February 2023 Recap. The Outperformance Continues.

This is going to be a long post but I hope you take the time to read this monthly recap and read about the new things I’m implementing going forward to make this substack stand out.

Let’s start with the most important thing when people spend their time reading whatever ramblings one has daily, PERFORMANCE.

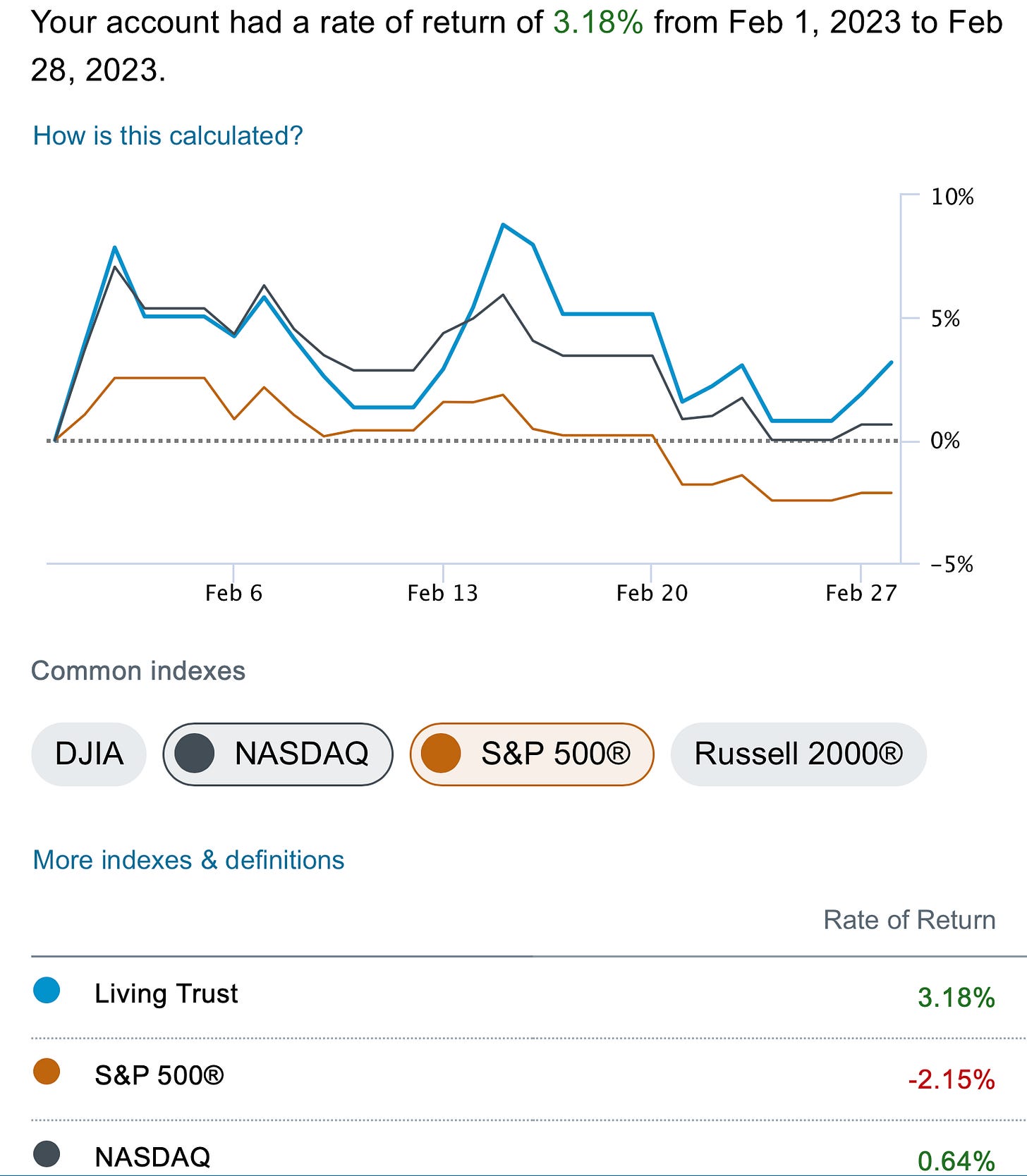

February

For the month of February, I outperformed the S&P by 5% and the Nasdaq by 3%. That doesn’t sound like much at first glance, but that is significant outperformance especially considering how leveraged up I am on my short puts. Remember, I’m not here buying calls everyday nailing 150% gainers, I’m selling long dated puts, and my big gains don’t really come until the second half of the year, so any outperformance early in the year is a welcome surprise.

