Q2 2024 Recap

Well, we just wrapped up another strong quarter. I always love these quarter recaps because it gives me a chance to go over where we’ve come from and what is ahead. These are almost like my version of a shareholder letter. They are a bit long, but I have alot to say. I will have no best idea post this week. It is a short week and volumes will be very low with the 4th of July holiday.

The market just closed its 6th green quarter in the last 7.

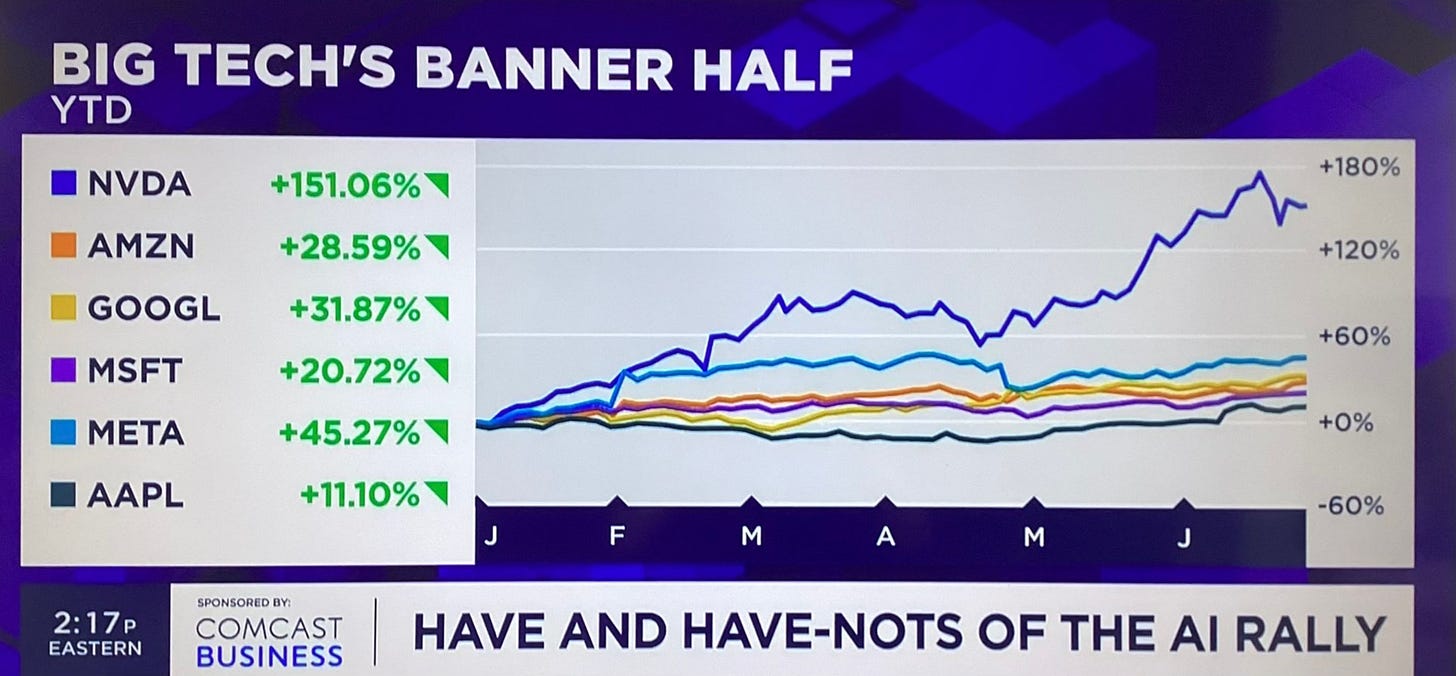

I don’t know how anyone could be bearish right now. Price action is truth and of the “Mag 7” all but Tesla just had their highest quarterly close ever. Basically, the 6 most important companies in our market are telling you that things are more than ok right now. They’re all printing money, most are buying back stock, and rewarding shareholders.

