The Tesla Saga.....

I won’t be sending out a recap today because it is a half day. I do have something I want to discuss so I’m sending this out early in the morning. I had a few comments on yesterday’s recap about Tesla finally going up and my dislike for them possibly hindering my option flow posting, so I wanted to say a few things, here were some of the comments……

The Reality

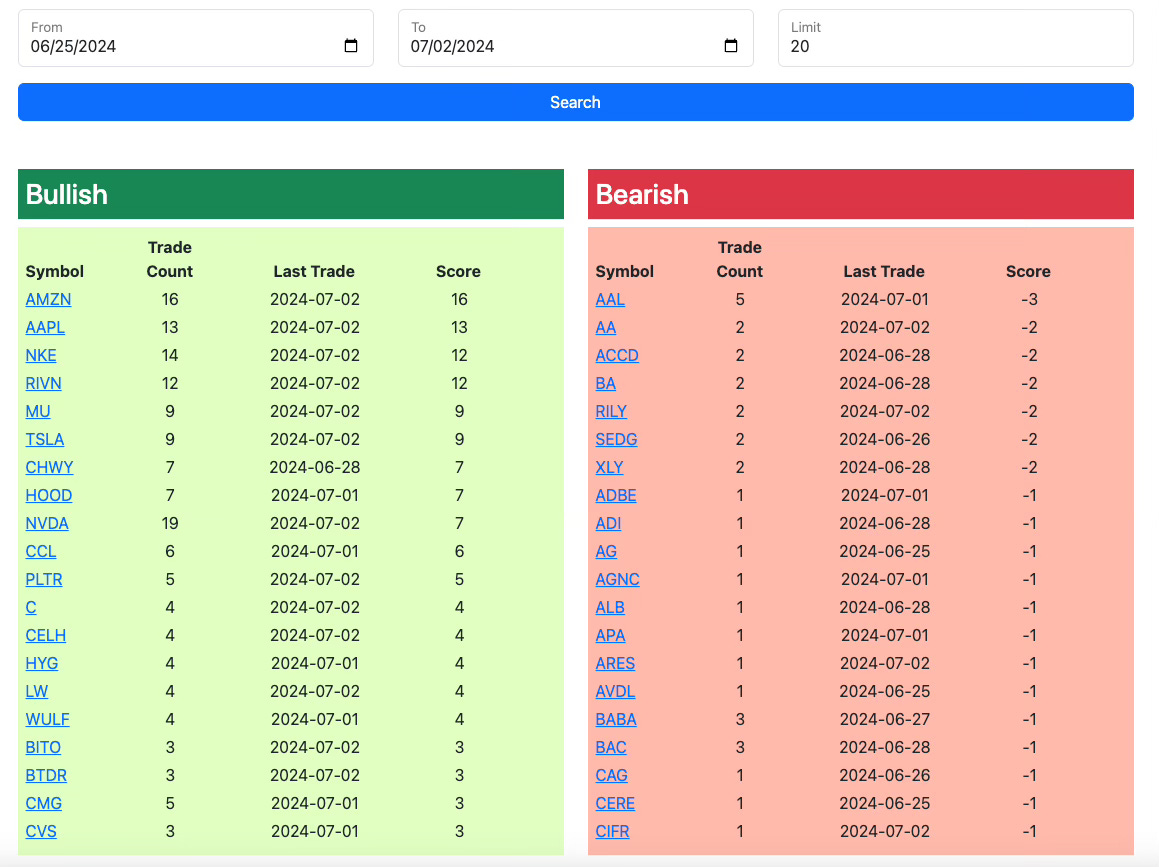

