6/3 Best Idea For The Week Ahead.

GM

I feel like we’re about to start a rotation out of the S&P 7 into the S&P 493 from here. It doesn’t mean tech is a sell but it means tech has done an incredible job and it’s time for some of the normal equities to catch up. GM made a powerful move on the daily chart friday. You can see it was coiled up below all these moving averages and finally broke above them. It has nothing stopping it between here and all that resistance at 36.

The weekly chart closed over the 8/10 for the first time in months. Another sign of strength and you can see the MACD curling up, much like say Amazon a few weeks back. All signs point to emerging strength here

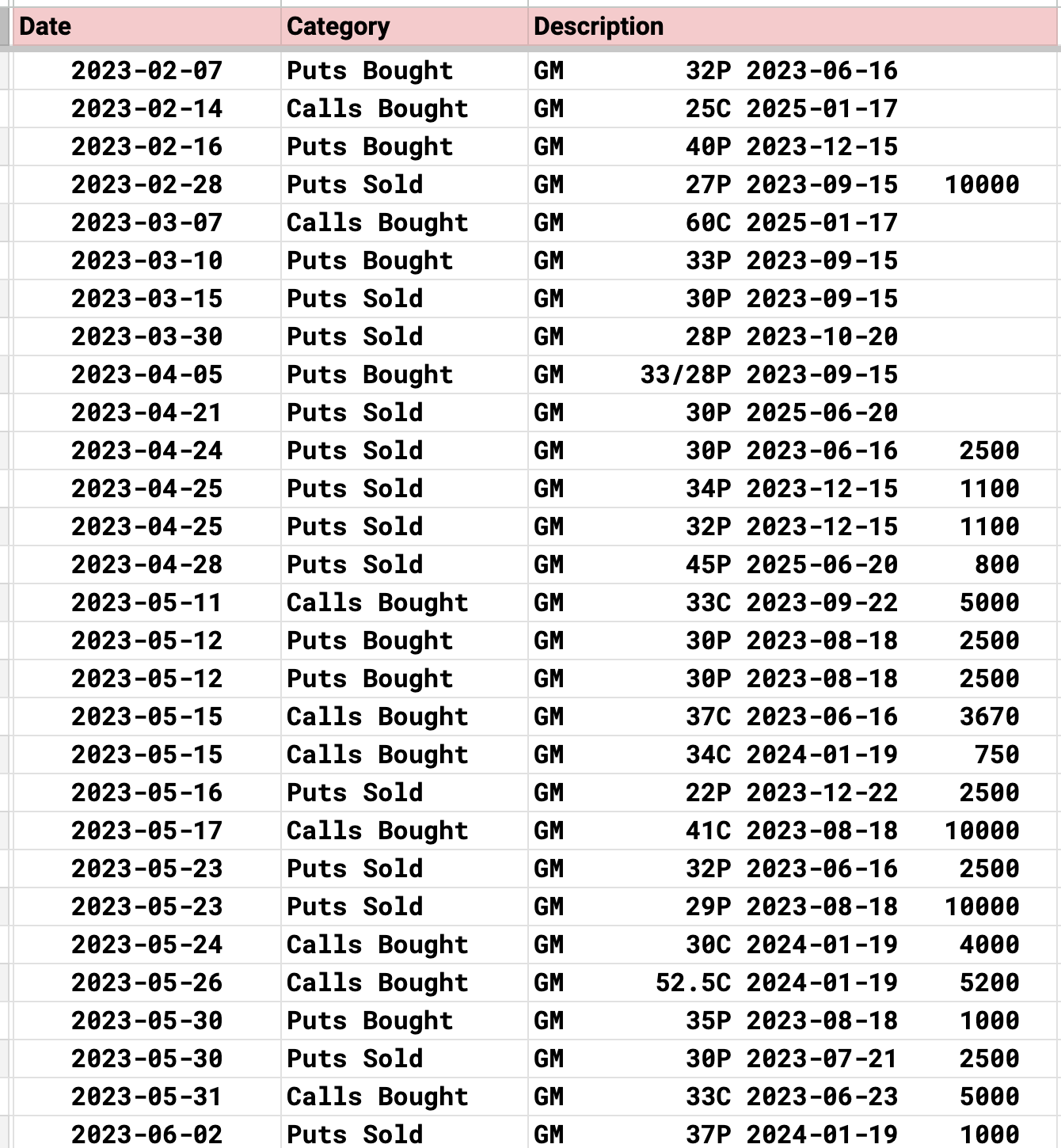

The Options Flow

These are all the open options in my database, lots of puts sold targeting the low 30’s open still. A few weeks back there was a large 10,000 block of puts sold at 29 expiring in August. Those seem like nice sells to me if one was interested in the name. There was a sizable block of 1000 puts sold at 37 in the money yesterday that was interesting to me, they only do that when they see considerable upside. There is also heavy action in August 41 calls. Bottom line, I like the idea of selling puts at 29 or 30 a few months out on a quality name that seems to be turning around.

Lastly, I’ve been getting emails asking me when I’m going to begin posting trades again. I just want to say what I’ve said all along, the purpose of this substack is not what I do, it’s the data I post. I post my book to be honest with you, but this isn’t high school and you’re not here to copy me. I’m breaking down some really expensive data and organzing in a way that nobody else does. That is what this substack is about. Modeling trends using options flow. It’s disappointing to me that so many think it’s just a copy me newsletter. I’ve explained why I’m not actively trading. My dad has skin cancer, for the next 6 weeks I have to basically spend a few market hours a day driving to pick him up, take him to the appointment, and drive him home. I can’t manage 30 open positions when I’m not by my computer for that kind of time, especially with the leverage I traditionally use. More than that, it’s summer, I have some trips planned after all that is done and I don’t want to focus on markets. With that said, if you really were copying me, what did I do 2 weeks ago? I made a long post on why I felt it was time for Amazon to turn around and that’s why I was hiding there for the next few months during this period. Those calls are up 20%, so my book is up 20%. It hasn’t been a bad 2 weeks for me. I just get disappointed with the emails that look past the real value in here which is great options data.

Even when I noted that huge 96,000 block of Amazon calls bought a few weeks back before the huge move, every other options service out there had that as a sell and I had to spend hours of my life explaining to countless people on twitter why they were wrong. I am providing things that no automated options service can, and I will continue to do so even if I’m not actively trading myself. I hope you see the value in that. Other services give you every single trade, I try to make your life easier by pointing out just the oddest ones so you don’t have to waste time looking through everything to find what’s important. This is a giant cheat sheet of the notes I use to look over charts at night and find nice setups. I don’t take all the trades I highlight but if you pay attention to the 5 I highlight everyday, many work out, very quickly. Just want you to understand, what I do in my trading book, is not what this is about. Taking the information and applying your own touch to it is the goal. Whether it be you selling puts or buying calls or buying common. It doesn’t matter, what matters is finding levels institutions are playing at, and using that information to better your odds of a successful trade.

Have a great day and I will see you tomorrow with some charts of interest for the week ahead.

Thanks James!

Thank you! Have a good weekend