Q3 Recap. I Outperformed, By Alot

I outperformed the market by 31% since I began writing this substack

This is going to be a longer than usual post. I have alot to discuss.

Let’s start with my performance. Those of you who have been here since the beginning in June, I can’t thank you enough for trusting me enough to sub this. I hope on my end that I’ve done enough to open your eyes to how markets really function and what one needs to do if they want to do the allegedly impossible task of “beating the market”. I beat the market, actually I kicked its ass this last Q let’s dive into the numbers.

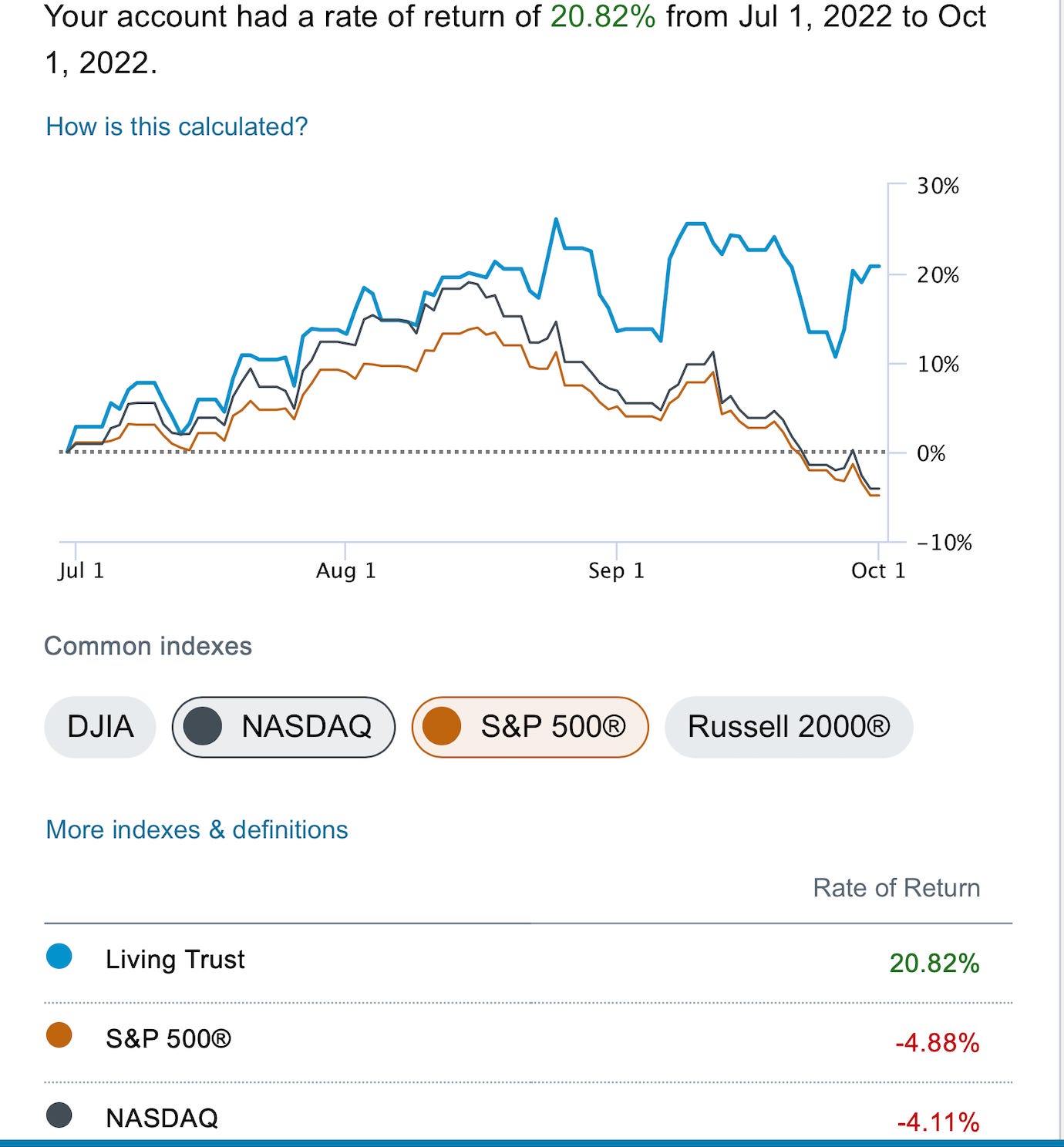

Believe it or not, the market was not down much this quarter. We had tumbled well before this quarter began and from July 1 until October 1, the S&P was down 4.88%, the Nasdaq was down 4.11% and I was up 20.82%.

