What Is Wrong With Amazon?

With markets closed Monday I figured I’d answer the question that I seemingly couldn’t avoid the last 10 days or so. I couldn’t even begin to tell you how many emails and dm’s I got this past week alone from people on here regarding this so I figured I would give my thoughts on everything in one long post.

What Happened Recently?

May 9th - Amazon hit a new all time of 191.70 after a multi year period of consolidation. The stock faded hard that day and has been weak ever since. It was simply a failed breakout.

May 14th - We got new that Adam Selipsky, the CEO of AWS was resigning

May 15th - We got news that a leaked email from Jeff Bezos emerged and that he was worried that Amazon was falling behind in the AI race.

That’s about it. That sums up what happened. You have the Chairman of Amazon saying he is concerned about AWS in regards to AI when and on the last earnings call Amazon said Capex was going to rise dramatically to numbers they couldn’t even pinpoint with most of it focused on AI because Andy Jassy keeps saying it is the biggest opportunity of his lifetime.

Do you see where this can be concerning to institutional investors? You have a company who just overspent on warehouses in 2020 and 2021 and said mea culpa in 2022 and sold many for a loss. Now that same company is telling you last quarter that they’re going to spend an enormous amount of money in the coming months on AI capex and simultaneously the chairman is saying “where are the AI customers”. That is a scary proposition when no company on earth is allocating more to capex in 2024 or 2025.

What makes things even more concerning is Amazon seems like a rudderless ship. Jeff Bezos is worth $200B today and he seemingly could care less at this point. Long ago, Jeff was in my opinion the most dominant entrepreneur of the modern era. He was a guy who was part of the team, he was on the floor at Amazon, and he led the troops on what became an incredible journey. Great companies have great leaders, but something changed in 2020 and Jeff lost his drive. He stepped away from his life’s work and put Andy Jassy in charge. That I have no issue with, we’re not here a long time and Jeff had nothing left to work for. The issue is, he remained Chairman which means everything still runs through him. The problem with that is that he’s never around anymore so when he sends an email saying he’s concerned about a segment where Amazon is spending fortunes investing in, it triggers the caution bells.

If you step back and look at all the issues Amazon has faced recently regarding Capex, they’re all Mr Bezos’ pet projects.

Alexa - Amazon loses billions a year running this thing and completely missed gen AI with it to this point. This should have never been so far behind but rumors emerged this week that Amazon will announce that they’re launching an AI subscription, let’s see what comes of that

Kuiper - which really should be under Bezos’ Blue Origin endeavor but he’s using Amazon to fund his ambitions which are very far behind Starlink at this point. Again why is Blue Origin funded by Jeff but he drops Kuiper on Amazon?

Prime Video - Amazon spends more than Netflix developing content and they have a fraction of the hits. Even things like the ad tier they just launched, Netflix charges much more for their ad tier but Amazon can’t because the quality of content is just not there. Prime Video is Jeff’s pet project because he wants nothing more than to be a Hollywood power player. Almost $20B/year in spend on content with many shows like Citadel being proven to be wastes of hundreds of millions of dollars.

While every other megacap is focused on shareholder returns by buying back stock or issuing dividends, Amazon remains the only one that does neither. Instead they spend those billions funding Bezos’ vanity projects. Everything with Bezos is about power, he isn’t focused on doing what is best for Amazon or its shareholders and hasn’t in years. If he was, he would step down as chairman and let Amazon mature like the rest of the megacaps ex-Nvidia where the founders have all stepped away from the decision making and allowed financial engineering to begin.

Now What?