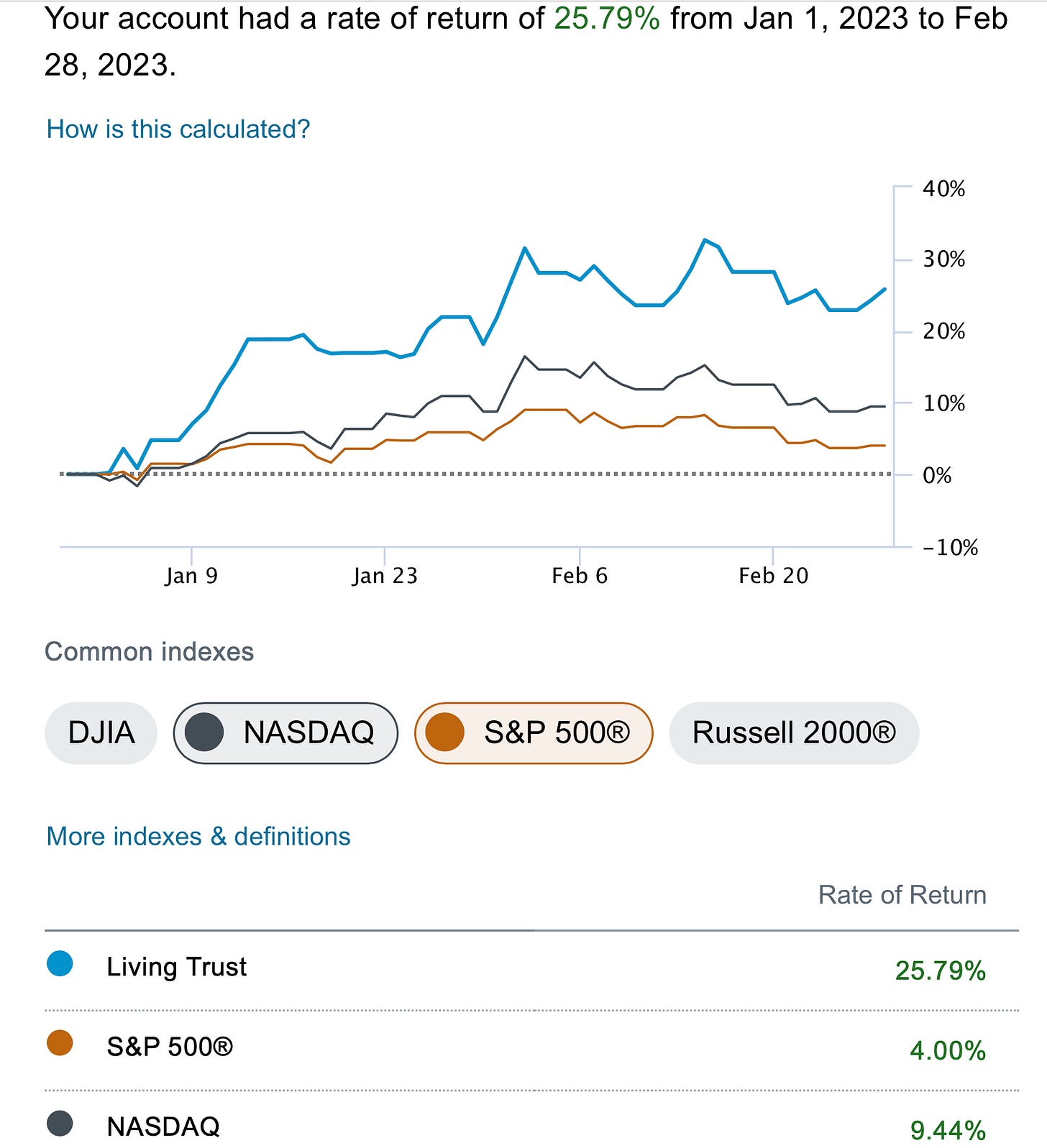

Year To Date

For the year 2023 so far, everyone should have done well, markets are up nicely. I’m up nearly 26% in those 2 months, while the Nasdaq is up over 9% and the S&P is up 4%. As the market has been off to a hot start, I have outperformed because of the heavy focus early on selling premium into the strength that we saw in small caps. I was heavily layered into short puts on a myriad of names that had tremendous runs early in the year and that led to this outperformance so far. Names like Twilio are up 50% these last 2 months and that was my 2nd largest position coming into the year.

