You Can't Win Them All

I wanted to make more post today because I won’t be around tomorrow, I wanted to go over something regarding the options data I post everyday.

First off this is simply data to help you make a more educated guess on the direction of a stock. There is absolutely no guarantee that every single trade is going to work. If they did, most funds wouldn’t underperform the index. The reality is, these are calculated bets which may seem like a lot of money to you, but in the scope of things, most of these bets are a small amount of capital to the funds putting them on.

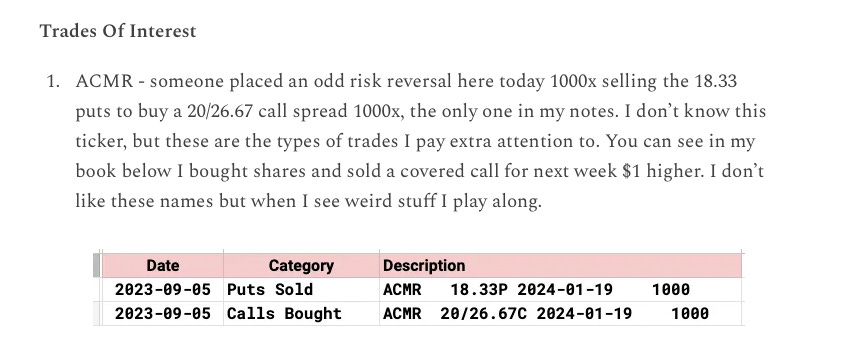

Case in point ACMR

On 9/5 I noted a very odd risk reversal placed selling 1000 puts to buy 1000 calls, here is a link to that recap LINK

That day I said I didn’t know the ticker but I take note of really odd trades like that and I did

Here is my transaction log for all my ACMR trades, that day you can see I bought 10,000 shares at an average of $18.97 and I sold a covered call at $20 for 9/15 on an equal amount of shares, 100, for .44/.45. I also sold some puts lower at 17.50

Now, you can see 6 days later, this past Monday I closed up that trade and if you look at my recap on 9/12, here, you see ACMR with “0” next to it because I had sold out of it the day before. As you can see above I lost something like .30/share but you can see I closed my covered calls for .19 from .45 so I gained .26 there all in all I lost peanuts maybe .05/share but the price action below wasn’t encouraging, the macd was rolling over and frankly I didn’t know this name, so I closed it.

Anyhow, I got an email this morning letting me know the ACMR trade I noted was closed out.

It just made me want to remind you all that sometimes, funds are wrong too. It is just reality, but unless you’ve worked in that business you wouldn’t understand the amount of work that goes into the placement of each individual one of these trades you see.

Many of you here work in the business so you understand, but the reality is most funds have multiple decision makers involved before an actual trade occurs:

You have the analysts who crunch numbers and model things

The traders whose job is to come up with the best way to play that analysis

The portfolio manager who actually signs off on the trade

So each little options trade you see in these tables daily, while they may look like just 1 simple trade, the amount of work, decision making, and projection that has taken place before that trade is placed is beyond your comprehension. What you’re seeing is the final result of hours upon hours of work done by multiple people and unfortunately they’re not always right but like all things in life, if you follow the money, you will win more than you lose.

What we see in these trades whether it be $1m here or $5m there, it sounds like alot of money, but unless you know the exact AUM of the fund placing it, it really is impossible to know the significance of the trade. For example, $8m of calls to someone with $2B in AUM is no crazier than you throwing $1,000 at some weeklies. It’s crazy to think of it that way, but it’s true.

More than that, as I’ve said many times, the whole purpose here is to try to note the trades, catalog the bets to try and gain an edge on direction names are going in and to play that, not to play the specific trades as they’re placed. As you saw I didn’t take that ACMR risk reversal exactly, I played it pretty conservatively buying shares and selling covered calls, if I wanted to I could have sold for a gain shortly after buying, but I gave the trade a shot and it didn’t work out. You see the bets, but how you play them can vary tremendously. The bottom line is you might have access to seeing what is being traded but you still have to know when to cut your losses, for me it was a very tight stop because I didn’t like the chart and moreover I didn’t know the name or feel comfortable with it.

There are tons of trades placed daily, they don’t all work out, how you size the bets on your end in your book are really up to you. I post my book everyday, you can see how I am positioned, but even I am not right every single time, the goal though is to be able to work your way out of it when you’re wrong through rolling out or selling covered calls in a worst case scenario, otherwise if you are uncomfortable you just close a trade and move on.

Great post

There were some very positive trades before ULTA's most recent earnings. I took a position. ULTA crashed after the report! Disappointing, but that's how it goes sometimes.