Things are going well. Price action doesn’t lie. Fundamentals, those can distort your views on markets, the macro guys, they too can confuse you, but the reality is, there is alot of buying going on in the most important names in our market. The end. Don’t overthink it. Until there is a trend change, we stay the course. Again, as I’ve said many times over the years here, not one time in history have markets sold off without a major trend breaking first. When that happens, we will have plenty of warning signs ahead of time to de-lever.

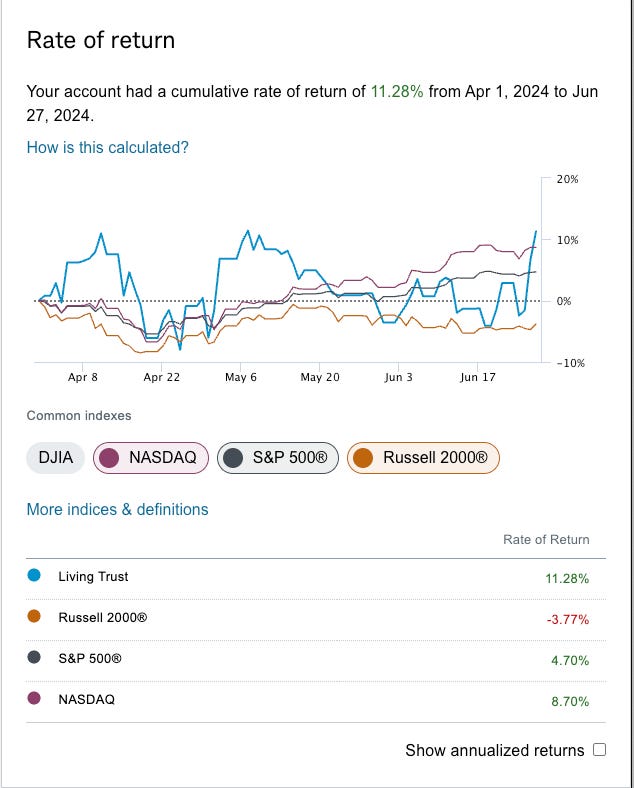

I’m writing this up on friday night because I won’t be around tomorrow morning so this doesn’t include friday’s numbers. Before yesterday’s little sell off the SPY was up 4.7% this quarter, the Nasdaq was up 8.7% and I was up 11.28%. On the surface that doesn’t sound like much, but that’s nearly 50% outperformance on my end vs the Nasdaq and that required next to no work as I pretty much did nothing other than swapping some Amazon leaps for Apple leaps recently and a few smaller trades along the way in FOUR,QRVO,IBIT,etc.