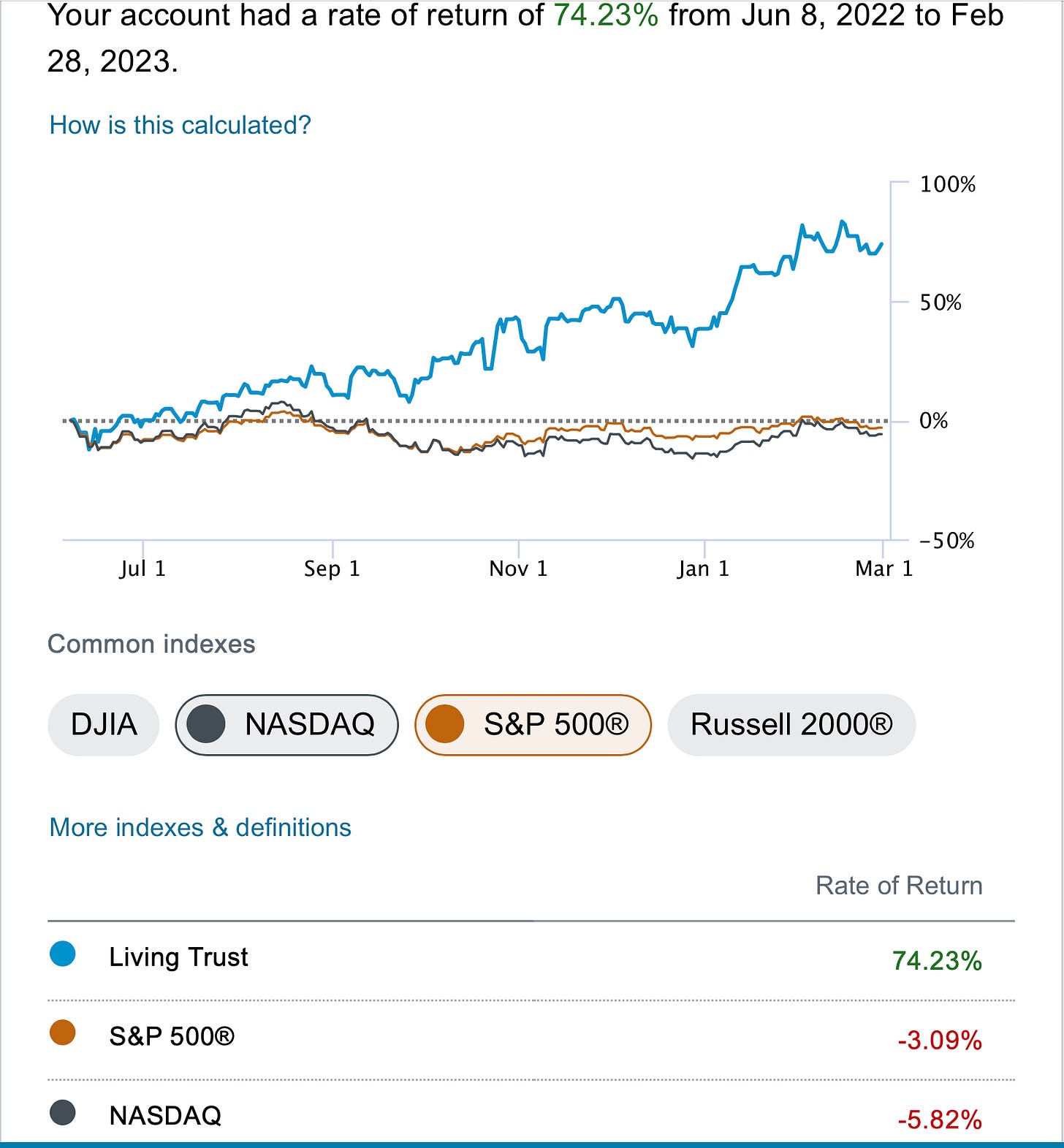

From Inception Of This Substack June 8th, 2022

This is what I’m most proud of, I’m now up over 74% in the last 9 months vs the S&P down 3% and the Nasdaq down 6%.

I AM OUTPERFORMING THE MARKET BY 77%

Do you realize how difficult that is? You see all these people on twitter now posting their YTD returns after the hot start and their 3 year CAGR adding in the covid boom, but nobody wants to discuss their returns during that nasty period we just had, one of the few times equities went down for an extended period. I started my substack in the midst of that. I’ve posted my trades and tracked my performance this entire time and shown you what is capable during even the roughest of times if you put in some hard work and dedicate yourself to this game. We always hear about how nobody can outperform the market in the long run and I set out to show everybody how silly that statement was last June. So far, 9 months into this project, things have gone very well.

I never knew how far I would take this thing. What started out as me trying to point out unusual options trades and a detailed look at one of the markets dirtiest secrets with a simple daily recap noting a few options flows and charts has turned into a detailed recap with my best ideas and now a database tracking all the unusual flows with the ability to spot trends over time. I initially intended to share my daily notes that I would study nightly to prepare for the next day and the evolution of that has been amazing as you all have thrown out suggestions on things you wanted me to add.