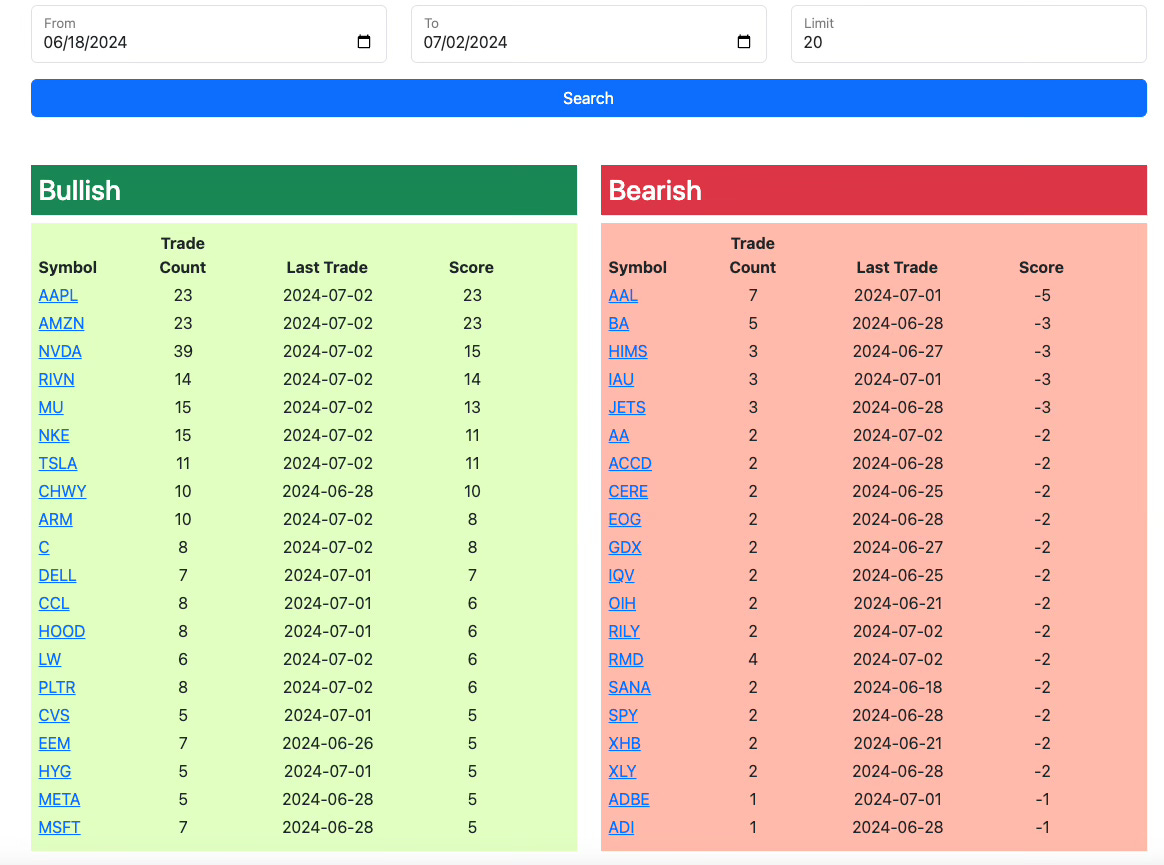

Ok first off, let’s look at the facts here. If you look at yesterday’s post, there is a trends table, it literally shows you that TSLA has been a top trend recently. The 1 week trend has Tesla as the 6th most bought name in the database and the 2 week trend has it as the 7th most bought name, you can see below, if you cared to look at all. There has been alot of Tesla bullish activity recently.

