4/16 Recap

When markets turn, the amount of emails I get are astronomical. Everyone who hasn’t read any of my posts for the last few weeks starts with the “what should I do” and I honestly don’t know what to say. I’ve been pointing to this downturn literally from the day it began. Do you remember this afterhours post I sent out on that bearish engulfing candle

and then this weekend’s warning saying we broke trend

I think one of the hardest things with running a business like this is trying to get everyone on the same page. All I can do on my end is point out what I’m seeing and this weakness was visible from a mile on my own system of not being bullish below the 21 ema. Since that afterhours post all we’ve done is display weakness and now we’ve followed through to the downside. As I said nothing is changing on my end, I’m not creating a huge taxable event to try and evade a little market weakness after 6 months up. That’s how I’m playing it, what works for me isn’t going to work for everyone but at this moment, this market is going to remain weak as we are well below ALOT of key moving averages and until those slope down more and we reclaim some of them, we’re just not going to run higher. That is just the reality of the matter. Right now in the megacap space, only 2 names are above their 21 ema: GOOG and AMZN, that’s it. So it’s pretty hard to see strength when of the 6 names that carry the market, 4 are technically breaking down with a 5th, Tesla, in complete freefall.

Look at this chart below, would you buy that? I wouldn’t. The SPY is breaking down and continuing lower. That’s why things like that bearish engulfing were so notable when it happened, it was telling you in that candle that sellers not only rejected the levels up but they pushed it to new lows. Whether it was about the war, interest rates, whatever, that all was irrelevant what mattered was the price action sent you a big warning sign. All bounces will continue to be sold for now. What can change it? Lower rates, peace in the middle east, megacap earnings but until any of that happens, this is what we’re dealing with. So as I said over the weekend, don’t even think about short term trades on the bullish side.

Recent Trades

WIRE -I had not highlighted this name, I try to avoid $300 stocks in these recaps just because if I mention selling puts on something like that alot of you aren’t going to sell 1 put for $30,000 so I get that. but this name saw 3 big trades in the past month with nothing else including 1 on 4-4 targeting 4-19 at 280 a week after 1000 were bought at 270 expiring this week. Yesterday, WIRE was taken out right before those calls expired!

Here was the headline from yesterday, another great trade in an obscure name from the option players. The amount of alpha in these smaller underfollowed names is off the charts.

Trends

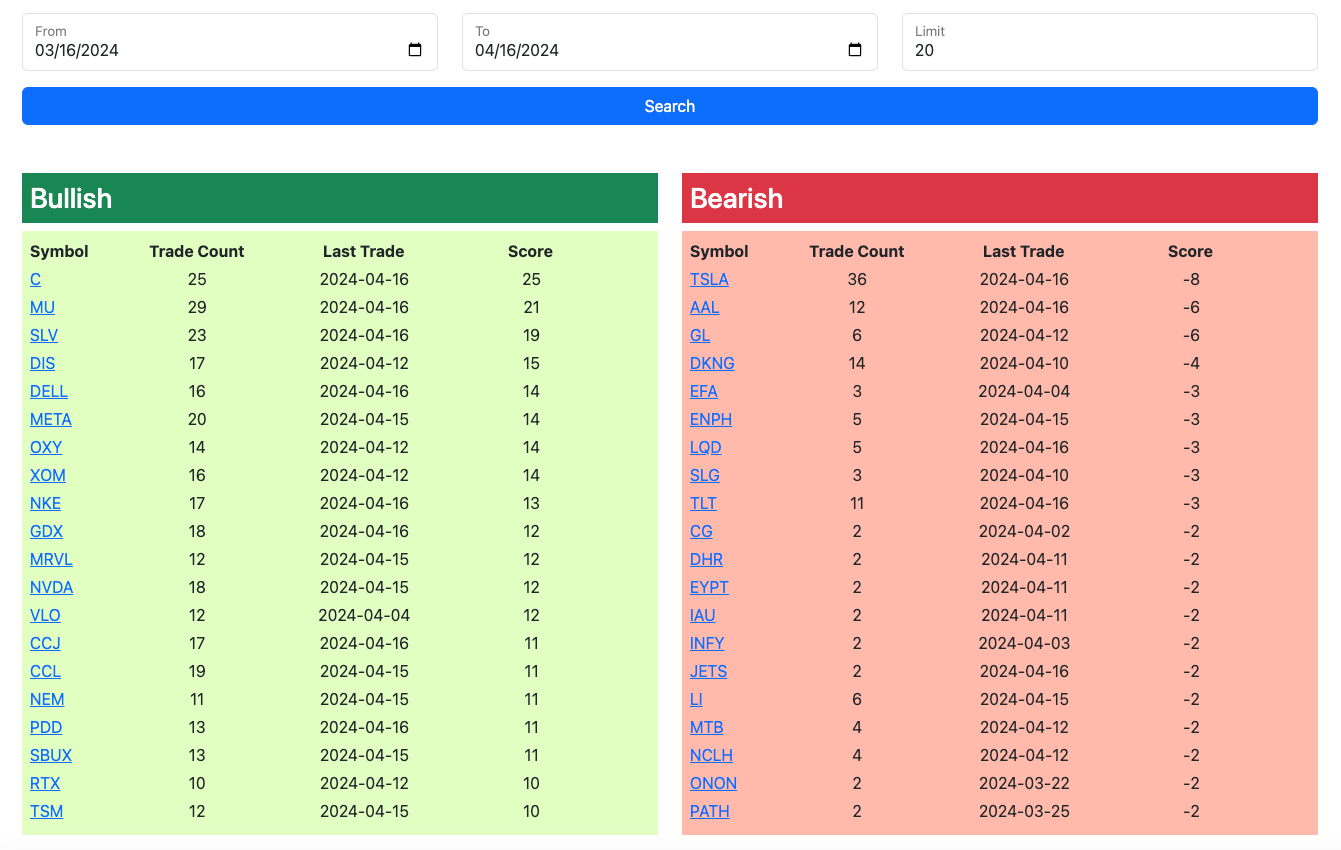

Citi remains the top trending name on the bullish side of things, its down with all the banks again but if you look in the database none of the trades are targeting this week. I think that’s going to be a good trade if that much inertia is headed the other way. It seems like shares are probably warranted.

1 Week

2 Week

1 Month

Today’s Unusual Options Flow

Here is today’s link to the database. I will have the rest of today’s action uploaded by tonight and you can check back for the updated data and trends.