9/3 Recap

What a choppy market, as of right now, we haven’t even broken the 21 ema, so technically speaking the SPY is still in an uptrend. Of course you can see the bearish divergence on the RSI and you can see a breakdown from a bull flag now below the 8 ema. Unfortunately you can also say a lower high has formed as we never took out those 565.16 highs. So while we are in an uptrend for the moment, we’re very close to the 21 ema and it isn’t looking good now. We’ll see how we react to that 21 ema test, there is that small gap below you can see from 8/14, that would be my target to be filled.

The SPY looks alot better than the QQQ, tech looks terrible right now, we’re nearing the 100 day, today we broke the 21 ema and leaders like NVDA are getting destroyed down over 7%. We are still almost 10% higher than those August lows but something just doesn’t feel right where next week we have the Iphone event and all the megacaps are lagging. MSFT is about to break the 200 day and it seems like the AI revolution is on hold for the moment with investors as defensive dividend names are the ones being bought hard which is worrisome as that is a recession trade.

Oil is also getting throttled today, this was one I told you to keep your eye on as a potential recession signal. We nearly broke 70 today. Between the way oil is acting and the way megacap tech is acting, it is hard to say the market isn’t beginning to price in a recession no matter how well we are told the economy is doing daily only to get revised numbers in the future. Again, price action is truth, the narratives are the noise.

Recent Trades

V - On 7/24 here I highlighted the far OTM Visa Calls. At the time the stock was sub $260 and a player bought these max strike $400 calls in December 2026 for 4.20, Visa has made a nice move since to 282 and those calls are now $9.10 for a well over 100% gain in a month.

Trends

1 Week

2 Week

1 Month

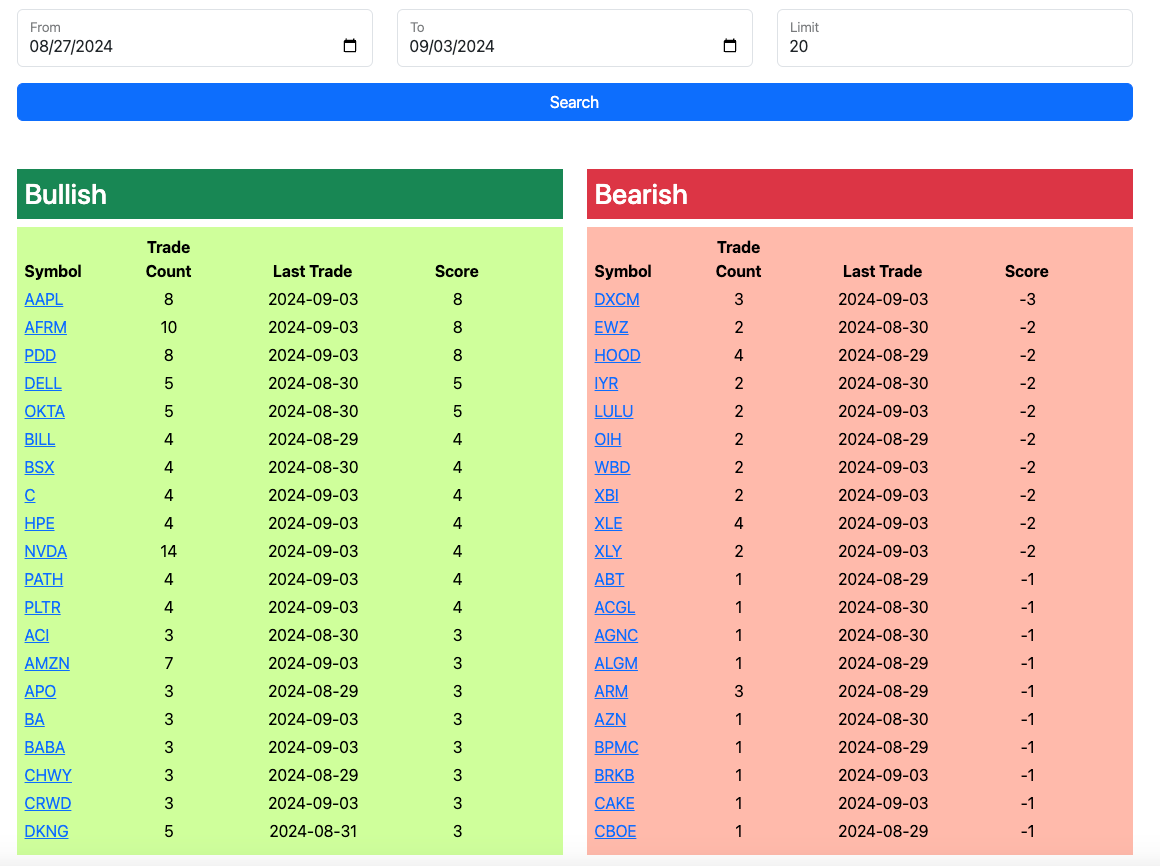

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire tomorrow at the open and the rest of today’s trades will be added by the afternoon. You will notice today was one of those rare days where the number of puts bought exceeded the number of calls bought, considering how small the percentage of bearish market participants is, this is notable when it occurs to me.