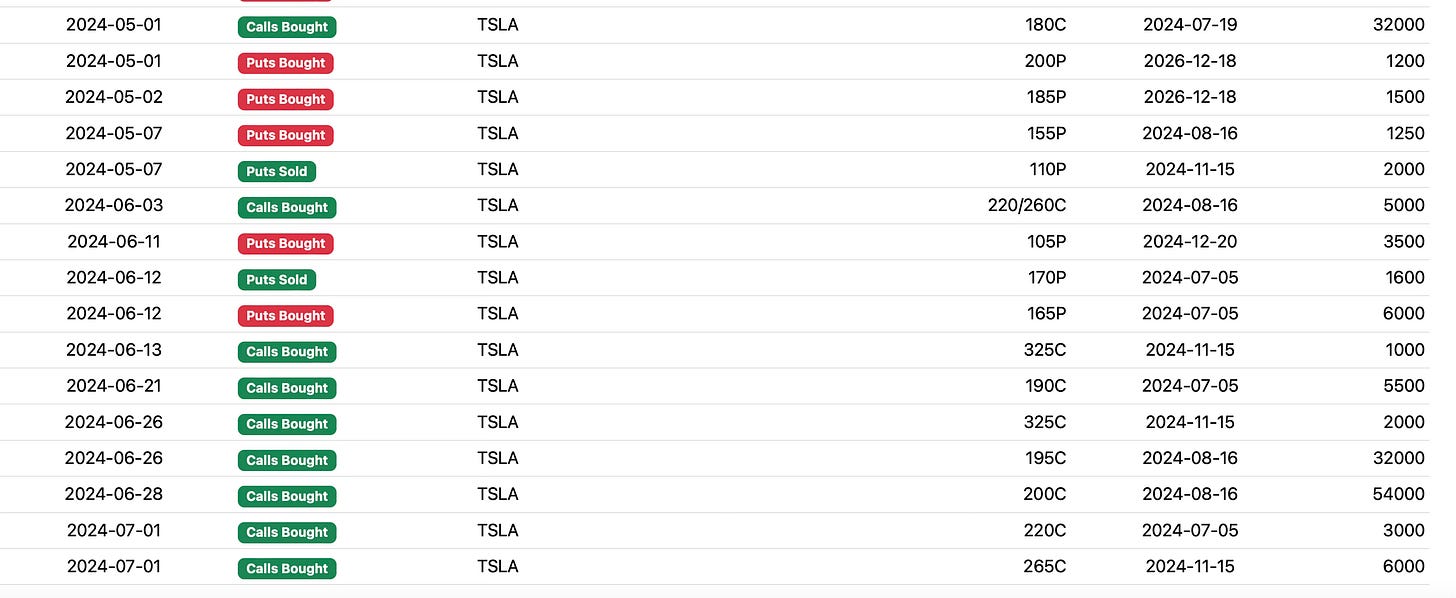

Secondly, here is the actual flow in my database, there’s thousands of people who can all see it, nothing is hidden from anyone. If you even cared to look there was a massive block of 54,000 calls bought on 06-28 which is last Friday for Tesla along with a 32,000 block of calls bought for 195. These were gigantic trades. If you notice since June 13th I haven’t posted 1 bearish Tesla trade, that is around when this run began.

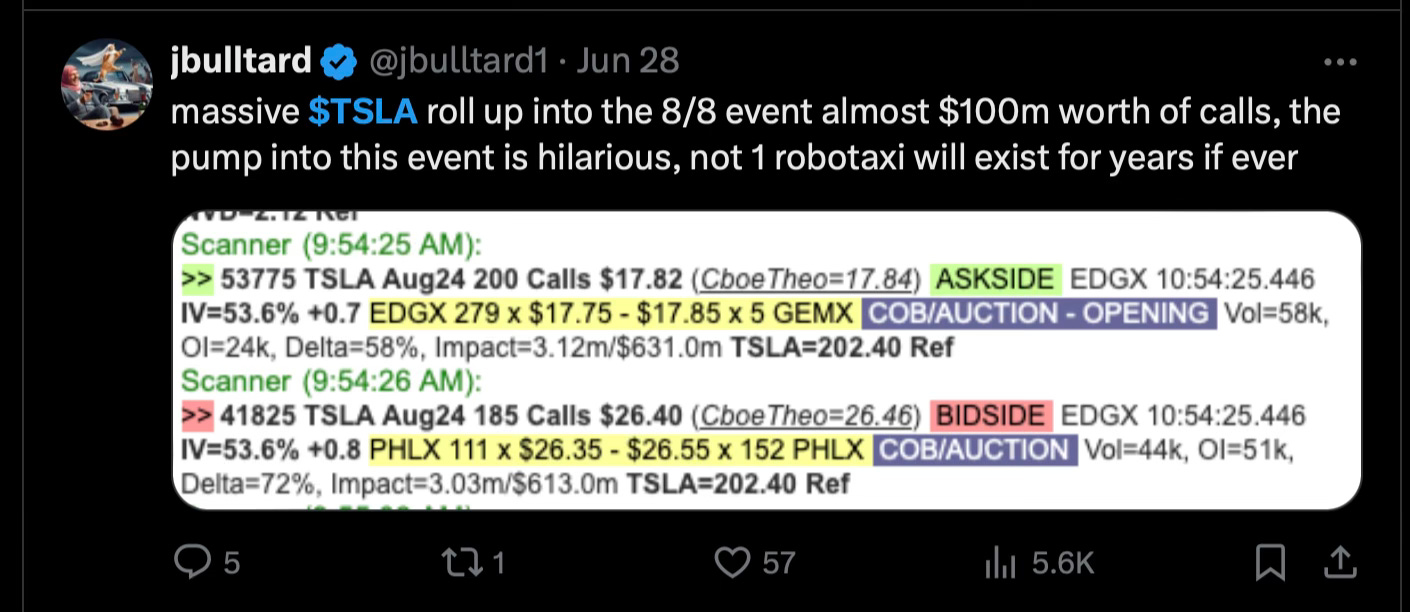

I actually found those calls so hilarious that I tweeted about them on friday, you can find that tweet in my account if you just search for it.

