My Positioning As Of Now

As I mentioned 2 day ago, I recently took a position in Apple leaps, I’m going to discuss my thoughts and why I took the trade I did.

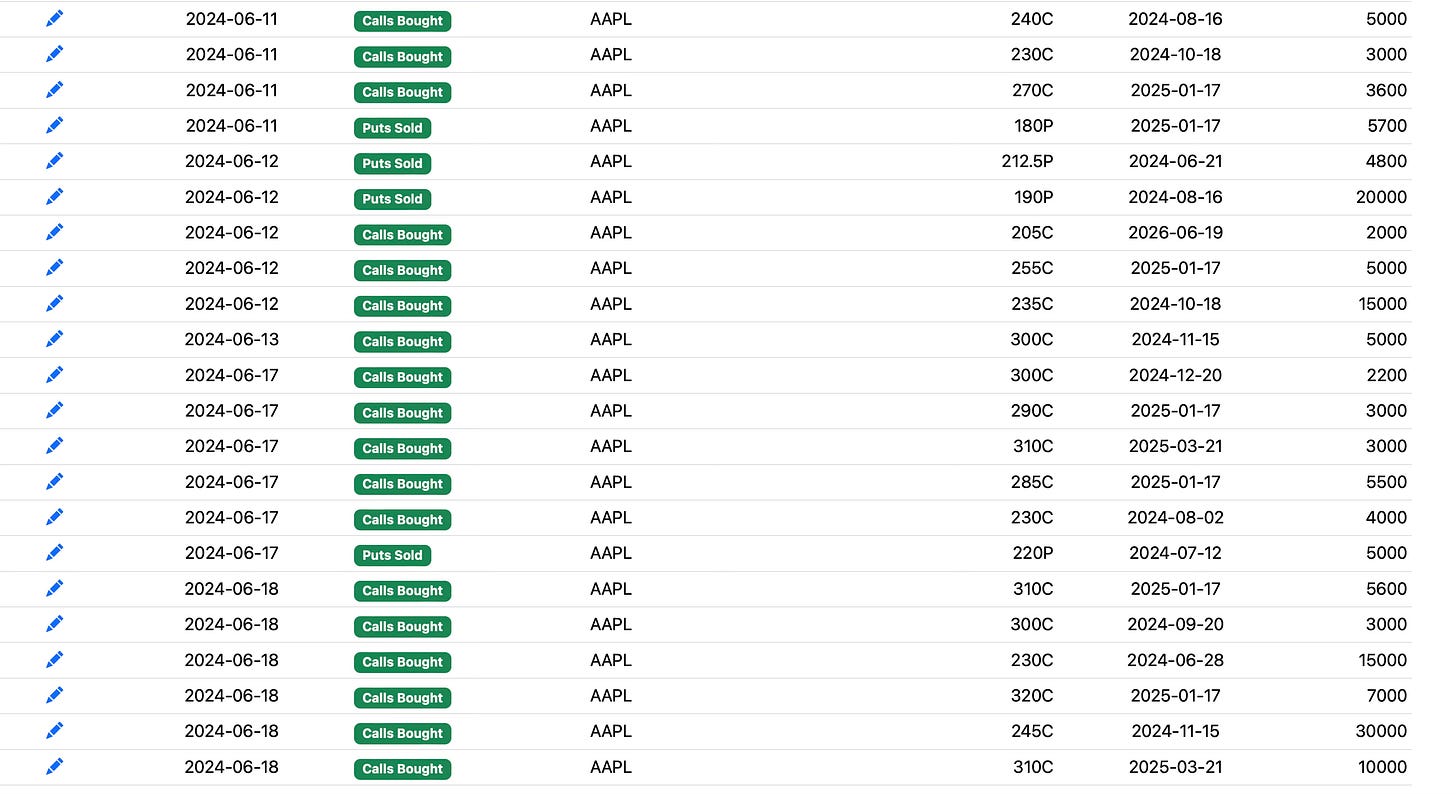

For starters, the bullish positioning has been off the charts the last week since their WWDC event. Here are all the calls I’ve logged in the last week, the amount of positioning from 280-320 over the next 12 months is immense.