Since we started, you asked for a discord so you all could chat amongst yourselves, I added it. You wanted more Youtube Chart sessions, I’ve added those. You then asked for a more organized way to look back at the data I was posting daily and Edwin(Sped on Discord), who is a really busy guy, running a very large startup, helped me organize the data in such a great way. I never even used anything like that for my own benefit previously. I was old school, writing oddities with pen and paper as I saw them and keeping track of things. To say this has evolved from a substack to something significantly more is an understatement.

My goal when I started this substack was to provide the bet unusual options service in terms of data for the lowest feasible price. Alot of the options services that exist are just hooked up to the CBOE and feed you all the data that is readily available in your brokerage trading platform. That isn’t what I wanted, there is no need for all the data, only the best parts. I wanted to filter out the most unusual trades based on historical data and volume to provide the most unusual things that I was seeing daily. These other services were all charging way too much for what they offered in my book, but access to options data is not easy to obtain for a cheap price. I myself pay over $2,000/month for my bloomberg terminal to access such data. So it does make me chuckle when I get all the unsubscriptions and they cite “price” as the reason they unsubscribe. I think $49.99/mo for someone using a $2,000/mo terminal to find the options flow and then spend alot of time organizing it into your daily cheat sheet is a very reasonable value.

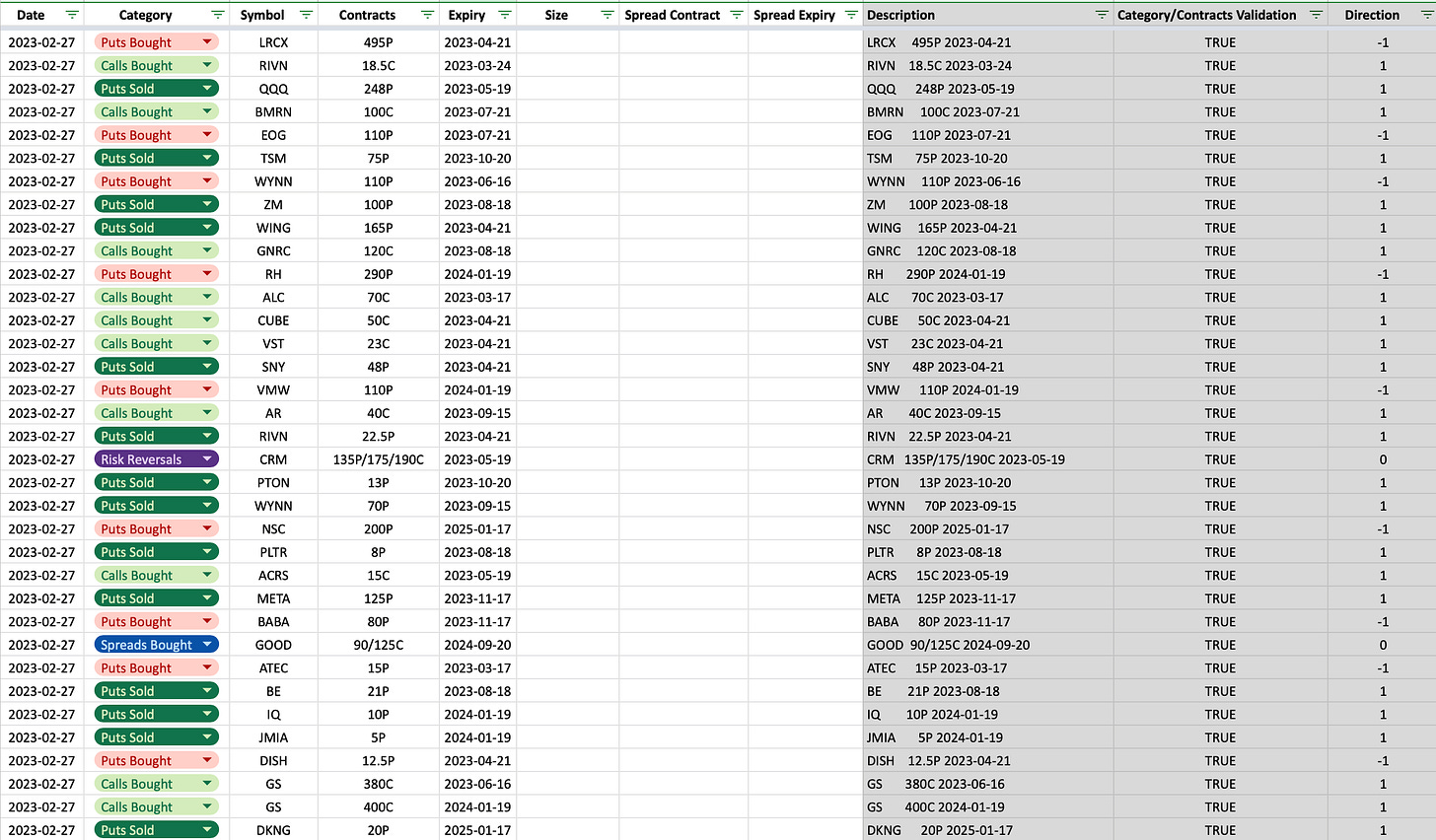

Database

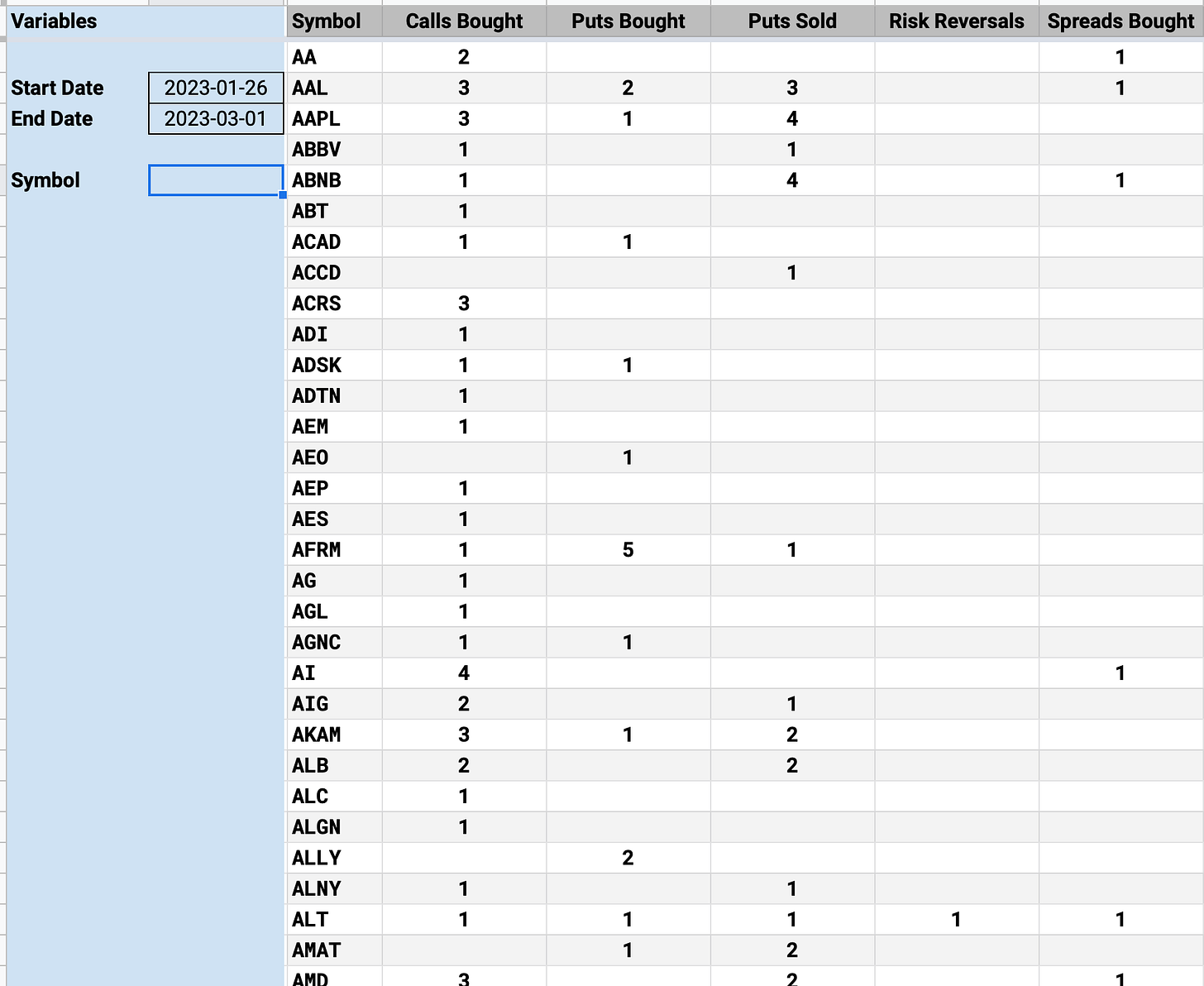

I want to discuss the new functionality I’ve added recently to this project. A database has been created to track and log all these unusual options. We are now 1 month into this. This is what I’m using to manually input all the unusual trades I am seeing, just a spreadsheet which collects all the inputs and sorts them for us all. This is time consuming, but it’s building an incredible amount of data that I can utilize effectively.

