6/18 Recap

Slow session into the holiday tomorrow. We have no market because of the Juneteenth holiday. This morning the retail sales number was a miss which is odd because I know Amazon is tracking ahead in all the 3rd party data, so it makes you wonder who is tracking behind? It seems like the lower end retailers are the ones that are really getting smashed, not the Walmart types, but more of the Dollar Tree, Dollar General,etc.

The SPY is just on cruise control right now, there isn’t much to say look at the chart below, we’re still in drift higher mode for the time being. It’s weird because today every tech name except NVDA is red, but the RSP is picking up the slack today with the rest of the market rallying as oil picks up and banks are going well just a healthy shift from tech only carrying us everyday.

Tomorrow with the day off I will send out a longer write up on what I’m thinking with my Apple trade yesterday.

Recent Trades

Chewy is up 15% more today. In the 5/20 recap here I highlighted some calls on CHWY expiring the last week of June. The calls are nearly up 10x today from that time and if you used the unbalanced risk reversal I suggested your profits are incredible because you got paid to put that trade on and now have $10 per call. The January $10 puts went from .75 to .10 now.

You can see the volume here and they’re still in the open interest today, so this player has not closed them at all, what an unbelievable trade a near 10x in under 1 month as they’re 10.15 x 10.95 as we speak from 1.24 basis.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

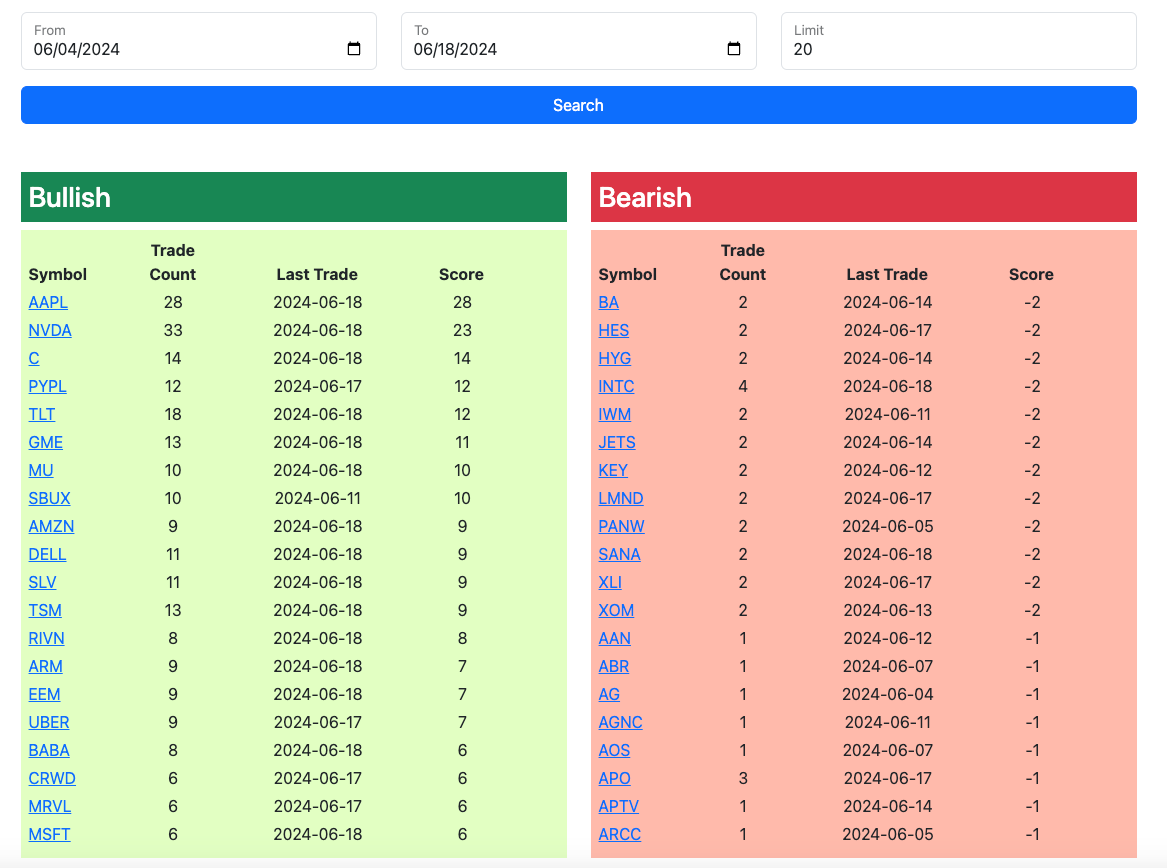

Here is today’s link to the database, since there’s no market tomorrow, it won’t expire until thursday morning at the open. The rest of today’s trades will be added in by the afternoon. There was a lot of calls today so they don’t all fit in the screen grab, you need to check the link anyways to see all the trades today.