So Tesla has very much been bullish short term, why didn’t I highlight it? Well because I cannot in good faith highlight a $700B+ company that is FCF negative to thousands of subscribers. While Tesla stock has gone up in the short term and alot of you have gotten excited, the reality of the matter is Tesla is still very negative on the year. It is a massive underperformer, very sad stuff actually. Think of the raging bull market we’re in, you could throw a rock and hit a stock that is up on the year and Tesla unfortunately is not up. So it’s pretty embarrassing for a fund to disclose ownership of such an underperformer especially when it is still 50% off highs from 2021 3 years later. Tesla is a retail driven name mostly, very little institutional money is in it, actually in dollar terms, it is the most heavily shorted name, hence the violent move we saw recently. That was mostly short covering.

Even take yesterday’s “big beat”, it wasn’t really a beat, they lowered expectations so much over the last year that they finally beat that number, and barely. Impressive?

The company is really struggling, look at the chart below, this is very bad for a company that claims to be in the 1st inning of a massive revolution. It actually seems like they’re running out of people who want a Tesla hence why they’re doing all the price cuts and gimmicks for 0% financing now which crush their margins. They’re selling more cars but at significantly worse margins. I could sell $100 bills for $95 all day long too.

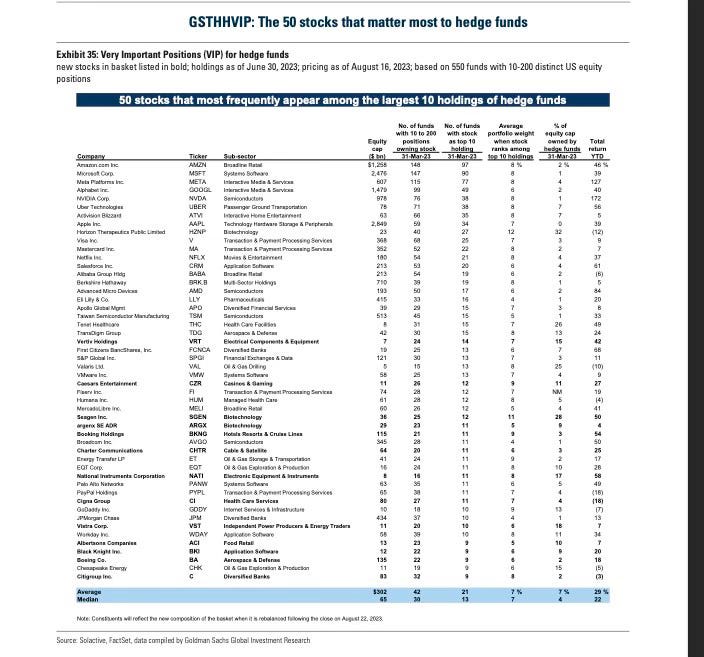

With that said can you name any of the best hedge funds that hold a major Tesla position? Outside of ARKK or Ron Baron? You can’t because I posted this chart last year with the most important names to hedge funds, Tesla didn’t even make the top 50. Amazon was number one in those rankings. The reality is Tesla is a retail driven name whether you want to believe it or not.

This isn’t some conspiracy, funds have a fiduciary duty to manage clients money with the utmost care. It’s hard to explain to clients how you’re heavily invested in a company where the actual business today is operating very poorly and generating negative FCF but you’re invested in the thing because of Robotaxis and Optimus when neither is generating revenue now or any time in the near future. Did I mention even with this massive 70% move in Tesla in the last few months, THE STOCK IS STILL NEGATIVE ON THE YEAR. It’s underperforming the S&P by a mile this year. Again, Amazon currently has a license to operate robotaxis in California and Tesla does not, those are just facts, that isn’t my bias. I don’t know what he announces on 8/8 but it won’t generate a dime of revenue any time soon. Zoox, owned by Amazon, is functioning with a license in California right now and Amazon says commercialization is coming, but no time soon. Meanwhile Tesla had not even applied for a license to run one of these things as of April 24,2024 when NBC published this

So this isn’t beyond Elon to make up stuff that doesn’t exist, he’s done this many times, he’s a man with no morals. If you remember he made up a buyout at $420/share a few years back to squeeze shorts. The SEC had to give him a Twitter monitor, how sad for a grown man. I know many of you love him, and that’s fine but this is a guy who lied through his teeth for years on end about Full Self Driving coming for nearly a decade, so he could keep Tesla elevated and do offering after offering to avoid bankruptcy. Even now look how unhinged he is on Twitter. I mean it, how many CEO’s out there would respond to a tweet like this, in this fashion?

In my experience, no CEO of any legitimate enterprise is concerned with short sellers, they’re focused on executing and making a business run as well it can. He’s recently saying things like Tesla can go to “$30T”, do you all realize how big that number is? If you took our 6 biggest companies right now: Nvidia, Microsoft, Apple, Amazon, Google, and Meta you’d have around $16B of value, Elon is telling people he thinks Tesla can be $30T. That is crazy, even Andy Jassy at Amazon recently leaked that he thinks Amazon can head to $10T. That is a tad more realistic considering that is based on things that actually exist, whereas the Tesla bull case is more of a close your eyes and hope things he says will exist but don’t currently, eventually do.