Basically as I input the data, it creates trends. The trends look like this and show how many times each type of different trade has been logged in each name. I now have over 1700 trades in nearly 700 names logged in the past month since I started, so you can imagine the trends I can catch with 20,000+ trades a year.

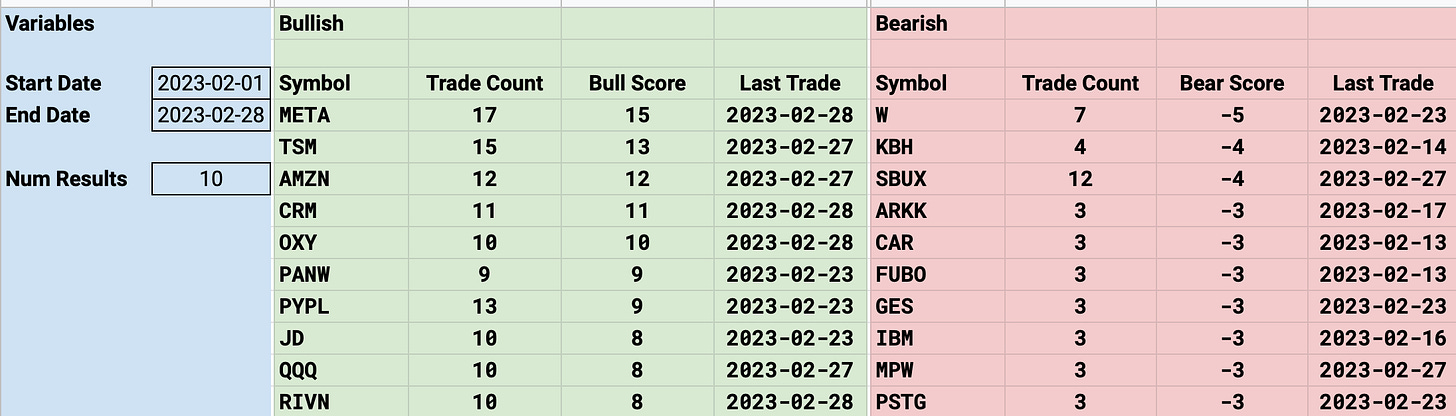

Those trends have now been organized into the new ranking system that just got implemented yesterday and will allow me to quickly spot trends over shorter and longer timeframes to share with you. This is a look at the top 10 bullish and bearish trends over the last month. You can see the bull score and bear score which come from the data inputs show the net of the bullish/bearish trades I have logged. Simple stuff, but very useful.