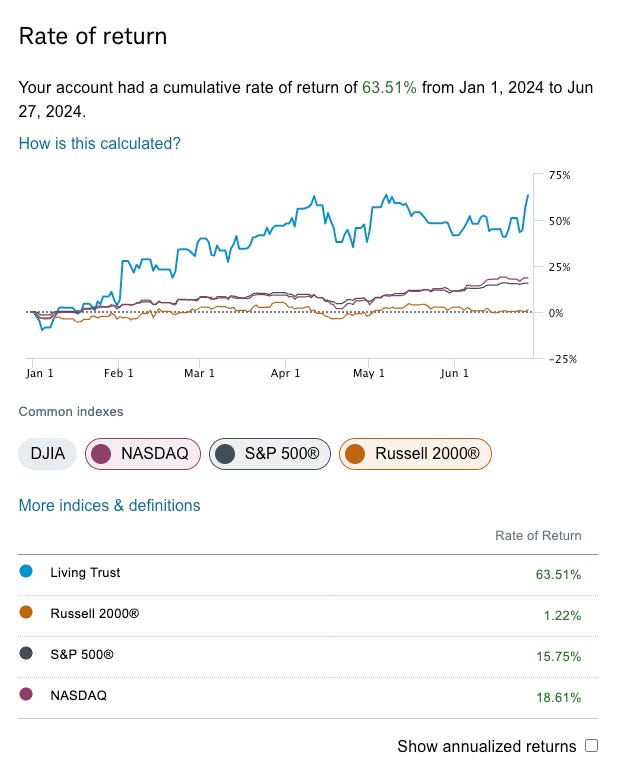

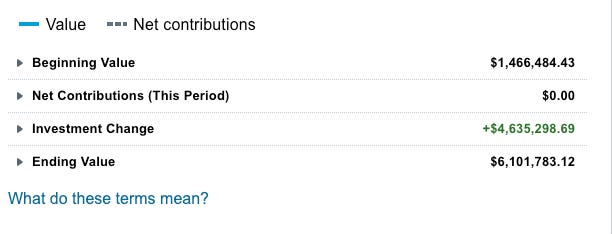

This year I’m up 63.5% and the Nasdaq is up 18.6%. So no complaints there either. I know alot of you are in the same trade I am with the majority of it being levered to Amazon so your year should be give or take the same.

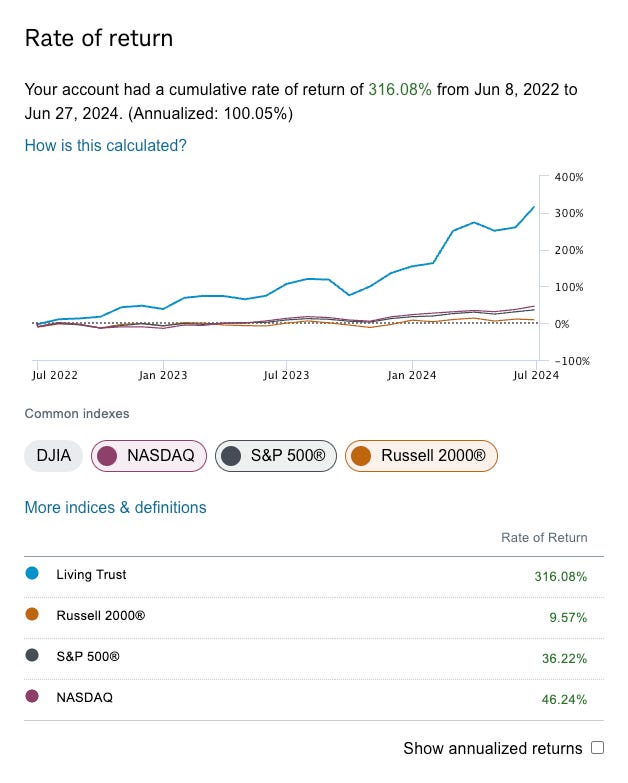

Since this substack began on June 8,2022. I’ve outperformed going up 316% vs 46% for the Nasdaq. To return 100% annualized without investing in small caps is really hard to do. It requires the right utilization of leverage and of course central bank liquidity.

I’d like to think documenting this whole process is showing you that you don’t necessarily have to take 30 trades at a time to build your book. I really haven’t done much of anything in 14 months now outside of the leaps and I’ve done incredible. You just have to find the right name, seeing enough directional flow is a big help, and lever into that properly. In my case Amazon is up 70% from when I went levered long in May 2023 which sent my returns into the stratosphere. I think if you look back at the last 2 years of me doing this, 2 huge allocations to 2 directional trades did the bulk of the lifting for me. Think about that, you are 2 huge trades away from changing your lives dramatically. Was it luck? I’d like to think that I had a solid bull case for my Twitter and Amazon trades with the size I put on. If your story lines up with the option flow, you have a winner in my book. When this Amazon trade is over, it is very plausible that I’ve returned 8-10x on my initial starting capital in here with simply a handful of trades. Think about that when you’re thinking about your sizing and goals. I’ll discuss it more below.