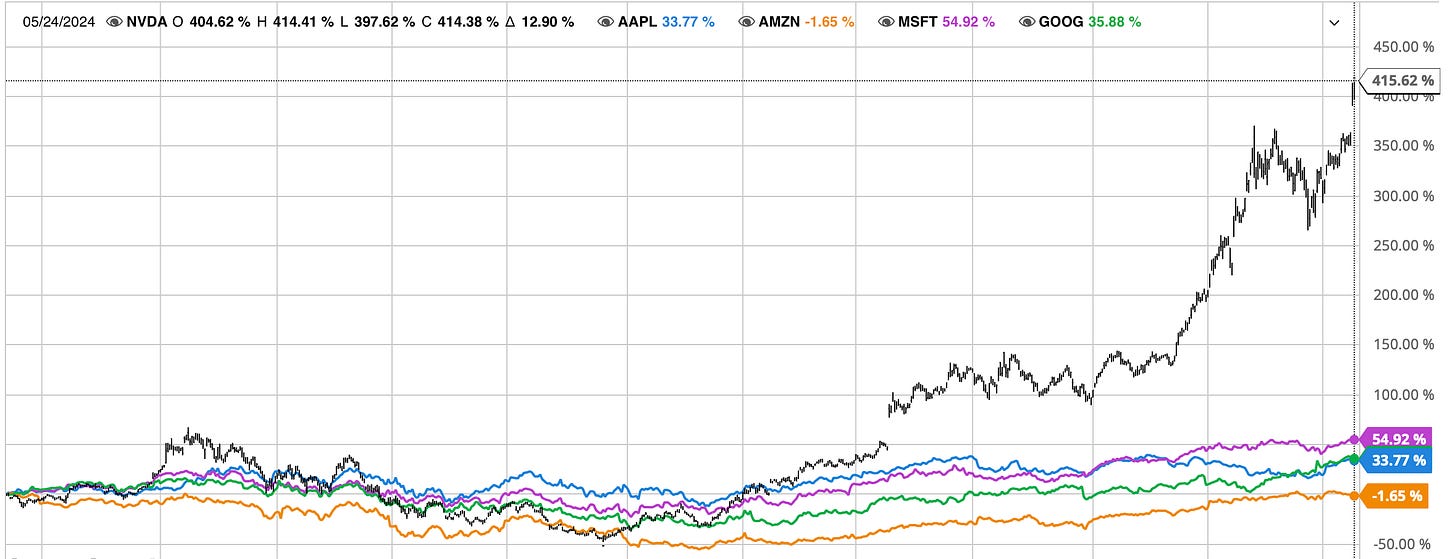

So with the above in mind, what’s happened is simply, big money grew tired of Amazon these past 10 days. They grew tired of the “Amazonian” way of everything being secretive and we know better than you do so we don’t have to explain anything to you little people. The problem is, since 2020, it could be argued that they in fact do not know better. Amazon stock is now looking at a total return of -1.6% since Andy Jassy took over, that is factoring in share count increases. The absolute worst megacap over the last nearly 3 years and it isn’t even close.

