Amazon Q1 Earnings Recap

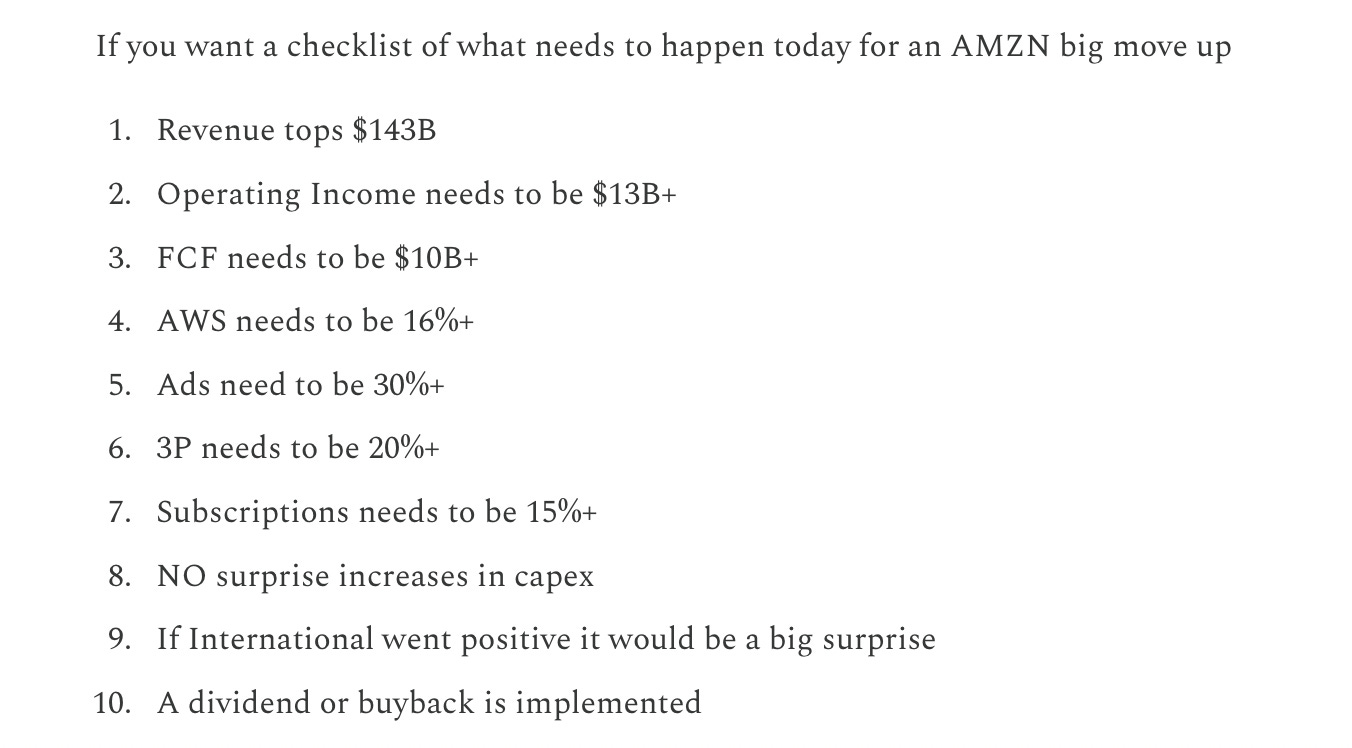

Amazon had a fantastic quarter, AWS blew away all estimates and that was the point of contention going into yesterday. A couple things did not go as well as planned, but still were very good. Going back to yesterday’s recap I added a checklist of what needed to happen for Amazon to go up meaningfully, of those 10 things only 5 happened and thus the muted reaction we’re seeing right now.

Let’s get into the issues I see first

On the call Amazon said Capex this quarter was the lowest it will be all year and will be “materially higher” ever other quarter this year. Not good, this was supposed to be the year of harvesting and Amazon would be 100% focused on free cash flow generation but now although they will generate alot, the need for AWS Capex is just too great as Andy Jassy called AI “the biggest opportunity he’s ever been a part of” so he tried to spin it in a positive light but investors did not like the same old song and dance from Amazon about investing for tomorrow. Again that is the modus operandi at Amazon over the last 20 years, but that was never during a high rate environment where their biggest competitors were focused on capital returns to shareholders.

Speaking of capital returns, we got none, another big negative here short term. I was never a fan of the potential dividend and am glad that fell through, dividends are an awful thing and provide no benefit to the company. For everyone who thinks it attracts new shareholders, you also lose other shareholders who are there for growth. The bigger issue for Amazon is in the mega 6 or whatever they’re called today, they are the only one not paying a dividend or buyback. Apple,Microsoft,Google,Meta, and Nvidia are all rewarding shareholders while Amazon still seemingly doesn’t care about shareholders especially giving that ridiculous $5B wide light guide they always do even though we’re a month into the quarter and they know they can forecast better than that.The light guidance yesterday isn’t important to me because they do that every quarter but there is just no need for that especially when the market is weak like it is now, that is management just being dense and having no grasp on the current moment.