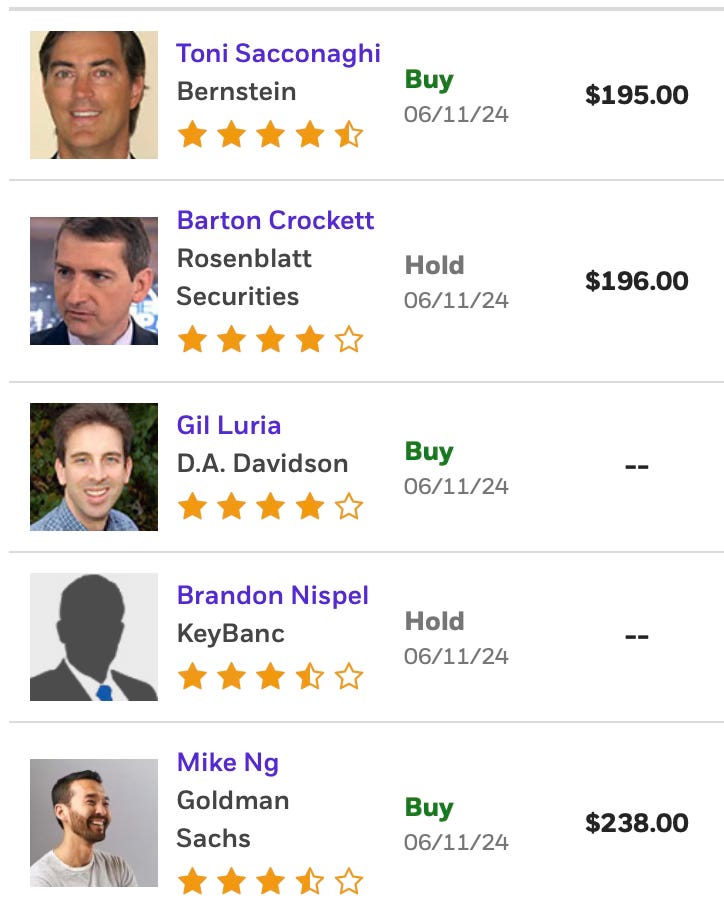

What makes it most intriguing is no analysts are looking for anything near that, here are some of the analyst targets

If there is something that causes these analysts to begin to upgrade Apple, the move can be vicious.

What could the catalyst be? In my opinion the catalyst is going to be the fact that every analyst is off by a mile on earnings, this can happen, look how NVDA came out of nowhere and quadrupled in a year and no analyst saw that a year back. As business improves, estimates rise. As of right now analysts are looking for 7.68 in 2026 EPS, I actually think that number is going to be closer 10. I’ll explain why below.

Apple is currently almost 60% of the North American phone market, it is a far smaller percentage of the global phone market. This new iPhone is probably the first one ever with a material upgrade. Do I think it’s fluff? Sure the AI stuff is not remotely important to me, but to the entire world, this is pretty much the first AI equipped device. Sure we have computers out there, but the iPhone is the world’s most important product. I myself am still on an iPhone 12 Pro Max, I haven’t really seen the need to update over the years because my phone works and all these new phones do nothing materially different. For millions though, this is their first opportunity to see what the AI hype is all about and I imagine the rush to get one of the phones will be far bigger than many anticipate. Along with that, the issues Apple was having in China recently have cleared up. Basically, the coast is clear for significant improvement in growth if the AI hype is a real thing. If it is, these Apple numbers are going to need to be revised upwards, these option buyers are certainly looking for that. These aren’t hedges 50% out of the money.

Could they be wrong? Absolutely, but Apple has the cleanest story in big tech. While the others are all battling each other for AI supremacy, with Capex requirements galore, Apple is sitting back, making devices, with no pressure on them to get involved in the Capex war. They’re taking all that free cash flow and buying back stock. Here is how many fewer shares there are today than there were a few years back. Stocks are easy, you make money, you buyback stock, up it goes. Apple just authorized a $110B buyback, that is around 3% of the company at today’s levels.

How about the charts?

The daily is a bit extended right now, you can see the 8 ema racing upwards and that should act as support for the stock, it currently sits below 210. On a break of that, the 21 ema should be the next support and that is way down at 200, this move up has been rapid. It needs to consolidate for a little bit.

The monthly is clear as day, look at this breakout. This is a multi year breakout and there is no questioning what is happening. Typically these moves love to extend, that longer the base, the higher the space saying applies here. The base goes back a couple years to 2021.

So why did I take the trade that I did?

I took the January 2026 230 calls for a little over $27 and I sold the December 2024 $300 calls for $1. My total outlay was a little over $26 with a breakeven at 256.xx in January 2026.

So anytime you buy leaps, you have to remember they’re simply levered shares. I won’t be getting the dividend every quarter and when you buy them you have to have the breakeven in mind. Take my huge AMZN leap trade, I paid 28.xx for those 170 leaps in January, now after this weakness they’re still 47.xx. The reason I took those was because my breakeven was 170 + 28.xx meaning anything over 198 in June 2026 and I was profitable. The probability of that was very high in my book considering Amazon was 189 in 2021. So that’s why I had no fear putting on that trade in that size, that far out of the money at the time.