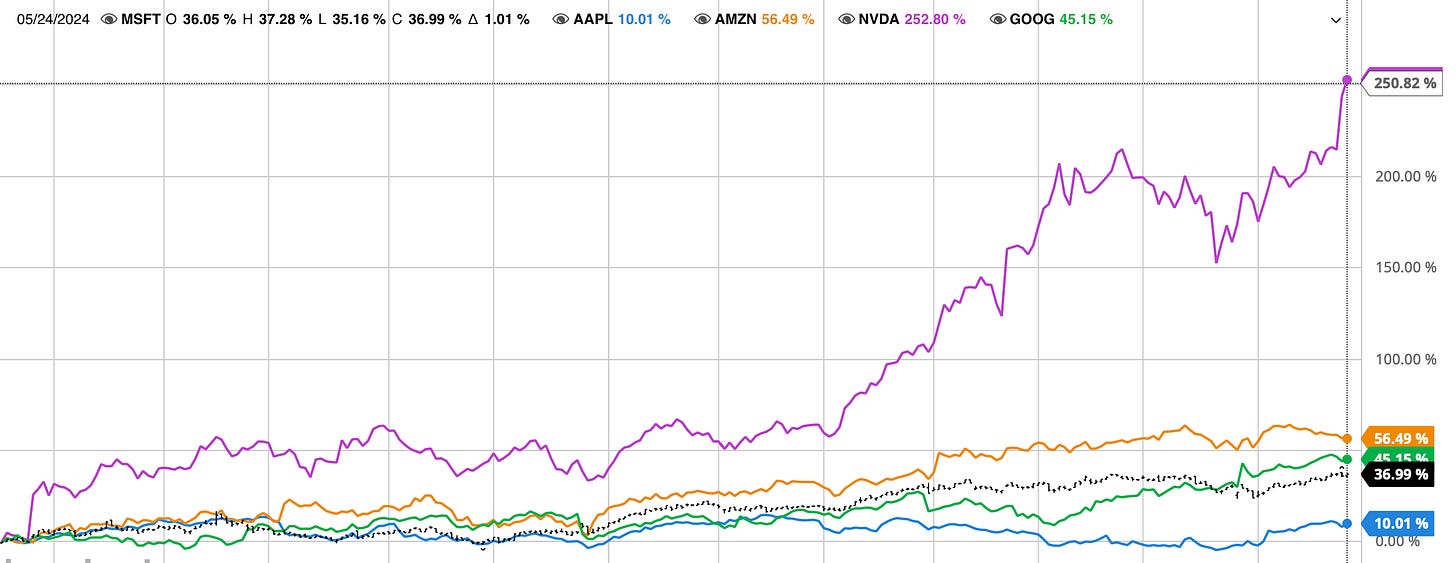

NVDA is up 416%

MSFT is up 55%

GOOGL is up 36%

AAPL is up 34%

AMZN is down 1.65%

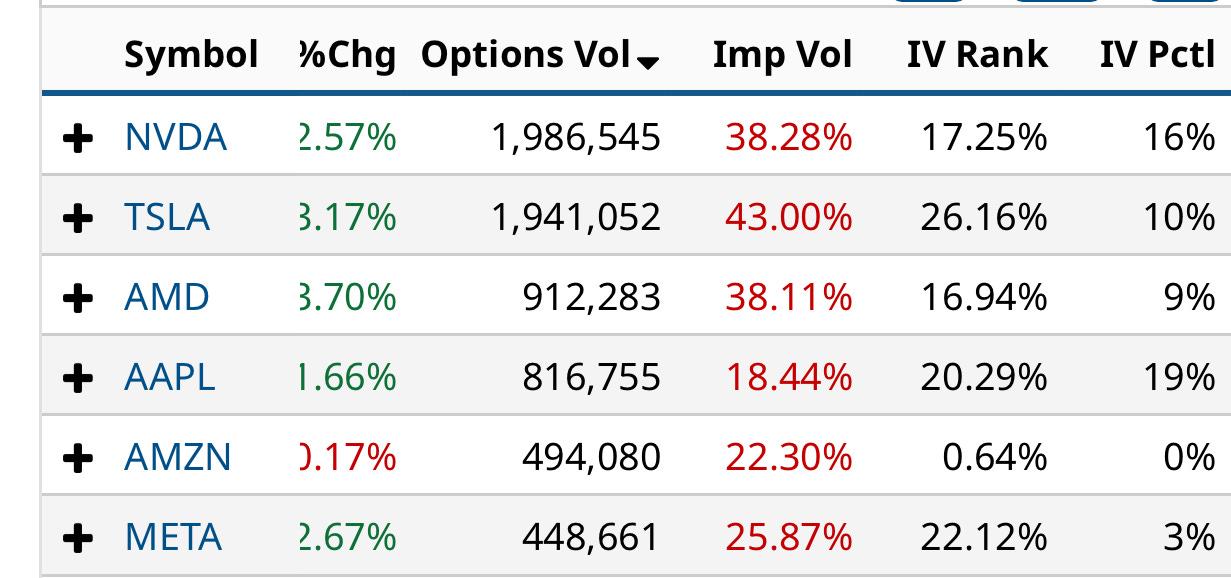

To put into context how pathetic that is when nobody has spent more on Capex in that timeframe is hard to explain. For years it has been just trust Amazon they know whats best but the reality is the market is slowly starting to ignore them and believe they just don’t know what they’re doing. That is very evident in the below where Amazon IV rank is .64% meaning in the past year at almost no point have options been cheaper. The market is simply not expecting much from Amazon at this moment while at the same time it’s almost every banks top pick and the most owned named by hedge funds.

That is quite the statement about how little the investing world believes in the status quo regarding Amazon management even though it might be the most popular name amongst big money.

It’s hard to ignore all the levers Amazon can pull. Look at advertising where out of nowhere in 7-8 years they’ve built a business up from $0 to nearly $60B in 2024 at really high margins. It took META 13 years to go from $0 to $55B in ad revenue. That’s what people are in Amazon for the potential of all these monster segments to combine for a cash machine like no other in history.

