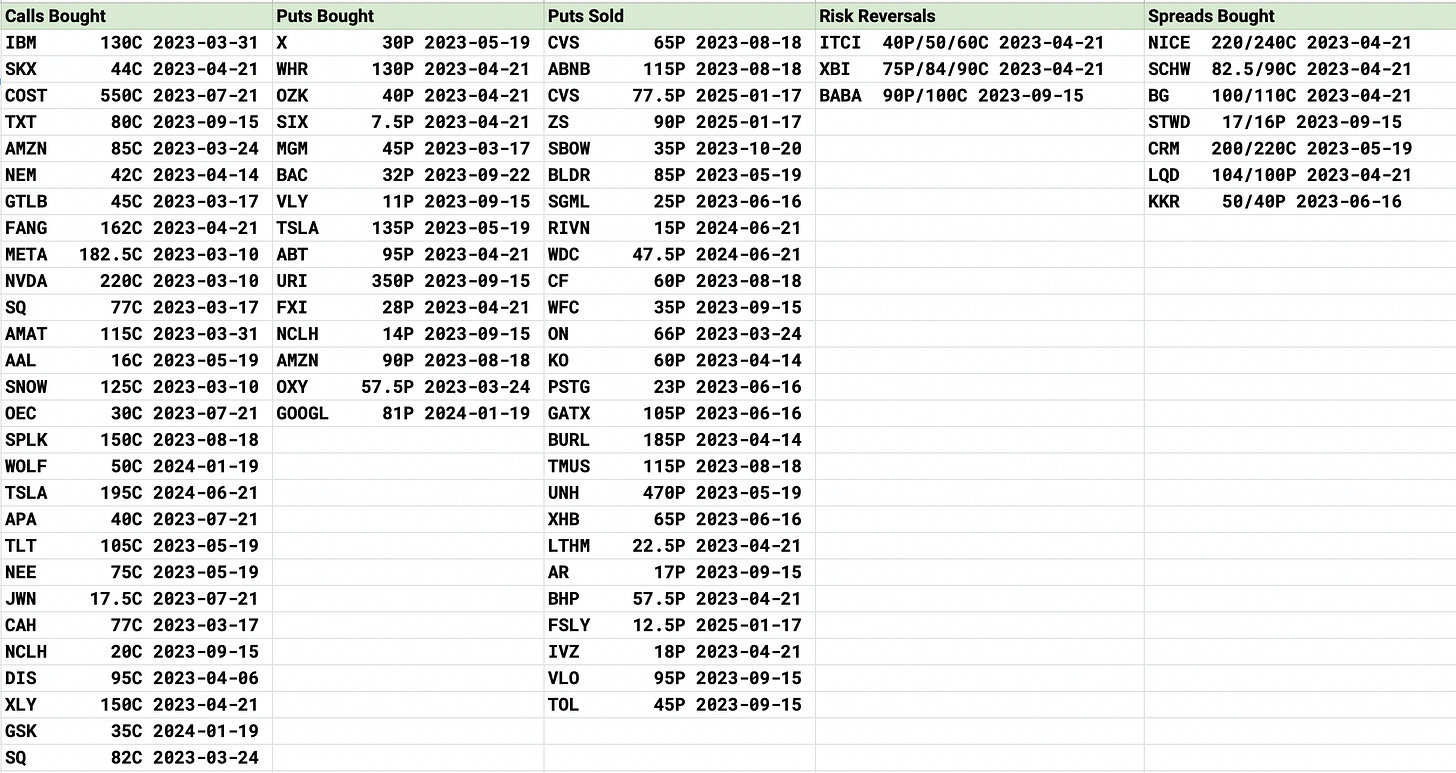

Today’s Unusual Activity & What Stood Out

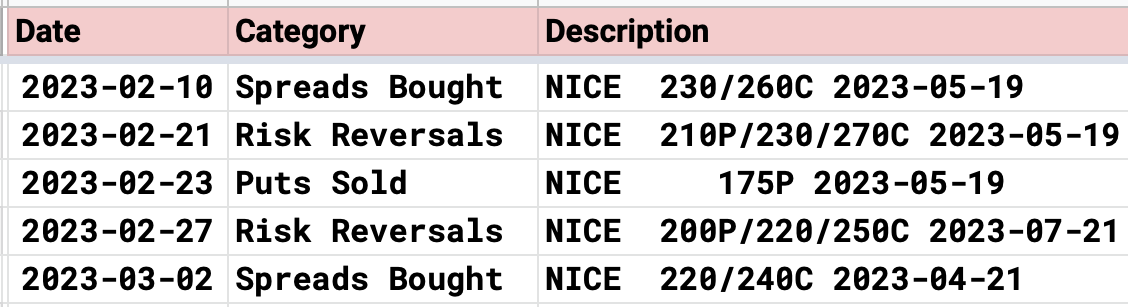

NICE call spreads bought again 220/240C in April, I’ve noted alot here recently

The ITCI risk reversal was interesting selling 40 puts to finance a 50/60 call spread in April. I don’t know this name but very interesting trade.

