5/13/25 Recap

The SPY is just drifting higher now, we’re over all the key moving averages and now are approaching max overbought levels, what a crazy shakeout. We are extremely extended right now, we’re at 588 on the SPY and 558 is the 21 ema, so expect some sort of cooling off period where the moving averages catch up, even the 8 day is over 3% lower at 570. The megacaps are still down year to date as a whole and are finally being bought again, the market cannot go up without them, the Mag 7 make up over 30% of the market by weight. Most analysts are walking back their recession calls this week and rightfully so as we’re not going to have this full scale trade war it looked like we were having 3 weeks ago.

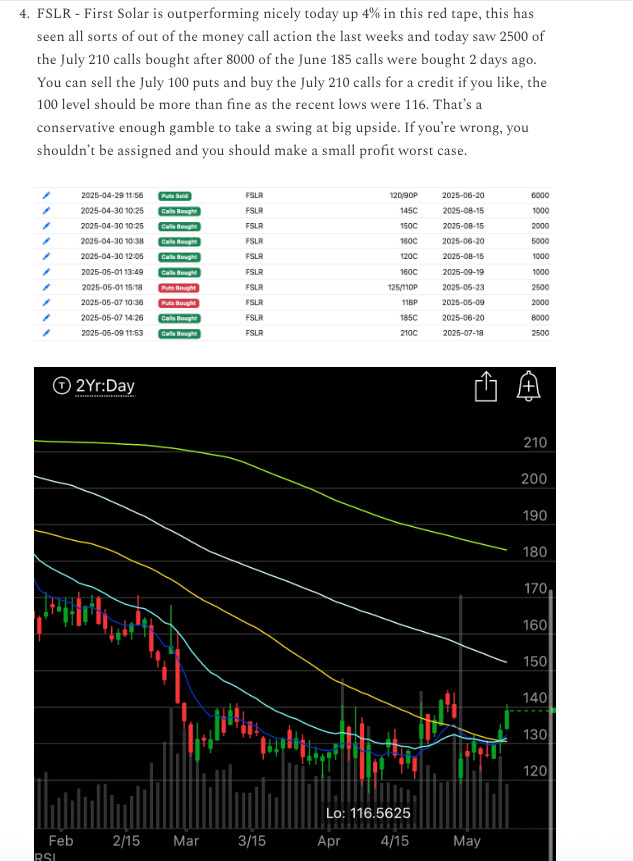

I think regardless of whats happening in the market, you’re still going to see pockets of option flow getting egregiously bought. Look how many times I highlighted FSLR over the past month?

It started on 3/26 here before the trade war in that recap when I flagged all the massive put sales in 2027 that day.

Then 2 days ago on friday here it was under 140 and I mentioned even more outrageous looking calls below like the June 185’s bought that day, with the stock at 138 on friday, those seemed absolutely insane. Here we are 2 days later and its $190 up 21% today alone after being up 11% yesterday. When you see a name like this repeatedly in the flow, even if you don’t want the calls, you can grab shares or if you’re conservative sell puts like I did. The point is to be in the right names as often as you can, and I’m trying to find what names are being bought. Otherwise there’s no reason to waste time reading these recaps. Sometimes names like this FSLR over the past few days was getting egregious where yesterday’s recap had me highlight multiple calls over $200 and you have to really follow those, I unfortunately did with put sales so I made way less than had I bought commons or calls.

My Open Book

Here are the trades I made today