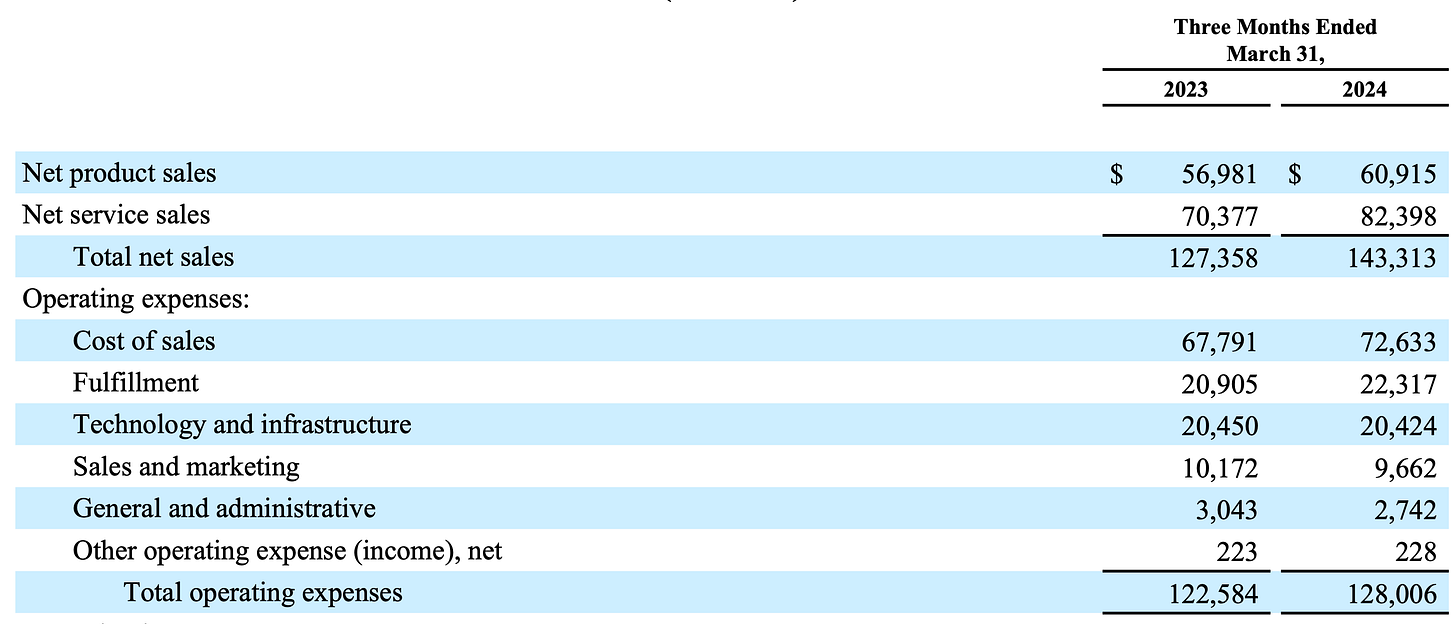

Look at the last ER to see the dominance of Amazon, services, which are the only segment that matters at Amazon grew nearly 20% while Amazon mostly managed costs nicely seeing sales rise $16B while costs rose $6B.

The efficiencies Amazon is improving upon in logistics are going completely unnoticed. At the moment, the market only seems to care about generative AI and how Amazon is a distant 3rd place there. I’ve written extensively on why I am in Amazon for their logistics prowess, not AI, but all of that doesn’t matter, the players in the market buy what they buy and for the moment being, they don’t want to buy Amazon and can you blame them? There are 6 big companies in our market and all have cleaner stories than Amazon at this point. It shouldn’t be this way, but Amazon is just very poorly run, nothing more. One of the first rules of managing money is to never buy question marks and now Amazon has some major ones that can’t be ignored. The big one being “Does Amazon management know what they’re doing?” and until they clear up some things the market simply is not going to reward them.

What I believe happened was Selipsky came to AWS from Salesforce after his company Tableau was acquired by them. Selipsky was fat and happy, he wasn’t brought in to go on the offensive, but Amazon wanted a splash hire to run AWS with Jassy becoming CEO. Adam stepped in and basically managed things for 3 years, but he missed the gen AI thing. It’s hard to blame it all on him when Jassy was there too. Whatever it is, Selipsky it appears may have been asked to step down and let a product guy take over. Amazon is telling the world German was the choice from Day 1 but he needed more seasoning. That very well could be true and Garman was critical to EC2 and Bezos felt the change was needed. Personally, I would love to see Bezos take it seriously enough that he returns to the office like Howard Schulz or Bob Iger did. I think the market would really love him to show some leadership here.

