3/5/25 Recap

The SPY is coming right into the 200 day right now. It looks like we may get a touch today or later this week of the 200 day. If we lose that keep an eye on 565.15 that was the previous breakout level. What was today’s narrative? Take your pick: payrolls were off by alot 77k vs 140k estimate, services PMI was a miss, and ISM manufacturing was indicating Stagflation. The last one could possible be people front-running tariffs so we will have to monitor that one. We still have NFP this friday but the data continues to be a mess on all fronts. I continue to think this is not the best year for stocks and bonds remain the better play. While the long bond trade is getting crowded and consensus now, it won’t be easy, but the reality is one of 2 things happens: we get a recession or all the DOGE cuts work. Either way, it is likely we are getting lower rates. The only way we don’t get lower rates is stagflation takes hold and rates have to go up.

Recent Trades

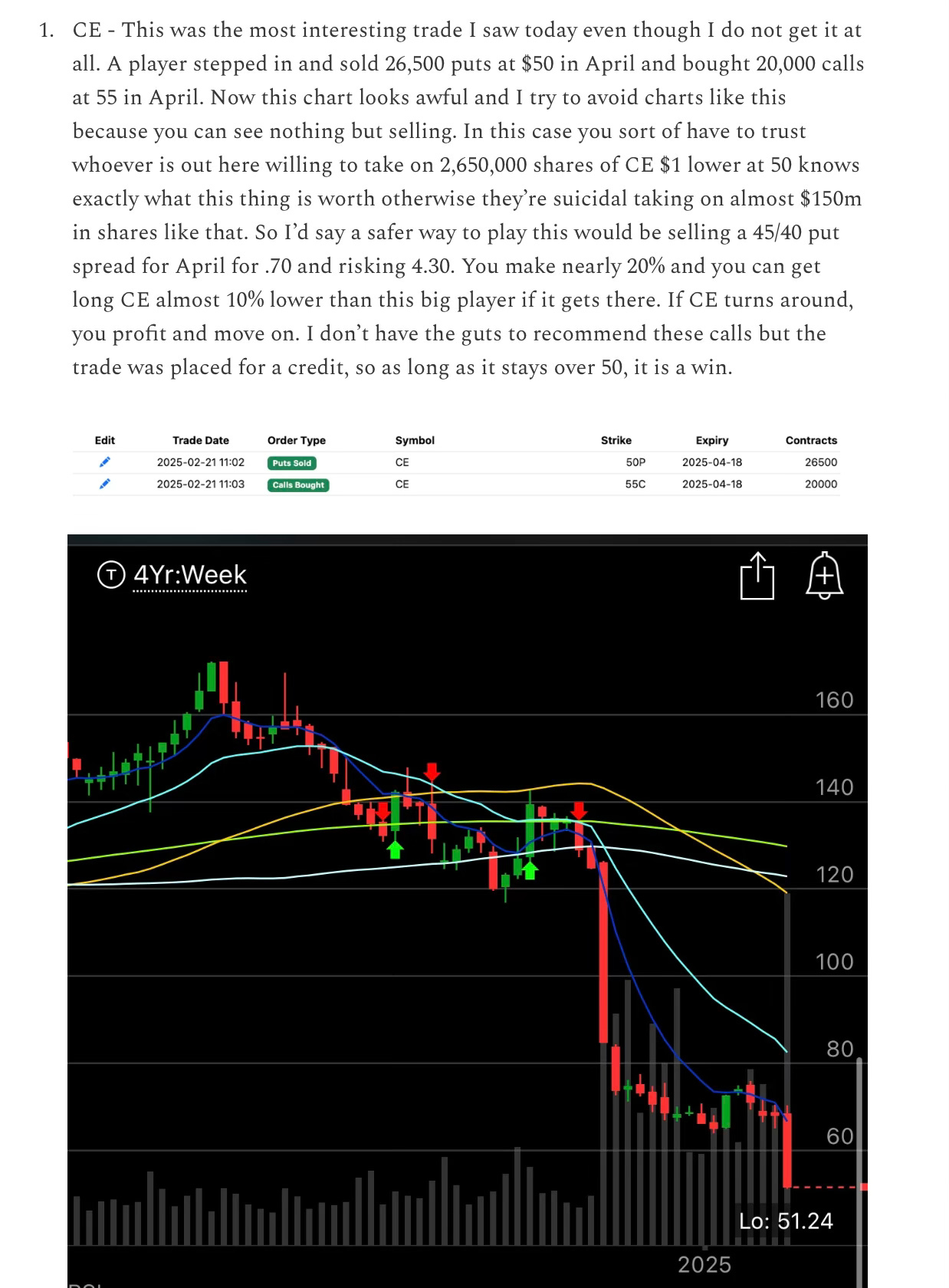

CE - Celanese was one I highlighted in the 2/21 recap here. It was a really sizable risk reversal in a name with no other data. It was slammed with the rest of the market these last 2 weeks but popped 9% today to 52+. That’s the thing with these big put sales, they act as a buoy and prices tend to stay above them which is why I always say the put sales are the most important of all the datapoints I log. Those are key levels big money perceives as tremendous opportunity.

My Open Book