That is not a typo, have a look below. I know some of you will say that was due to my positioning in Twitter, while that is true, that is still a call I made. I entered Twitter in late August and it kept me flat while markets tumbled, that is true. That was a bold call, and I repeatedly stated my case for why that was the right move with markets weakening and it worked out. Market positioning and sizing of the position is what separates the winners from the losers. Many have a great trade in mind but make it 1% of their portfolio, if you have confidence in your thesis, there is no reason to not go all in if you believe in yourself and your work. I made my case on why Twitter was not going to fall apart early, well before court began, and I maintained that conviction for the next 6 weeks which lead to outsized selling of credit spreads and purchasing of common stock.

Even if we go further back to June 8th when I began this substack, my outperformance widens even further to a 17.6% gain vs a 13.37% loss for the S&P.

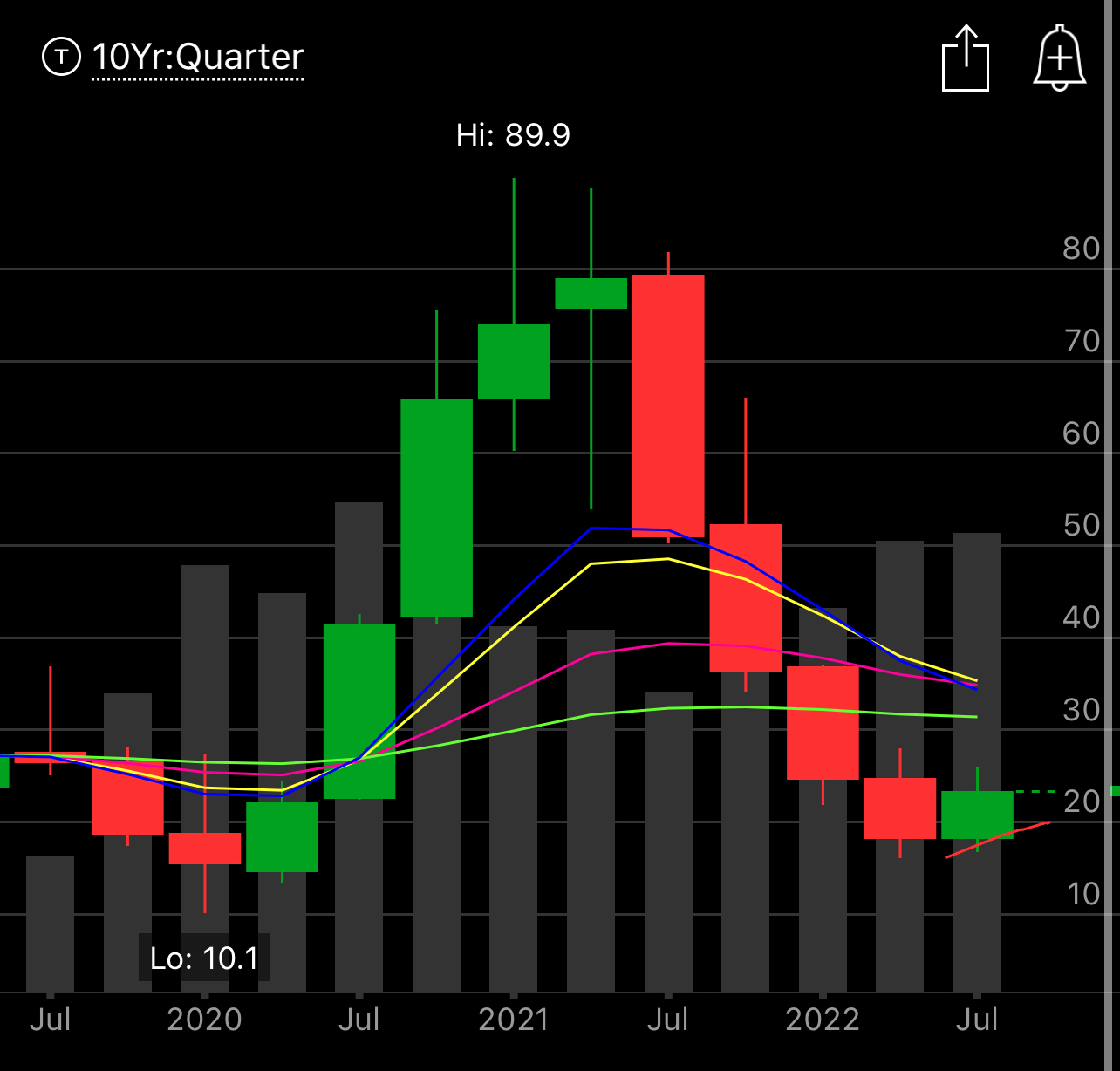

Let me tell you something, outperforming the market by 31% is not an easy task. If it was everyone would do it. Don’t forget, I’m not a bear. I’m not here shorting stocks for the most part, I’m not buying puts in size daily, I’m just focusing on charts and option flows and letting them guide me into strong names. What were my 4 most traded names this quarter? Twitter,Pinterest,Occidental, & Cameco. You know what all 4 did this quarter that the market did not? They all put in green quarterly candles, the SPY did not. Don’t believe me? Let’s take a look

Pinterest - put in a nice green candle this quarter in the midst of a tech bloodbath, the activist stake from Elliott Management certainly helped.

Cameco - this name saw insane call buying for weeks that I noted, in August we had the news of Japan returning to nuclear power and this name exploded higher.

OXY - Warren Buffett kept boosting his stake all quarter long. I kept noting sweep after sweep here and it too was positive this Q while oil really struggled and closed at levels lower than when Russia invaded Ukraine

TWTR - this had the back and forth of Elon Musk buying it then cancelling the deal then being sued by Twitter which lead to a lot of uncertainty, meanwhile the name, it just traded higher through it all.

Why do those charts matter so much? The market just got decimated and the 4 names that I traded the most this quarter were all green. They were all in various sectors. We had a social media name, a nuclear power name, a buyout name, and an oil company. How did I manage to trade those 4 names that just happened to do so well in the middle of so much turmoil?

Option Flows

All quarter long those names kept seeing massive call buying that I would note in my daily recap. Obviously I don’t take every odd trade, but I do notice trends and when names are seeing repeat unusual options activity that tells me something is brewing. That’s why I joke about fundamentals not mattering and the Twitter crowd always gets riled up. The reality is when you accept what markets are, you will see things clearer.