The good news here is Google just dealt with a similar period in 2024 where all the talk was about how Google was behind in AI, how ChatGPT was an existential threat and it took a while but Google cleared up those question marks. That ended the multi month period where it lagged the market and it has substantially emerged from that time as you can see below. Amazon is currently in that period where it is going to lag until the questions are answered and fears are squashed.

Regardless of what happens with AI or AWS, I do believe longer term AWS will be fine either way. The market loves to run with the notion that AI will be a winner take all field and Amazon will somehow be left behind as everyone goes to Azure or GCP. That isn’t going to happen, if the space is as big as everyone says it will be, all 3 will do well, and Amazon also has that little logistics business that happens to deliver things for the biggest retailer in the world while also running 80% gross margin advertising for them as well. At this moment the big retailers from Costco to Walmart are sitting at all time highs and Amazon itself is tracking 2-3 points ahead of estimates on retail in 3rd party data this quarter. Retail is fine, AWS is the question mark now which is funny coming off what was their biggest quarter ever in terms of revenue and margin but that is where bad management from Amazon has led to question marks being created. Also the AWS marketing team really does an awful job at not doing more to change the narrative that Amazon is somehow in a distant 3rd place in the AI race.

Amazon remains a 3 headed monster unlike any other. 3 large segments that can all generate over $10B/quarter in profit within say 2 more years. That is unheard of and why Amazon has the highest multiple amongst the megacaps. That is why the market ignores Amazon not paying a dividend or doing buybacks and still values them at nearly $2T. The market gives Amazon plenty of respect, but it is way past time for Amazon to respect everyone who respects them. All they have to do is be more open with shareholders in their communication. They also have to be more shareholder friendly by announcing a buyback, they don’t have to utilize all of it, just announcing it would show people that Amazon is in a new era where they’re focused on shareholders. Look at Apple, they had negative revenue for their 5th time in 6 quarters. They are way behind in AI relative to even Amazon and shareholders don’t care and bid it up daily now because Apple just told the world they’re going to dedicate 150% of their effort to rewarding shareholders by buying back so much stock to just push shares higher.

My Position

To begin, you all know that I have quite the pulse on the market, just looking at charts and moving averages I can usually give you a good direction on what is coming. Back on May 10th in the Amazon channel on the discord I said Amazon wasn’t a good risk/reward after the failed breakout.