3P is a concern to me even though it grew 16%. It’s hard to see a segment that is the world’s largest online retailer growing 16% and you’re concerned. On the call Jassy mentioned “customers trading down” which means people going to the Amazon brand things and that’s fine you could see it in the 1P business which was up 6%. Overall revenue was up so things are fine, but the 3P business had its slowest quarter in a very long time, again to me, this is Amazon’s most important business and it is still very early in terms of how small a piece of the global TAM they hold, but this is a concern, while this isn’t the dollar store and even in a recession would likely still be ok with higher income consumers doing most of the consuming, the slowdown is notable, we will see what next quarter brings.

Advertising was not good, again 24% beat estimates, I don’t really care what the analyst estimates were, my estimates were over 30% with prime video ads included. Why was this a disappointment to me? Last quarter Meta grew 17% and we were at 27%, this quarter Meta was at 27% and we were at 24%. Obviously Meta has more diverse ad products and heading into an election year the political ads are a big thing there and Amazon isn’t involved but we added Prime Video ads in late January and Netflix has told us how valuable those users are as they drive serious revenue. We have more viewers than Netflix and somehow adding Prime Video ads wasn’t much of a value ad? I’d say for me this was the biggest issue yesterday, moreso than Capex increasing but because it was the first quarter I will give them a mulligan.

Subscriptions were very weak at 11%, their lowest in a long time. Again here is what is concerning, before this quarter Amazon was growing subscriptions at a rate of give or take $300m every quarter over quarter. We grew $240m from Christmas to now and that is including the big push for $2.99/month ad free Prime Video. You could imagine without that, the subscription number was going to be materially lower than it was. That is not good. Are people actually cancelling Prime? That seems likely now, the reality is, you don’t need a Prime subscription to order things, you can still get free shipping in 2 days without Prime as long as you spend over $25. You just won’t have access to things like the Whole Foods Discounts, Prime Video, NFL,etc. For me the Whole Foods discounts alone are far in excess of the $139/yr I pay prime, otherwise technically I wouldn’t need it either as I don’t watch much tv.

So other than the thing that went bad, AWS was great, it surprised alot of people coming in at 17%, the margins were off the charts at 37% but that was more of a 1 time depreciation lever they pulled and they also did that in Q1 2022. Right now, Amazon is dominating across the board, but there are question marks regarding the retail business now, not AWS, and for the last 12 months the questions were around AWS. Amazon can never seem to get both its segments in tune together, one always has concerns. Do I think the Amazon concerns are competition? No, because we beat on revenue, I do think it is simply customers trading down, the Amazon brand stuff is very compelling in pricing, it is hard not to go with it.

Again 16% growth on 3P is tremendous numbers, but Amazon still trades at a hefty premium to all these other tech names and when you do, you can’t have deceleration like this on one of your major segments. That raises eyebrows, that is why we’re flat today. The best case scenario for Amazon here is it holds up during this period of market weakness, it has now been 3 weeks since the bearish crossover we saw, and until the 8 ema crosses up through the 21 ema, the market is going to continue to be weak. We got close this week, but have turned lower, if you remember my initial post when the crossover happened, I said these periods are multiple weeks typically. Here is that post so you can see for yourselves Link