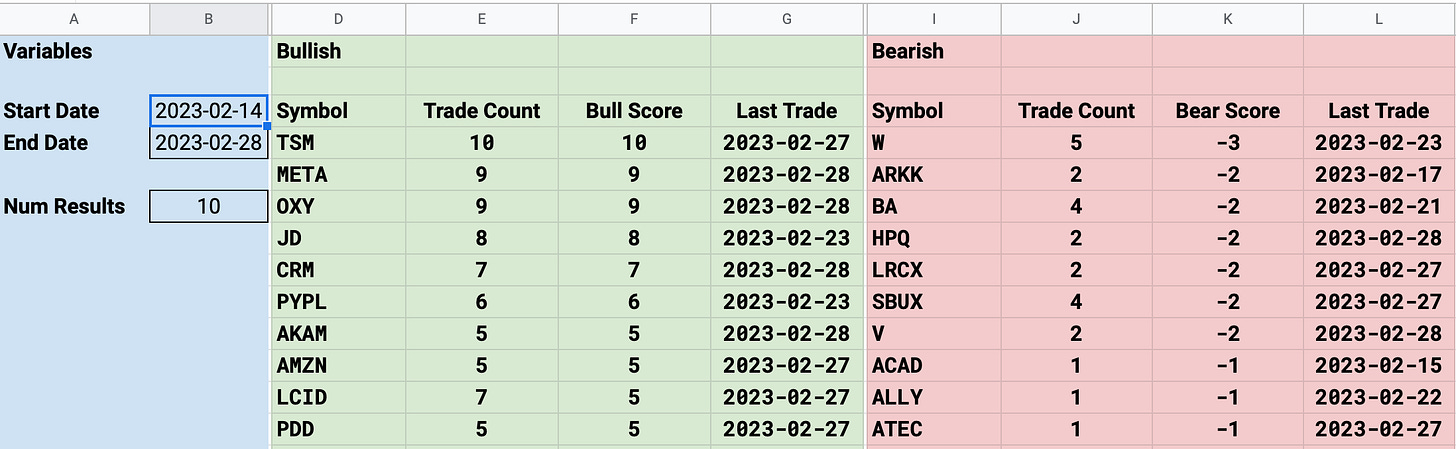

Here is the same ranking system over the last 2 weeks. As you can see, the names change as they see varying action over different timeframes. Look at something like W was one of the most heavily shorted names this past month and in terms of performance it was one of the worst names falling 25% in 1 session after earnings and the option flows were pointing that way well before it fell apart.

Here is what I had logged on W in the past month with dates before it crumbled, once again the unusual sized options activity came before the actual move.

If you look at the dates above and look at the chart of W, below, you can see most of those trades were placed well before it fell 25% on February 23rd. Highlighting the notion that the options market does hold they key to everything as it is where you see all the big trades going off long before you see the 13-F everyone is sitting around waiting for to catch positioning after the fact.