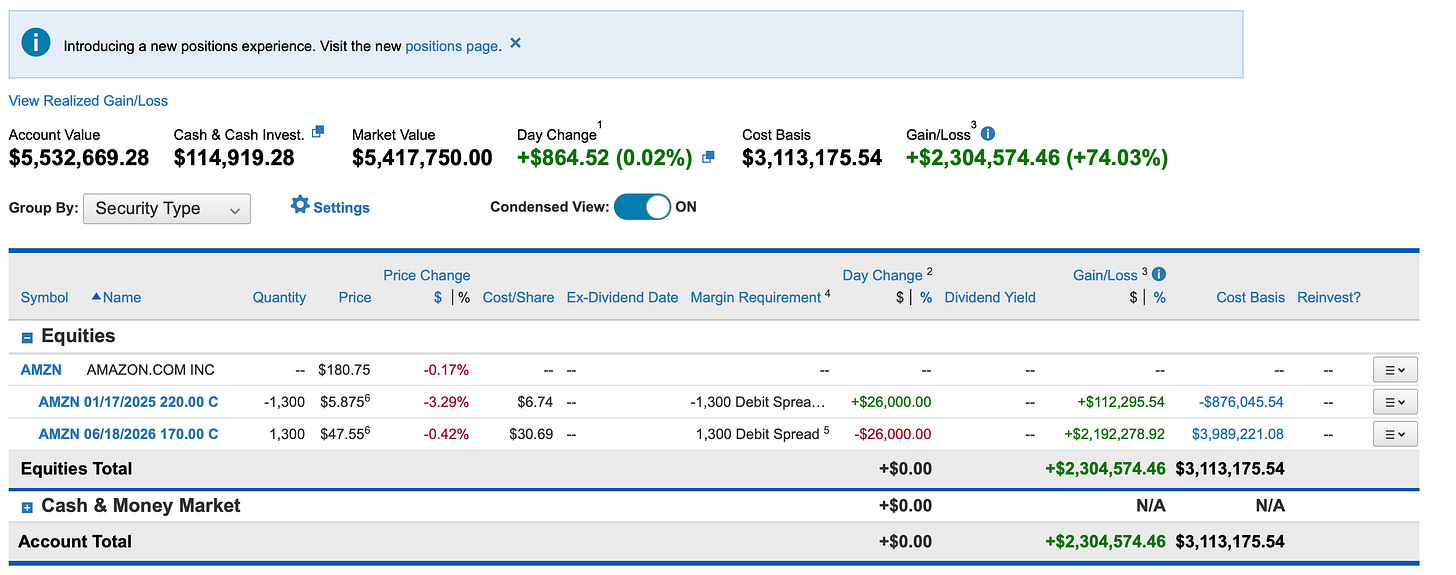

So why didn’t I sell? You all know my positioning here, I’ve discussed it in depth multiple times. I went long with my full trading book on May 18, 2023 in this post here and I held on until early January this year where I adjusted higher in this post on January 8, 2024 here. I now thanks to the move Amazon has made since and while I’d love to maneuver around I’m sitting on a pretty large gain right now of $2.3M after this recent decline we had. Selling now would be hundreds of thousands in unnecessary taxes so I’ve made adjustments via short calls but I’m really trying to go for a long term capital gain on this size. I’m trying to ride this out until January at least before I decide how much to trim to focus on other things.