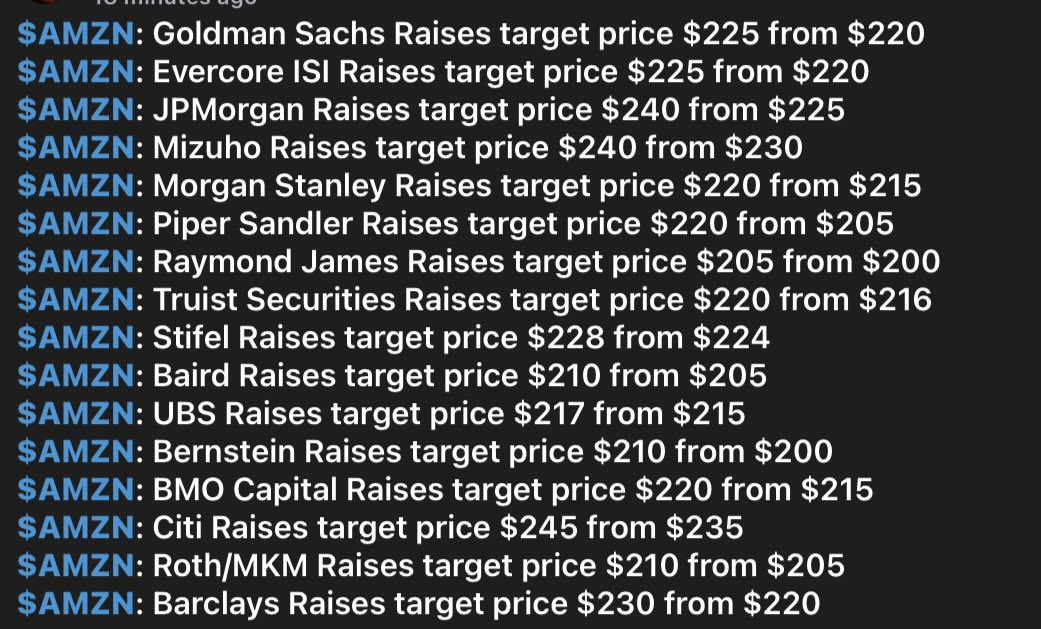

This morning nobody lowered their targets on Amazon, why would you, the quarter was very strong and Amazon was Amazon, nothing out of the ordinary.

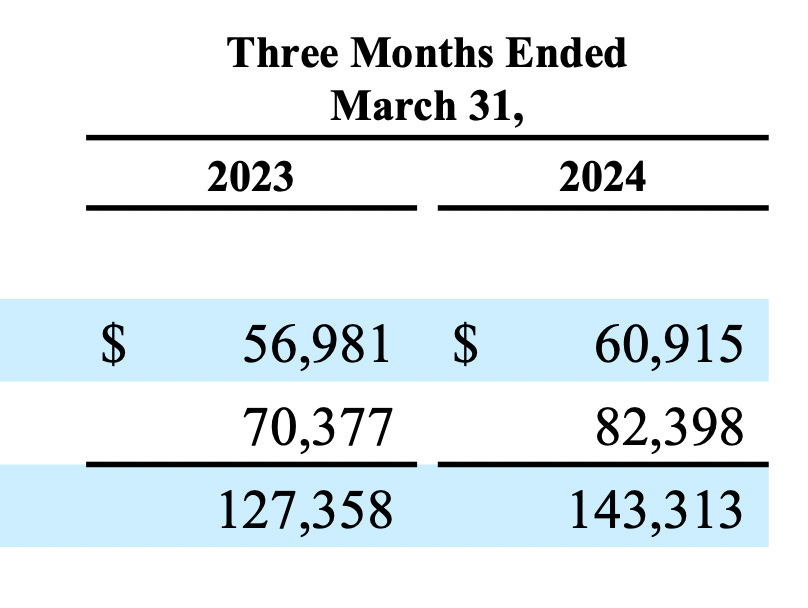

If you look through the whole earnings report, the most fascinating thing to me is this below, currently Amazon has $82.4B/quarter in services revenue, these are the most important high margin segments bundled together and the $60.9B is the low margin retail/physical store business. If you go back to Q4 2019, the last Christmas quarter before Covid, Amazon did $87.4B in revenue in total, today they do almost as much just in high margin growth segments.

Overall I see nothing to be concerned with, the market is up 6% this year and Amazon is still up alot more at 17% right now. We are in a correction right now, if we reported these numbers during a better period, things would be different but META,MSFT, and GOOG all sold off on great numbers. The economic data we’re getting isn’t good. How long will this period last? Who knows you’ll see it end when the moving averages crossover bullish but for now everything is going to be weak unless some miracle occurs today during FOMC. We had a great 6 month run, it’s over, but look where Amazon is, it is $177.xx this morning, this stock was below $120 in late October during the last drawdown, if you are concerned you could sell some now, but the business is doing great and I have no concerns right now.

As for the big concern everyone has today about rising Capex, I will say there is probably nobody on earth you want in charge of that besides Andy Jassy. He built AWS from the ground up and he has never once shown that he is a poor capital allocator, if he says this is the biggest opportunity of his lifetime, then you should be happy he is pouring more and more capital into it, even at the short term sacrifice of your stock not going up today. I still believe this stock is $220 by year end and $300 by the end of next year, if it isn’t, the market has some serious issues regarding a recession or stagflation. At $177 today I would say downside at worst would be last quarters gap below at $160. If you sell puts there that would be a tremendous long if you got it, we shouldn’t get there unless the market really falls apart but I would expect the 100 day below to hold up as it did last week.

The longer term technical picture is still very good and it seems like we may indeed now be forming a handle after this big cup, possibly down to that 160 level which lines up with the 8 month, filling that gap, and then later this year we get the breakout higher.

Thanks for the fantastic comprehensive update.

My one concern is that revenue was higher because 3p to 1p, remeber 1p more revenue less profit 3p less revenue more profit