My total gain so far in dollar terms from June 8,2022 is nearly $5M. That’s crazy because when I began this substack, my goal was to discuss what I was doing, show how I found names that had upside, share what I was thinking and why I was doing it in the midst of the bear market of 2022. Never did I think I’d return 316% in 2 years. I’m actually curious what some of you who’ve been here from the early days have returned vs the market, if you can, drop a comment below. Overall, I’m happy I was able to document it all, because it’s one thing to say you did well, but it’s another thing when you have hundreds of posts documenting your thoughts and process. I think you all can see I was even able to get bearish at just the right times just by using my simple 21 ema rule.

So what are my plans going forward? Honestly, not much until this trade is over. Amazon just had its highest quarterly close EVER today so that isn’t anytime soon. Management still has questions galore to answer, and if they do the stock can really run, but the market has lifted the stock to a new range and that isn’t bearish. While it has felt like a laggard just because of how it moves in big bursts and mostly does nothing the majority of the time, the name is breaking out on every timeframe and is up nearly 30% YTD. Patience is required when you take a long term trade, the amount of people emailing me seeing if I was changing my mind the last few weeks was insane. Names consolidate, NVDA went sideways for a long time in late 2023. You cannot have a gamblers mentality and worry about every 15 minute candle on a long term position. I hope those of you in this trade understand that now. Overall, you really couldn’t ask for more from a name and I feel very well positioned at this moment holding such a huge position in a name breaking out of a multi year base. Today was nothing, just quarter end shenanigans. I still expect Amazon to push materially higher in a catchup trade as it sits just over $2T now and a full $1.2T less than Apple, Microsoft and Nvidia.

The calls I sold vs my leaps yesterday are at 270. So my trade maxes out over 270 in June 2026. I do think Amazon goes even higher, but I don’t care, 1200 calls bought for $28.xx would be $100 over 270. My position would be worth $12M and that isn’t even counting the Apple position I have now. If I turn 1.4M in June 2022 to 12M by June 2026 that by itself, assuming my Apple trade goes to zero, would be beyond my wildest expectations for that timeframe. Assuming that capex doesn’t surprise negatively, which is Amazon’s big concern, I think this name ultimately should trade around $300 in 2026 at 30x $100B in FCF. A $3T valuation doesn’t seem nuts with where the others are, but even if FCF misses let’s say 30x $80B is still $2.4T valuation which is around $240/share. If they add in a dividend or buyback before, even better.

There really isn’t a right way to trade, so many of you have different styles but all those styles rely on 1 thing, being right on direction. That is the goal of using charts and option flow as your guide. You want to focus on what is being bought, not your thesis. As to what I said above about sizing, the big thing that separates me from others is I’m willing to bet the house. Is it crazy? Not really because I understand that if a major trend breaks, you have to cut the position and move one. You’ll never see me fight trends because of my belief of a story. So it’s not like I would ever ride a trade to zero. I’m disciplined, I have my rules and I stick to them even if I seem nuts on the surface. I try to find things where the chart setup aligns with option flow and I go for it. Since I entered Amazon last May it never once broke the 200 day(green line). If you look below, the green arrow is when I went long right as the 200 day was about to be reclaimed in May, it never went below it again. Had it done so, I would have cut the position, I don’t believe in holding names into downtrends. It’s fine if you want to sell puts, but never, ever, hold calls on a broken stock. You’re asking for pain.

Back to the point of sizing, I know alot of you discuss your positioning and what you’re holding with me so I want to say this. I think alot of you have too many positions. I mean that truly. Look, equities mostly run together, your name is probably not outperforming if the market sells off hard, so consolidating your positions into a handful where you can up your sizing and confidence is ideal. I struggle with the same issues. I loved some of these trades I took like FOUR or QRVO, they’re both up nicely since I went long, but I also struggle to deploy heavy capital into the calls on names like that because I just don’t trust them. I sleep just fine having seven figures in Amazon or Apple calls. So what happens is alot of you end up nailing a 300% trade on .2% of your book and it doesn’t move the needle. Take me, you see my book size now, if I buy $50k of weeklies on a name and it goes up $100k, that’s awesome, but the risk of it going to zero is very high and if it works out, I returned a little over 1% on my total book, big deal. If it doesn’t work I’m going to be mad I vaporized $50k.