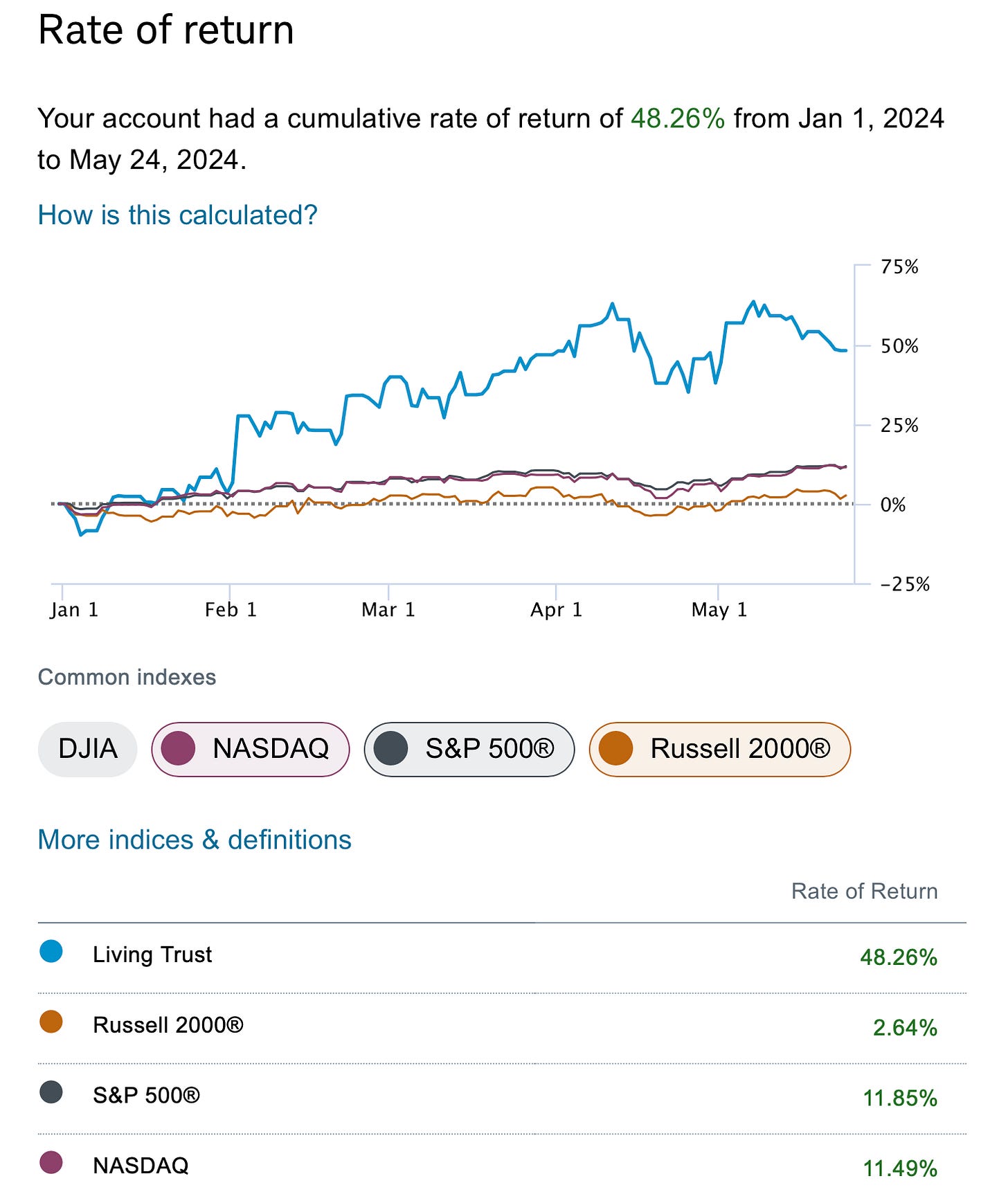

Again my goals may not be your goals. That is where I tell you all we have different goals and what I do shouldn’t be what you do. While it feels like Amazon is this giant pain trade, I step back and because of the leverage I’ve employed year to date I’m up 48.2% vs the markets at 12%. How can I complain?