You all know the saying “Follow the money” and in no place could it be more than Wall St. Option flows and charts simply tell you about the flow of money. I highlighted that for you all to really take that to heart and remember it. It doesn’t matter what fundamental analysis you do on a stock, if larger players are not buying the thing, you will not do well. Take this tweet I made in late april

When Amazon broke the 200 week, I told everyone that it was not going to do anything for a long time. It’s been 5 months since and it’s done nothing. People ask me, why did you quit tweeting about Amazon? What’s the point, it’s dead money, for now. I’m here to make money. Will Amazon be the world’s biggest company in 10 years? Yea, easily, but I’m not Warren Buffett and my timeframe isn’t decades, my timeframe is the next day. If action gets ugly or I see option flows I don’t like, I’m not dense enough to stick to my name and get killed. You see me close trades for a loss all the time. Last week when the Nasdaq broke down technically I told you I was exiting my remaining tech, it really is that simple, just trade what the charts are telling you, they are after all telling you the positioning of money.

Every now and then you will see some blatant unusual options trade like the Sierra Wireless one I noted back on June 8th. I actually began writing my substack because of this trade, that same day. I got sick of my Twitter feed being overrun with these people modeling these meaningless numbers. So many DM’s I’d get about Amazon and how I was modeling this or that. Here we had someone putting on a pretty ballsy risk reversal selling puts in December to buy a massive call spread at 25/30 in a name with almost no options action. What happened next? Sierra Wireless was bought out, at a hair over $30 a matter of days later. Where is the SEC? The answer is we don’t have one. Look at all the nonsense Elon Musk gets away, the SEC doesn’t have time to track the options market, so the truth of the market takes place there and I try to organize the best of it for you all everyday.

With that all out of the way, what am I trying to say? There is a flow in the market and what people think matters, is the least important of all. While most are focused on reading earnings releases, income statements, modeling things, the funds that actually move the market have decided your fate before you ever knew it. I always hear people say “you can’t time the market” and I cringe because you absolutely can, it’s called learning how to read a chart. Now if you’re a busy professional and don’t have time to understand this concept then fine, but don’t sit there and insult those of us here everyday by telling us “you can’t time the market”. I’ve been telling you for weeks in here that the market was going lower, in fact I don’t know how many times in my weekend chart sessions that I post on youtube did I mention the fact we would re-test lows. We not only did that, we broke them. So yes, you can indeed time the market. There’s many of us who do it well.