So as I said, I cannot in good faith ever mention investing in a stock with negative free cash flow at a $700B valuation. Sorry, I just can’t.

Lastly this comment made me laugh,

A 70% move over 13-14 months is actually pretty significant especially when you’re talking a company the size of Amazon north of $1T. It literally gained nearly a trillion dollars in value in 13-14 months, think about that, Warren Buffett has run Berkshire Hathaway for nearly 70 years and he hasn’t even added a trillion dollars of value, but Amazon did that in 13-14 months. NVDA was an all time legendary move, but SMCI that was referenced isn’t even a $50B company, that’s really not that big a deal, small companies make big moves all the time. Moreover, that 70% move has led to a very substantial return for me as well as many of the people who are in here because I made the call to utilize leverage properly on the trade.

So in closing, I’ll say this, I began writing this substack 2 years ago to try to actually help people. I wanted to give my insights on how markets actually work with options flow and charts mattering more than fundamentals. So many were getting crushed by all the growth furus and their bull cases during the 2022 decline and the reality is my book is up well over 300% since this began. You all see exactly what I’m in, you see brokerage shots, you see volume on the options chain the day I say I enter trades, you see honesty. That is what makes me who I am. Tesla is a horrible stock, it is 50% off it’s 2021 highs, and is dramatically underperforming the market for 3 years now, a small move the last couple weeks doesn’t change that at all. Everything I said above is true. You have a massive multi year underperformer that has negative FCF, what is everyone so excited about again?

Meanwhile, when some of you say Amazon has barely done anything since 2020, that’s true, but I didn’t enter Amazon then, I entered it last May. There is a big long post dedicated to it

In closing

I did not hide anything about Tesla, in fact I’m very open in telling you how big a joke the company is, but the option flow is the option flow and I posted all the trades of size right there for all to see. There’s so many names every week and I try to highlight the most intriguing ones, if you notice one thing about me, I don’t like to discuss broken charts. I posted the below on Twitter on 6/15 and you can see Tesla in a clear multi year downtrend, this current move is a rally within a downtrend, nothing more. The name was so oversold and it is catching up. If Tesla breaks out of that downtrend, I may end up buying it myself but I’d have to sell some Amazon so I doubt I would. When names breakout, they tend to have extended moves, like what we’re seeing slowly begin in Amazon now. Tesla has failed to breakout of that channel multiple times, you can see the perfect rejections below. Is this time different? It may be…..

As I said the other day, the more capital you manage the higher quality names you seek, I don’t know about you all, but for me having leaps for 13-14 months on a name that is up 70% with the size I put on, that’s good enough for me, apparently it wasn’t for the person who posted the comment above in yesterday’s recap. Yes Amazon wasn’t as good as NVDA or SMCI, but it was one of the best trades anyone could have put on if they wanted to be in a megacap name and did indeed end up being what I said it would be, a life changing trade with the leverage I employed.

While some of you may not like the things I post, the reality is. this, at this moment, this is the 13th biggest financial substack, so I’m clearly doing something right.

I’m a relative nobody who barely has 10,000 followers on Twitter, yet enough people stay subscribed and keep me as a top publication. If you think im being biased or unfair to Tesla and it bothers you, there is an unsubscribe button, you can use it at any time. I hear there is a guy named Gary Black who is super bullish Tesla, you can subscribe to him, I’m sure his returns are wonderful.

As I said, I cannot ever tell people to invest in a company with negative FCF and negative sales growth with it near a $1 trillion valuation. I’m not biased, I’m just a realist, if you invest in Tesla today you’re basically hoping and praying that alot of things that don’t exist, eventually do. Is it possible? Maybe, but I don’t invest in fantasy, there are plenty of great companies actually doing things today to invest in. That is why Tesla is negative year to date. That’s why it is negative since ZIRP ended. I don’t know how many other people out there documented a 300%+ return over the last 24 months, but I did, and I missed absolutely nothing by never being in Tesla. I know it’s hard to believe but there are other ways to make money in markets besides being long Tesla.

I hope you all have a great day today, I hope you enjoy the 4th of July with your friends and family. I love you all, even the perpetually angry Tesla fans. I will see you on friday.

We love you too! Nailed it on all of the above...and THANK YOU!

100% agree, actually it’s a good hedge as a short.