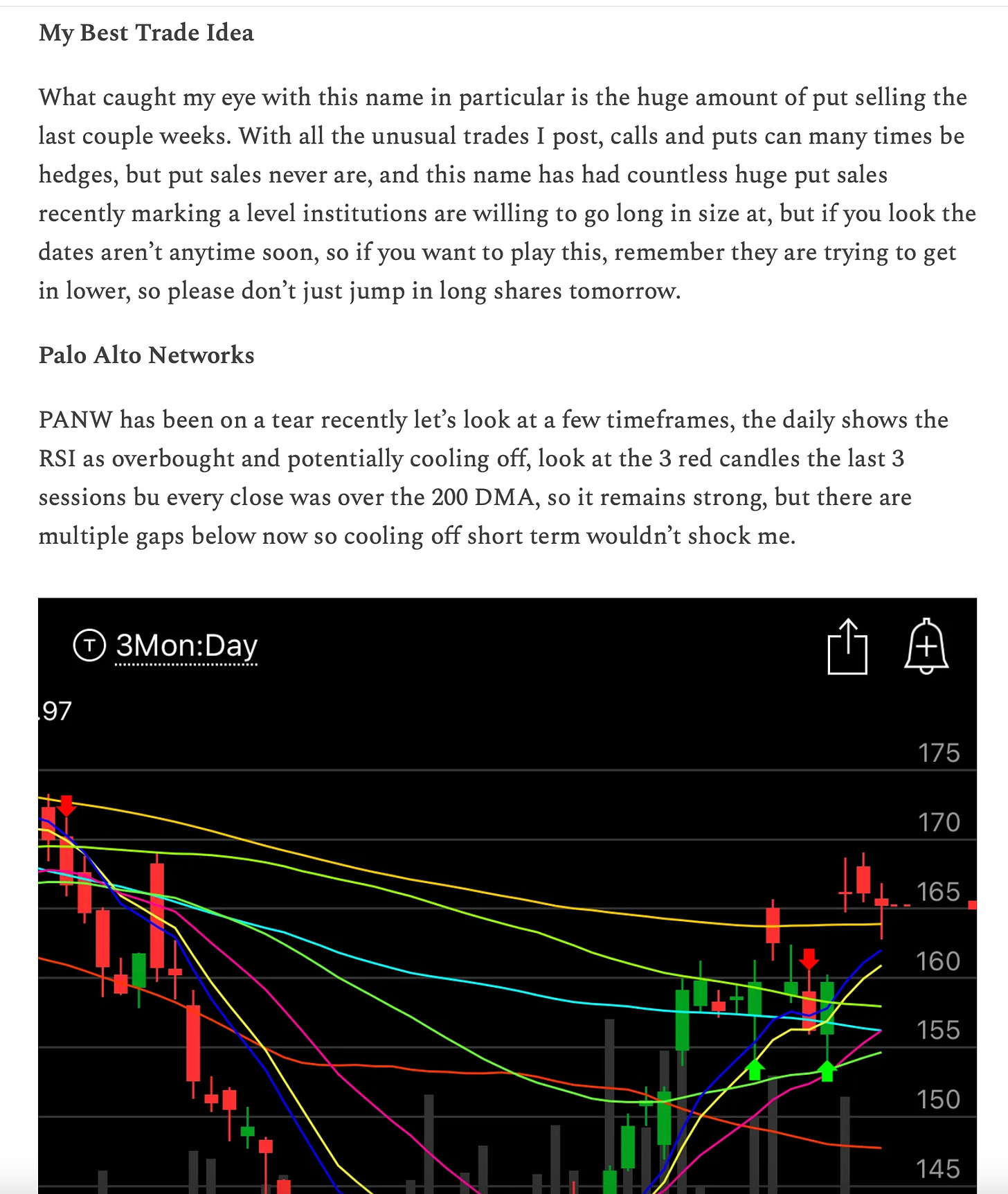

It’s added a significant amount of work on my end putting in nearly 100 trades a day but there is no way to automate this as I’m simply breaking down a ton of data into what catches my eye and then noting it. So although it does add quite a bit of time to my day, I kept on because I know this database will not only help me in my trading but it is what will separate me and this substack from anyone else. I know the ability to filter/sort trades will allow me to keep you all in the best names with directional trends like PANW a couple weeks ago when I made that my best idea and it took off since. If you go back to my post on 2/12, here was what I said on PANW

Since that date in just 11 sessions Palo Alto Networks, a real company that’s worth almost $60B, is up a little under 20%. That isn’t me moving a penny stock, that is a large company moving up because of the directional flows in the name.

So for all the naysayers who say outperforming is impossible. I want you to understand this isn’t easy, do you know how much time and effort it takes to compile and organize data to create a plan? Data runs the world, effectively utilizing it can lead to great things and that’s what I’ve shown you all over the last 9 months, slow and steady outperformance through good times and bad. Yes, trading is not the most tax efficient thing, I always laugh when people tell me “but I want to compound it and not pay taxes”…..compound what? Amazon is flat going on 5 years now, I’m just here to make money, taxes are a part of life, and taxes mean you’re making money, so I’m in the camp of I’d rather pay taxes and make money than wait for things to compound and lower my tax burden.

With all that said, I just wanted to say I appreciate all of you who have joined and stuck around. I think you’re seeing how my approach to markets work, I don’t care so much whether stocks are going up or down but I care more about finding strength and selling puts lower into that strength. Very rarely do I actually go long something but I always have key levels of institutional demand on my mind and I focus on trying to sell puts into that data.

The chat we’ve built in the discord is fantastic and I’ve met so many great people in there. The various channels where you all have started discussing different topics from charts to real estate are just fascinating to watch grow everyday as new people join. Hard to believe the caliber of the members in there. You have lawyers, doctors, guys who’ve sold startups, guys working on startups and overall it’s the same story you seen anywhere in life, people who want to get ahead and learn a new skill, find a way to come together and combine their brainpower to accomplish that task. I love nothing more than hearing stories from people in here who are taking their own investing to a new level to help achieve personal goals, that is what drives me to keep this thing going and grow into who knows what.

Lastly, I won’t have a recap today. Last night, my mother was admitted to the hospital, she’s been battling a urinary tract infection that won’t go away for years now and apparently the infection it has now spread, it’s called urosepsis? Yesterday she was feeling lightheaded and her blood pressure had plummeted so she was admitted to the hospital. I don’t know what will come of this, I hope good things but reading around online, it doesn’t seem ideal. So I am not going to be around today as I go spend the day with her there, it’s early now I started writing this at 4 am. I really want to give you an exact date on when I will resume posting and I hope it’s tomorrow, but when old people get admitted to the hospital, you just never know what direction things turn. You just hope for the best. So for now, let’s just say it’s going to be 1 missed day.

I hope you all have a great day.

Good luck with your mom. I'm sure all our prayers are with you and her.

Hey James, great work! All the best to your mum, hopefully she will recover soon :)

Here is an idea (from ChatGPT) how to do it with the subscription based access to google sheet. Maybe consult it with Edwin but sounds doable:

To make your Google Spreadsheet available only for your subscribers, you can use Google Workspace (formerly known as G Suite) to set up a subscription-based system and restrict access to the spreadsheet to only those who have paid for access.

Here are the steps you can follow:

1. Set up a Google Workspace account: You can sign up for a Google Workspace account and create a custom domain name that reflects your brand.

2. Create a subscription-based system: Use a third-party platform, such as PayPal or Stripe, to set up a subscription-based system for your subscribers. You can then integrate this platform with Google Workspace to automate the process of granting access to the spreadsheet to paying subscribers.

3. Restrict access to the spreadsheet: Once you have set up your subscription-based system, you can use Google Workspace to restrict access to the spreadsheet to only those who have paid for access. You can do this by sharing the spreadsheet with a specific email address or domain, and then setting the permissions to "View" or "Edit" for only those who have paid.

4. Monitor access to the spreadsheet: You can use the Google Workspace Admin console to monitor access to the spreadsheet and ensure that only paying subscribers have access to it.

I think there is also a way how to connect substack with your own domain.