So here with Apple looking at all the call buying, if this thing is going to 285-310, the my 256 basis, that should be ok and the trade could end up a 2-3x conservatively. If I’m wrong, well I’ve got something that has another year where I can sell calls vs it and lower my basis some more if need be. Bottom line, I have 18 months to see how the Apple thesis plays out in this AI world and the equity is breaking out of a multi year base, so the trade has some tailwinds with a little bit of calculated safety built in.

Why did I sell the $300 calls? I got a few questions of why I’d do that. I paid 27.xx for the calls, by getting $1/share back, I basically got myself a dividend so to speak of $1 x 400 calls, that is $40,000. If the trade goes against me, I could lower the calls to 280 or 270 for this year and go there, but I want to get a little money and try to capture the most upside that I can. If I get back $1 this year, then say another $4-5 next year, I could have taken $6 off my basis and have a breakeven over $250 then. Imagine if Apple is $300 in January 2026, then my original $27 calls, now with a $21 basis are worth $70. That’s over a triple. The SPY isn’t going to potentially triple in that timeframe, so the risk/reward is there for a great trade, if Apple works.

One of the things that is difficult to explain to people is, my book has nearly quadrupled from my first post in June 2022. I haven’t realized much of it because a lot of it is in that Amazon trade from this past January after I rolled the initial trade I put on last year. Look where my book was end of 2023 and where it is now. So the larger my book has grown, the harder it is to waste time with these smaller trades no matter how interesting they look. Whether it’s IBIT or QRVO or FOUR recently. I can’t deploy enough capital to move my book and sleep at night.

I think IBIT is tremendous, bitcoin is the best performing asset in something like 7 of the last 10 years. I’d probably need to deploy $1M+ dollars to generate the alpha I’d need for it to matter, but the problem is IBIT doesn’t even have calls for me to sell vs my position. Say I bought $100k of QRVO calls and they triple, great that’s $300k, that isn’t going to move the needly on a book my size. Can I put 10% of my book into QRVO calls? That is dicey because that isn’t a megacap with safety. The bigger your book gets, the more you look for fat pitches that can actually move the needle. It’s very hard to deploy a lot of capital, using leverage via calls and sleep at night. Can you put $1M into FOUR calls like I can Apple? I could not.

So my goal remains the same, I hope Amazon in general moves at some point and gets to its rightful value well north of $250, and with the recent moves in Apple, Microsoft, and Nvidia leaving them all at $3.3T, Amazon at $1.9T seems downright dirt cheap now. They have had some organizational failures which have spooked investors. Luckily it doesn’t seem too serious as the name remains a few dollars off all time highs. I would like to cash in my Amazon leaps from this January roll with a long term capital gain, unless something materially changes in the next 2 quarters, January 2025 will be my first chance to trim. In my perfect world, my book hits a level that I envision and I can sell those Amazon leaps and return to my pre May 2023 self where I was placing multiple put sales, taking shares, selling upside calls, etc and sharing all my trades everyday. I don’t want to say the Amazon trade was wrong because it was indeed a generational opportunity like I said I thought it would be, I’m up well over 100% since last May on serious size, but it has been a big laggard the last 3 months. Of course Apple and Google took turns earlier this year lagging and then had their moments as leaders, so I think Amazon will have the same type of move at some point in the next few months.

Overall I’m happy with where I am, I’ve had a tremendous 2 years documenting it all here, I think the next 12 months will be great too and I think Apple will be a big part of it with the directional flow I’m seeing. I had to make a tough decision to sell some of these smaller trades that I still think will be great, unfortunately I don’t have unlimited funds in my trading book if I’m going to keep it as is without adding funds. My hands are a bit tied with my Amazon trade and I’m not adjusting that with the monthly chart that has at the moment. Would you sell this monthly chart on the cusp of a multi year breakout over 190?

Hope this cleared up whatever questions you had. Markets aren’t that difficult, you just have to find a few quality names, leverage into them appropriately and you will outperform. I get the allure of the smaller names, I’ve traded those my whole life, but as your capital base grows, the level of risk you take declines. There’s that old adage, “You only have to get rich once” and that applies to me. I’ve gotten my book to a significant level over the last 2 years, and now I’m still being aggressive, it’s not like I’m sitting in bonds. I’m still using calls for leverage, but I’m not at the stage in life where I’m looking for trades to go 7x in a week on .2% of my book.

I hope you all enjoy the day off tomorrow and I will see you on Thursday.

Impeccable write up

Great work James I miss the days of taking pot shots on PINS tho 😉