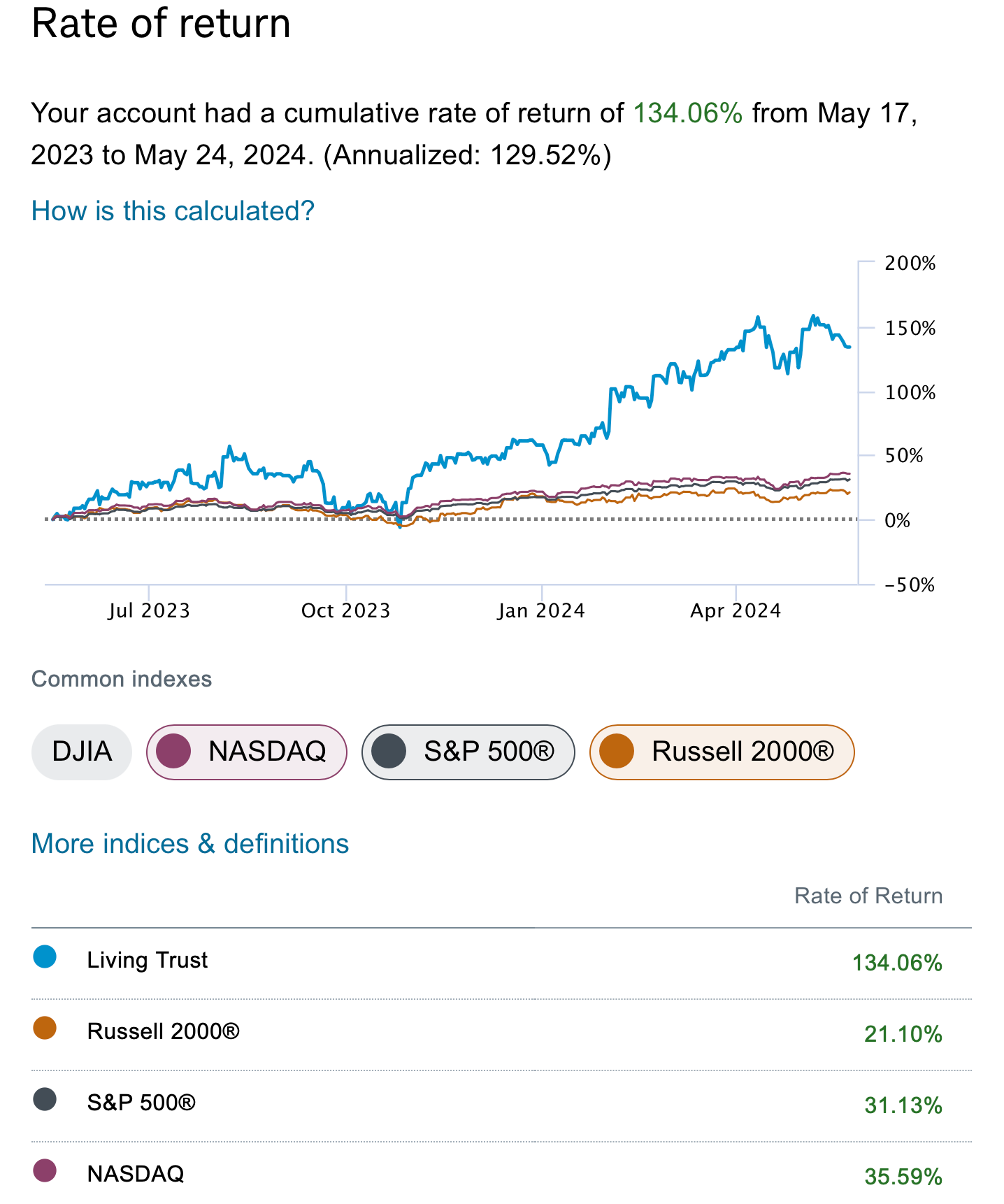

Going back to last May when I entered the trade I’m up 134% vs the market at 31%.

My stance on this is simple, if you entered Amazon when I did last May when I did, you’re up alot. If you’re concerned, sell it, it’s not like there’s a shortage of ideas in the daily recaps I send out. You can deploy the money elsewhere. If taxes weren’t a concern, I would have sold, but taxes are a concern so you have to think about them because I’d lose nearly 1/5th of my book in taxes to sell this thing here. I still think people really are underestimating the retail business and what is going on there, and I believe there’s a decent probability that if I held my position all the way through to June 2026 expiry I could be looking at a $250-300 stock with a substantial gain on those leaps from here.

These next few quarters will tell me alot more about where Amazon is headed but I’m not going to sell a name that I think is the best in the market because it underperformed for 10 days. You have to understand that when I entered leaps, it is basically like a levered bet on shares, I know the name isn’t going to be straight up everyday trade for the next 2+ years, there will be bumps in the road, this is one. What’s important is that your entry was right and mine was, going long below 120 last May did in fact end up being a generational buying opportunity like I said it was and this trade has been epic to me as I’ve returned a big number on some serious size.

I hope this cleared up some things for you, I hope you relax a little because alot of you are very high strung. To me when someone is this worried day to day over a name that is up significantly like Amazon, it means you’re over levered in short term options. Again this isn’t Tesla down 60% from 2021, those fans are still cheering that on everyday on Twitter, my inbox is filled with people upset over an equity that is up almost 60% from when I entered it last May, think about that? Now look at the Amazon channel in the discord and see the mental breakdowns daily from people up 40-50% on their calls this year and you begin to see the comedy here.

If you just step back and look at the big names since we entered AMZN is up 56.5% since last May. Google is up 45%, Microsoft is up 37%, Apple is up 10%. Only NVDA in the big 5 has a better return.

We’ve been leveraged into the 2nd best returning name in the 5 largest over the last 12 months, think about that. It was a once in a lifetime opportunity and many of you made life changing money during that timeframe. If you sold now, nobody would fault you. I am not selling, I’ve explained why, but I really can’t do emergency therapy sessions for all of you in my emails and discords over something that frankly isn’t an emergency in any way. Amazon is 6% off all time highs, I couldn’t imagine the email inbox of Gary Black with Tesla down so much, I almost feel bad for the guy knowing he has 50x as many followers as I do.

I love you all, I hope you have a great weekend and I will see you on Tuesday.

Two thoughts:

1) Given AMZN is woefully beyond on content, why don’t they make a play for PARS or WBD and get the back catalogs and production staff and create “cost synergies” by right-sizing?

2) Strategic NVDA play was/is obvious given all the CAPEX AMZN, TSLA, GOOG, META, etc discussed on their earnings calls. And it’s not a one-time thing as IT spend depreciates over 3 years so it is a ramp cycle w a tail. I expect NVDA run to continue for next 12-18 months (at least) albeit going from a Boil to a Simmer. If AMD, INTC, Groq others catch up, then TSMC, ASML, KLAC win regardless. Charts will indicate entry and exit points to go big and lighten up.

Great write up James, thank you. However, you should really give up on your TSLA hate. TSLA for me has been the biggest money printer man king has ever seen. That thing moves up and down so much, traders on TSLA can make 100x what they can make on AMZN. There is no better stock than TSLA for savvy traders both with PUTs as well as calls.