Just remember diversification is the enemy of wealth creation. Diversification is what you do when you’ve got alot of capital that you do not want to manage. It’s basically you saying you have no interest in risk and are spreading it out. That’s fine, but that’s not what trading is about. Trading is about finding setups you believe have material upside and attacking. You have to separate your trading capital from your long term investments and go for it with no rules on sizing in place. Look at all the best fund managers, most are heavy into a handful of positions. Even a conservative like Warren Buffett, he convinced Bill Gates to sell his Microsoft position so he could diversify and that was a horrible move as Gates would be a trillionaire now. Meanwhile Buffett has half his public book in Apple now. So he doesn’t even practice what he preaches regarding diversification.

You have to think more about how am I going to move my whole portfolio and the answer is bigger bets on fewer names. It means more quality and less junk too. Just remember you don’t actually have to hit a home run to hit a grand slam in the market. Everyone wants to dabble in these bad growth names because I’m told the upside is bigger. That isn’t true, if you catch a 15% move on a large cap and you’re levered into it properly with longer term calls, you might return 30-45% in a high quality name with far lower risk. Because of the lower risk, you might have more dollars invested, so your total return will be higher. There is really no need to buy some of these growth cash furnaces I see being traded. Just focus on better names, focus on better charts, focus on option flow and you will do great. I do my best to highlight the most interesting stuff I see daily to guide you in that selection process. The ones seeing option flow are great because big money is buying, what more can you ask for if you seek a guide on direction?