RIVN continues to see put sales, this time in June. Look at all the bullish action here over the last month

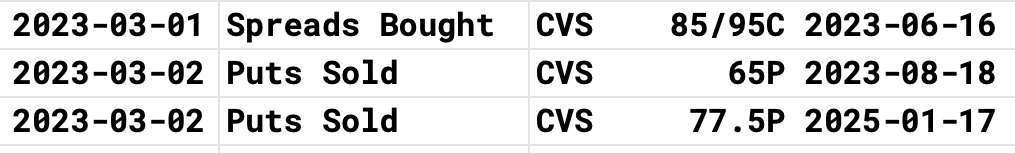

CVS had 2 very large put sales today, one in August this year and one in January of 2025. The name is very inexpensive and defensive. Here is all the action I’ve seen come in the last 2 days

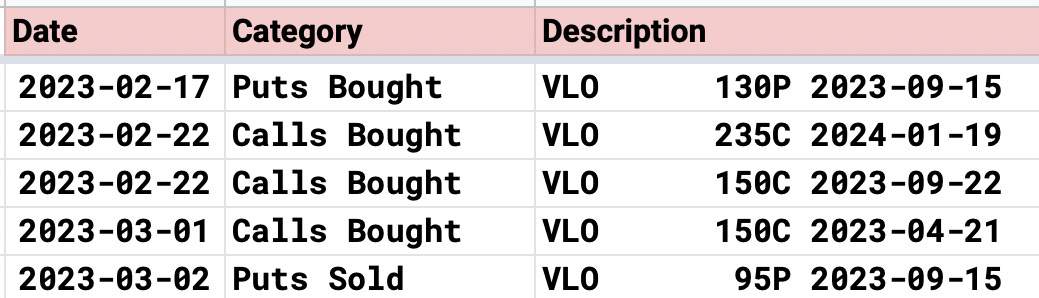

VLO, Valero, continues to see bullish action look at the large block of September puts sold today at 95. Then look at all the calls being bought the last few weeks. It is 139.xx right now.

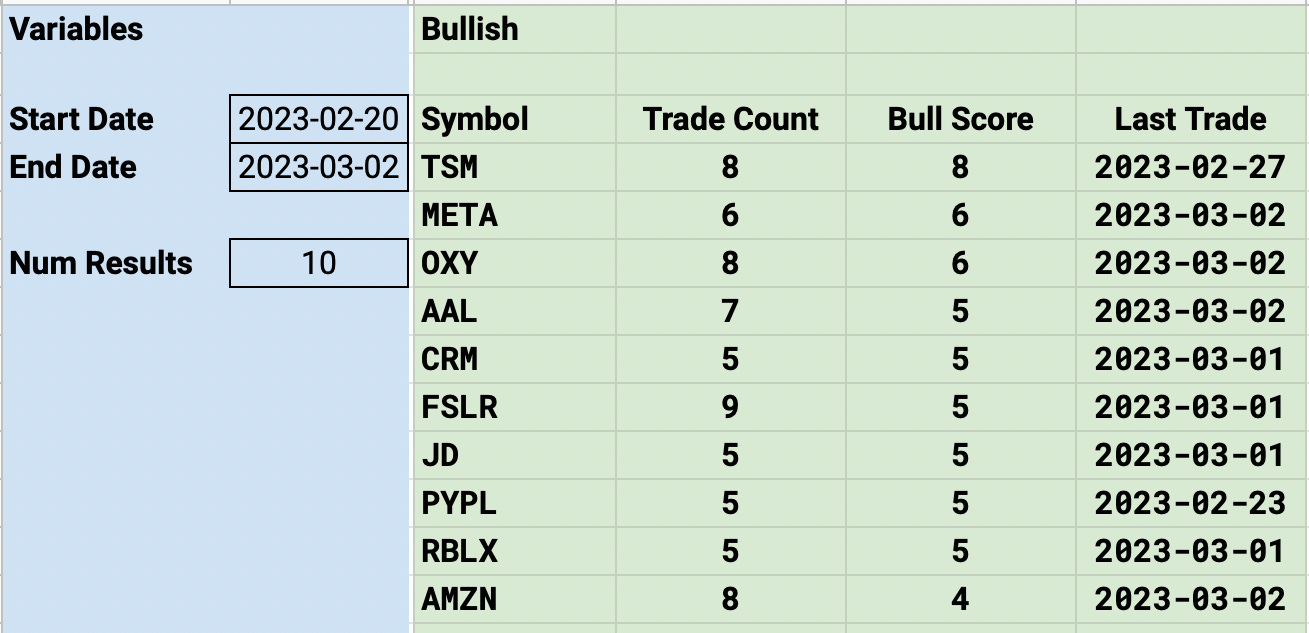

Here are the Top 10 bullish trends over the last 2 weeks

What Did I Do Today?

I outperformed by a lot, the S&P was up 1%, the Nasdaq just under 1% and I was up 3.6%, what happened? So many of my short puts erupted today. If you go back to my post Monday when I posted my whole book a lot of those went nuts today look below at the gains on SIX and TWLO today. That tends to happen to short puts as the VIX dies and the market goes green. Doesn’t mean much in the scope of things as I’m still focused on the longer term, but it was nice to see.

Trades I Put On

I sold 100 PINS 22.5 puts for 3/31 quarterly expiry

I sold 100 PINS 23 puts for 3/10 expiry

I sold 50 DIS 75 puts for 1/2024

That’s all, I didn’t do much as I was at the hospital with my mother most of the day and by the time I got home the market had exploded and I didn’t want to chase anything. I feel good about my positioning from Monday, there isn’t really much to change/adjust at this point. I’m pretty well positioned for whatever the market decides to do and as a put seller that’s all you’re trying to do, prepare for the worst and hope for the best.

It’s hard to believe I just wrapped up 9 months of this substack yesterday and all the 3 quarters so far have had a return over 20%, today was an incredible start on the next 3 months. I hope you all have a great day and I will see you over the weekend with my best ideas for next week.

No worries. Appreciate all your hard work, thanks

The PINS puts that you sold - is that purely based on incoming options flow or based on company’s some financial metrics as well ?

Just trying to understand your decision making process on selling puts as I have never done it before.