7/15 Earnings Preview For The Week Ahead

I know I typically do my best idea on Saturdays but I’m going to post that tomorrow instead. The reason being, these earnings previews are very long, I have options data from way too many names to post and I want to make sure you have enough time today and tomorrow to draw up your battle plan for the week ahead. It’s alot easier to digest a best idea post on Sunday than it is to look through options data and charts on over 50 names in 1 day.

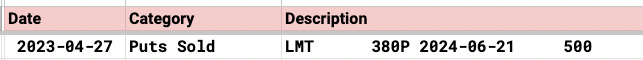

Here is the calendar for the week, if I don’t post a name it is because I have no trades of note in my dataset. Again you would have to check the open interest on these tickers individually if you are interested in playing because many of these trades were placed months back and may have closed out already. So please keep that in mind.

With that said, my advice is to not play earnings at all unless you have some deep convictions. The reason being is this, it isn’t worth gambling. You have names who smash earnings like JPM yesterday and selloff, then you have names miss every metric and guide down but the stock rips higher. Earnings are a crapshoot. I know its human nature to want to gamble, but those who have been here through multiple earnings seasons know that I am a big believer in a market phenomenon called PEAD, Post Earnings Drift, and that is the concept that names tend to drift in the direction of their post earnings move for the next 3 months after a report. Thus, there is no need to play earnings because if a name gaps and goes you now have multiple ways of playing it higher for the coming quarter. Personally I like to wait for gap ups and then sell puts back down where the gap was created on good earnings reports. Gaps tend to fill the majority of the time and that is my preferred method.There was no need to catch that initial move and all the risk involved.

With that said, if you have conviction, go for it, the worst that can happen is you gain a valuable learning experience from whatever goes wrong.

I’m going to organize these by the date and whether the name reports premarket or postmarket just so you can organize your gameplan better. Again with all this data my number one focus is finding levels institutions are interested in going long via puts sold. The other trades are important in building a thesis along with charts, but the puts sold are, to me, the most valuable part of this data in deciding where I want to sell puts. Use the size of the contracts and the date the trade was placed to determine how valuable a specific trade was in your thought process. Lastly, remember I didn’t add contract sizes until maybe May so that’s why many earlier trades don’t have the size of the trades but trust if I noted it, the size was an abnormality.

Tuesday Premarket

Tuesday Afterhours