Going forward, this quarter will likely not be a pretty one for the overall market, let’s look at why.

Here is a quarterly chart, you will note, the MACD is about to flip negative, we haven’t done that on a quarterly basis in over a decade. That is indicating an ugly market.

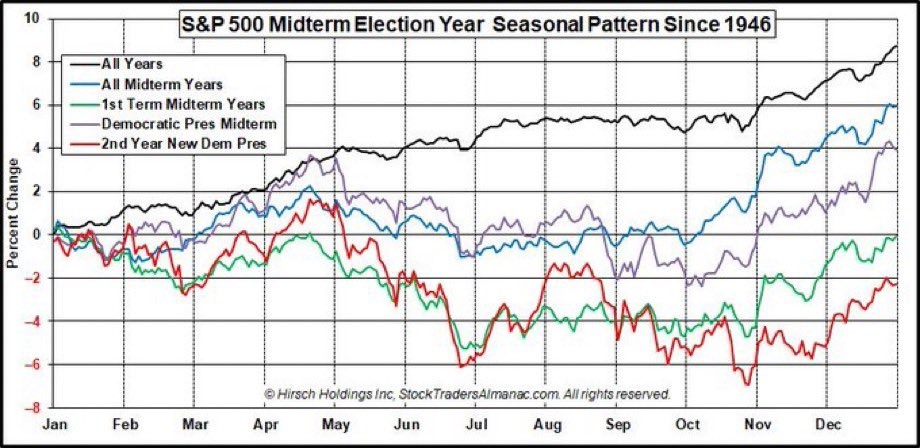

Now I see many posting their midterm year seasonality charts on Twitter over the weekend showing we will bouce soon. Let me tell you something, that chart doesn’t show the current situation, I could care less what markets have done for the last 75 years. I’m focused on what the market is doing this year and I don’t see any way we rally like that at this point. This market from a technical standpoint is broken for the time being.

As we look at the weekly chart you can see a clear as day breakdown on the SPY this week. We’re in a defined downtrend look at the line ontop, until we break that, it’s a downtrend, there is nothing to overthink. All these bounces are meaningless.

Look at this monthly chart, this is horrendous. Not only is there a clear breakdown, but we closed at lows and there is a large bearish divergence on the MACD. This is not “buy the dip” moment. I’d prefer to see a bullish divergence before I start buying but that is just me. You’re welcome to fight gravity if you want.

That’s my quarterly recap. I hope you all enjoyed it. I hope you are finally seeing the importance of the data I post in my recaps everyday. For those willing to expand their horizons and look at the market in a different scope, there are indeed ways “to beat the market” but like anything in life, if it was easy, everyone would do it.

Lastly, I know I always post a best idea every weekend, this weekend I am not. Why not? There is literally nothing on the scans I do with a nice bullish setup. I’ve posted 21 of those, 19 have worked, and you don’t have to press your luck every week just to “trade” sometimes sitting and watching is the best move. I do think Twitter is still dramatically undervalued for the next 2 weeks into the trial on October 17th. If you’d like to sell puts at the $40 level, I’d say that’s a solid trade here, the name should be over $40 into court, easily.

Have a great weekend. I want some feedback from you, how did your quarter go?

Almost every stock looks terrible and are below moving averages. Although I have not done as well as you and am still learning, I am making higher lows and outperformed S&P by around 15%. I'm happy with my progress, and look forward to learning more from you.

You make a very good case for your approach. Very impressive results! It's a lot of work, but it certainly looks like it's worth it.

One thing I've never understood is why you don't do call spreads when you see something bearish. Since you are so successful(!) with put spreads, why not use call spreads for bearish situations? Then you will have something to do on weeks like this.

BTW, I tend to do short strangles--with much(!) smaller sizes. I use Tastyworks as a broker. They are organized especially for option trading. They are owned by Tastytrade, which does a lot of options research, which they publish openly. Their work, though, is typically not the sort of thing you do. They start with the assumption that at any moment, the market has incorporated all available information, i.e., the efficient market hypothesis (Your work seems to demonstrate that's not true!) If the market is efficient, the way to make money is to sell premium. So they concentrate on how best to do that. Of course, you do that also, but with a very important directional edge!

They have a series called Rising Stars in which they feature people who do well in options. I'm sure they would be interested in featuring you--even though it's not their style . (If it makes money it's worth talking about!) OTOH, perhaps you don't want to publicize your approach too much. Otherwise, too many people would follow it, and it would get too crowded.