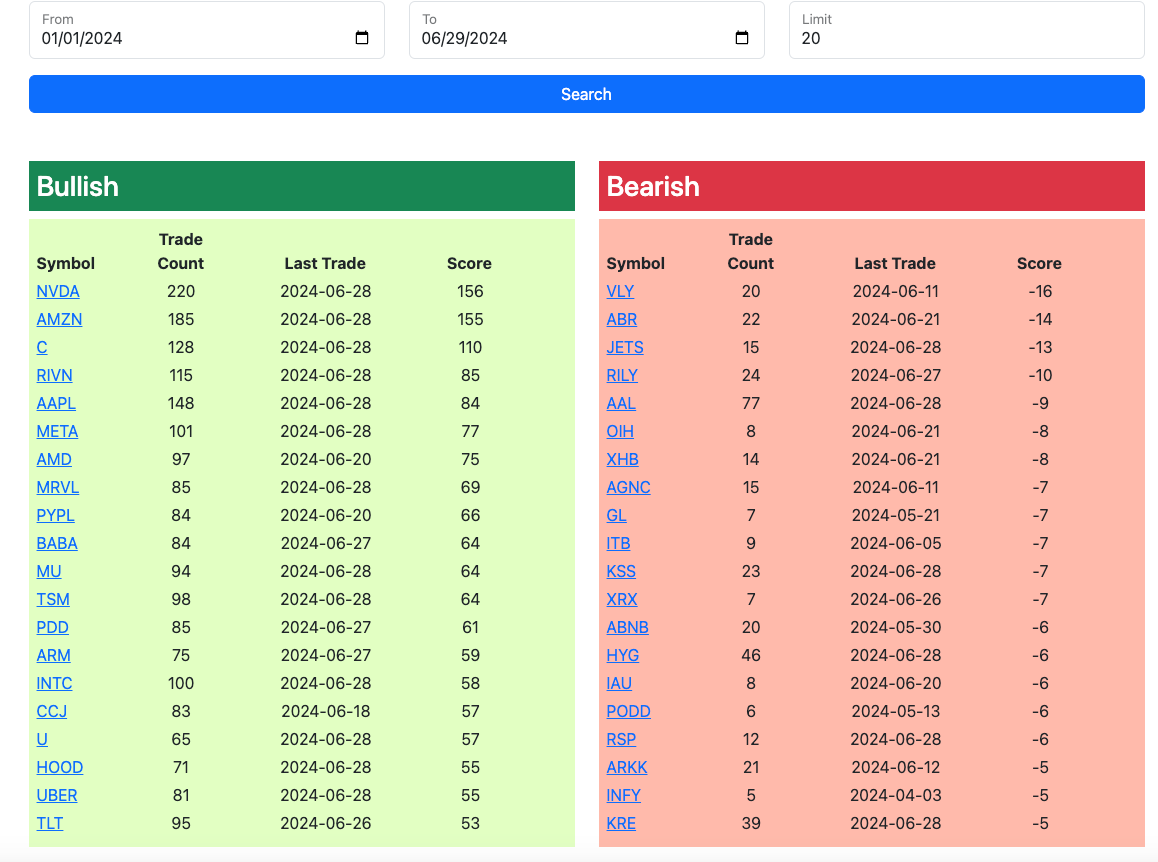

If you go search the database from the start of the year until now under the rankings tab you will see this, the top 20 bullish names this year have alot of big gainers: NVDA,AMZN, AAPL,META,AMD, MRVL,MU,TSM,ARM,CCJ,HOOD,UBER. Yes a few didn’t go well, but if you stuck to the high quality names seeing bullish option flow, you had a strong guide on a direction. I don’t think anyone would say PYPL,BABA,PDD,U or RIVN were high quality names you should have dedicated heavy capital too. Not shockingly those are the ones that didn’t work out.

I think the second half of the year will be fine, we have the presidential election in November. I imagine we run into it. Short term, we closed below the 8 ema today, could we see some weakness before earnings start? Sure, but ultimately I think earnings go well in late July and we end the year higher. As long as these megacaps keep making up the bulk of the weighting, up over 30% now, it is going to be hard to knock the market down as people would rather those names than cash at this point. High interest rates were supposed to pull money out of markets, that didn’t work and people want to be invested in the names making all the money. I don’t blame them.

Lastly, alot of you have asked me for an update on my dad and I’ve been really bad about answering emails the last 2 weeks, I really haven’t had much free time. I don’t have much to update but I’ll try here. Today is 29 days in the hospital. Basically in April when his merkel cell carcinoma came back a 3rd time in 12 months, they gave him an at home 5 day pill chemotherapy which caused all sorts of issues. We’ve been in the hospital since because of that, not the cancer. We actually don’t even know whats going on with the cancer yet because they can’t even do a PET scan because he’s temporarily doing dialysis due to the chemo complications and you can’t do a pet scan with contrast during that time.

Aside from that he keeps getting blood transfusions but his hemoglobin keeps dropping a day or two later into the 5-6 range, they need it in the 8-9 range. This week they decided to do a bone marrow biopsy to see if the cancer spread there and could be causing those issues but we don’t have results yet. I’m not a doctor, but I’m learning so much on the fly. I feel like I’ve gotten a crash course in this world and if any of you are dealing with this, you can email me and talk whenever. It is a nightmare that never seems to end, I’m trying to hold up as well as I can. The community here has been great, but it has been hard. I’m still hopeful, but it’s been nearly a month in the hospital now, I don’t really know what to think anymore.

I hope you all have a great weekend and I will see you Monday.

Thank you. Try to stay strong for yourself, your dad, and your family.

Prayers for all of you.

Hey James, Before telling you my performance, I wanted to get to what's most important. You can't put a price tag on family and good health and I'm 100% pulling for you and your family all the way. With that being said, since the start of 2023 when I started focusing on the patented Bulltard strategy (which is ironically also around when the market bottomed lol), I've returned just a hair over a double. Needless to say, I'll take that over an 18-month stretch all day every day. Thanks for continuing to show the art of what's possible, and cheers to hopefully a fine 2nd half!