8/19 Recap

We’re back in that slow drift higher on the SPY as we’re less than 2% from ATH again. That crash 2 weeks ago is looking like a generational dip at this point assuming Jackson Hole goes smoothly this friday. We have a big gap below now at 545 or so and we’re a bit extended from the 8 ema(dark blue line) now so a pullback to that isn’t out of the question. We have NVDA reporting this week which will cause alot of names to move with it but this market is looking good for the moment, the 21 ema is sloping up again and we’re all just waiting for this friday at this point, you can use this week to clear up some things into Jackson Hole incase it somehow crashes markets like 2022.

If you want one commodity to keep your eye on its oil, this is not looking good at all right now, I could even see this flush below 70 if that 72 level below is lost. Obviously oil in decline is good for keeping inflation in check, but it also could be a recessionary signal. So keep your eye on it.

Recent Trades

EQT - In friday’s recap link I noted those way out of the money calls bought 100% OTM in January 2026. EQT is up near 5% right now a session later and those calls are up 25% to .50 from .40. That’s about as good of a start to a trade as you can ask for with EQT approaching $34 now.

Trends

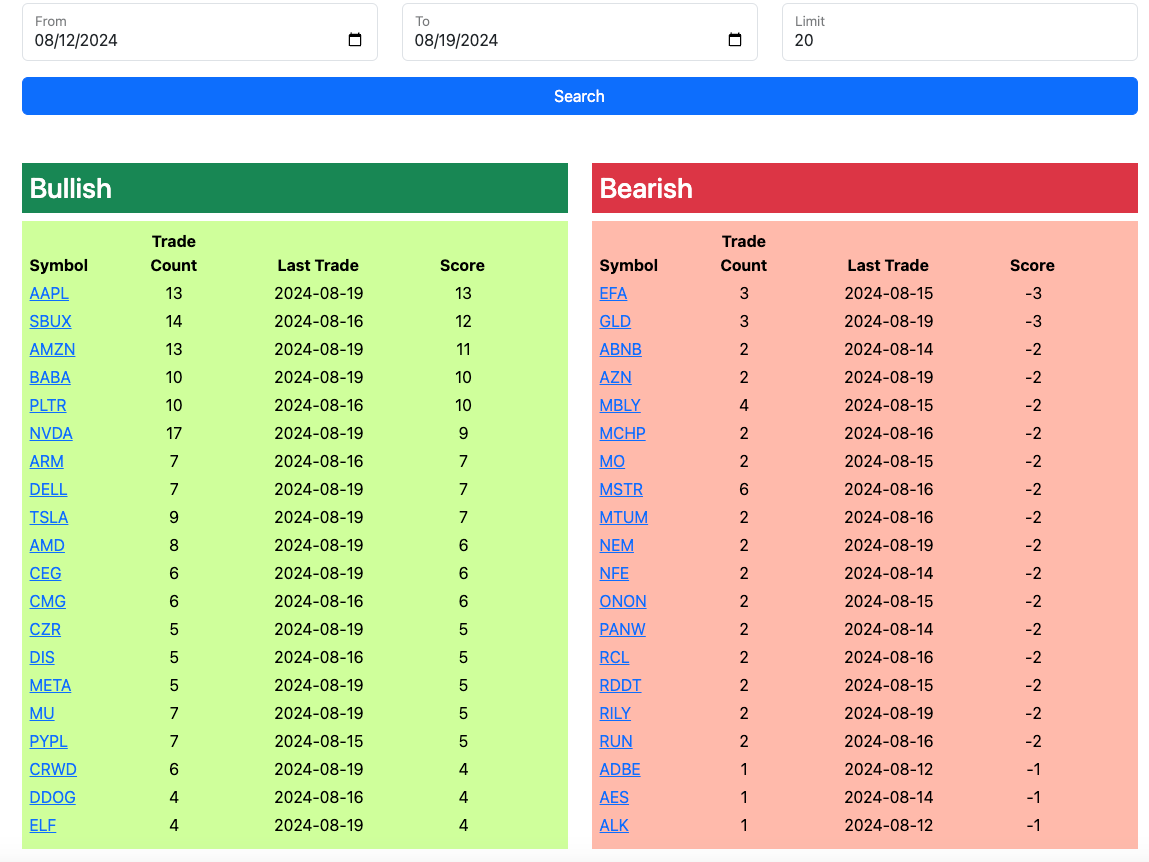

1 Week

2 Week

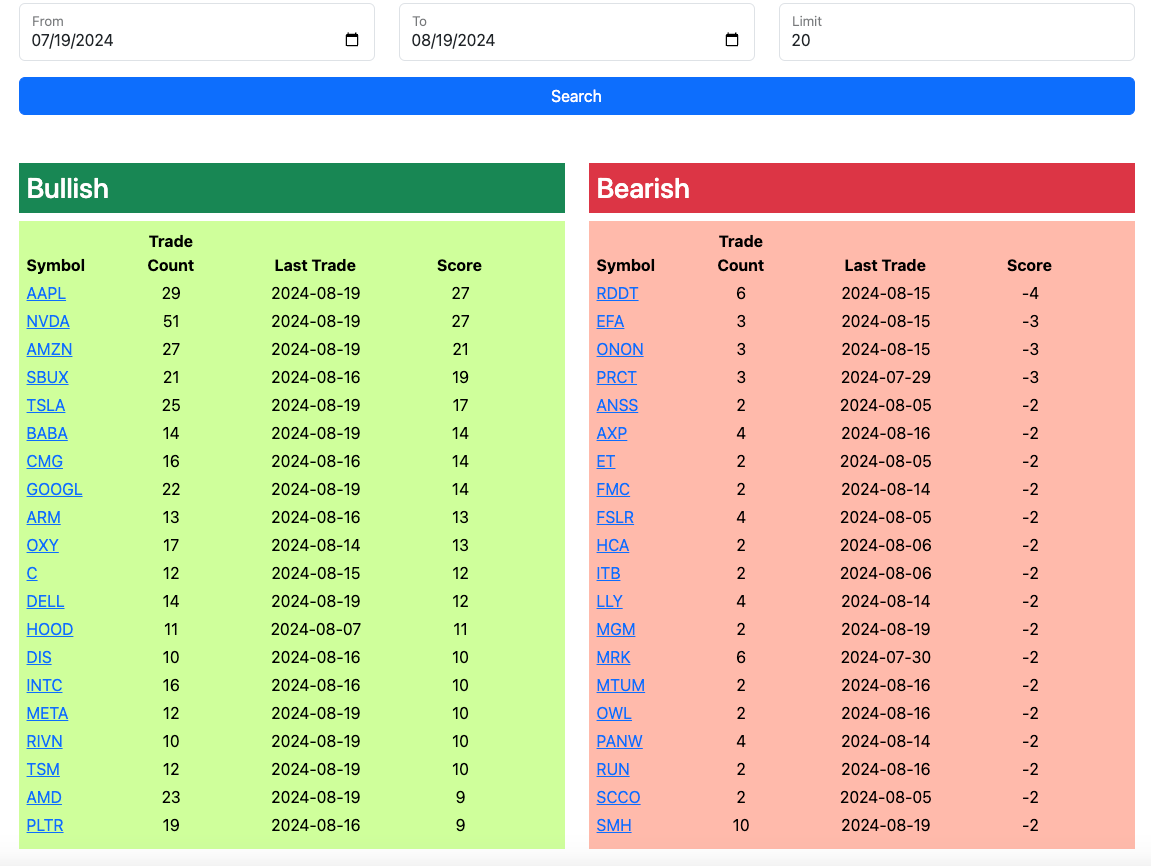

1 Month

Today’s Unusual Options Flow

Here is today’s link to the database, as always this expires tomorrow at the open and the rest of today’s trades will be added by this evening as I have to head out after I send this. There were alot of trades today so check the link below to see all of them because they didn’t fit here.