Why subscribe?

Paid Subscribers Get:

Access to my web app where you can go through my whole database.

Access to my community discord which is now over 2,000 members and 40+ channels. Live Data is included for everyone who chooses to sign up for it, there are 5 private channels at the top of the discord where there is a live feed and I post what trades I’m taking myself in a separate channel along with a channel of all the trades the others are taking and a discussion tab.

The day’s unusual options activity which includes over 150+ trades organized by: calls bought, puts bought, and puts sold to simplify your discovery process.

A daily post with a chart recap of the market technically

A recap of recent trades I’ve highlighted and how they’ve gone

Trends from my database showing my ranking system and which names are bullish and bearish on various timeframes to help guide on direction and making it clear what names are trending.

Trades of Interest which is the 5 most interesting trades I saw that day highlighted to a deeper level with charts and past trades on the ticker out of my database with a potential ways to play it following the big whale.

On the weekends I post a deep dive with a best idea based on options flow with charts and more.

So why should you subscribe?

There’s an order flow to the market that most retail investors do not understand. The focus is always on fundamentals, having focused on this throughout my life I can vehemently tell you that fundamentals are last on the totem pole in terms of importance. There is an order that dictates direction and it starts with options flows, then come charts, and then come fundamentals. Why? Because 90% of the market is computers trading and they trade off triggers and those triggers are the moving averages we see in charts. Charts in their simplest form are visual representations of buying and selling. We want to be in things being bought, if you do that, markets are a lot less painful.

Why the option flows? Because you want to know what big money is doing right now, correct? While most investors focus on 13-f releases which are months after the buy, I note the unusual options activity daily, and even live for those who want that in the live tier which is available at checkout. It’s uncanny how equities move after big players make these trades. In every daily recap I go over what recent trades I noted that worked out. So I take a unique approach that I developed in my career where we look at what options flow are happening and combine it with technical analysis to give an edge on the direction of a trade. That’s it. I’m taking all the available data available to me and trying to give you the best trade opportunities around based on what bigger players are betting on.

This is a good product for those who seek option flow data with a guide on direction, is it for everyone? No. I’m now one of the top 12 Finance Substacks with nearly 6,000 subscribers so that should tell you that others find enough value here to stick around. Yes other options services exist, some may even be cheaper, but I built this by taking what I didn’t like about those and fixing it. I curate a great list of trades daily so you don’t have to waste time. I highlight trades in depth, I filter the noise to give you only the most unusual action I see daily. I’m biased but I think this is the best bang for the buck out there. I have a unique method that I developed over time and I’m not sure anything similar to this approach is out there. This process is repeatable and understanding how to combine option flow with technical analysis is something you can apply across any ticker. This methodology helped me find direction on names while looking for an edge. I’ve taken a fairly complex and difficult to understand topic like options data and organized it in a manner that removes all the hard work while highlighting the best trades daily to simplify your life in a short daily recap.

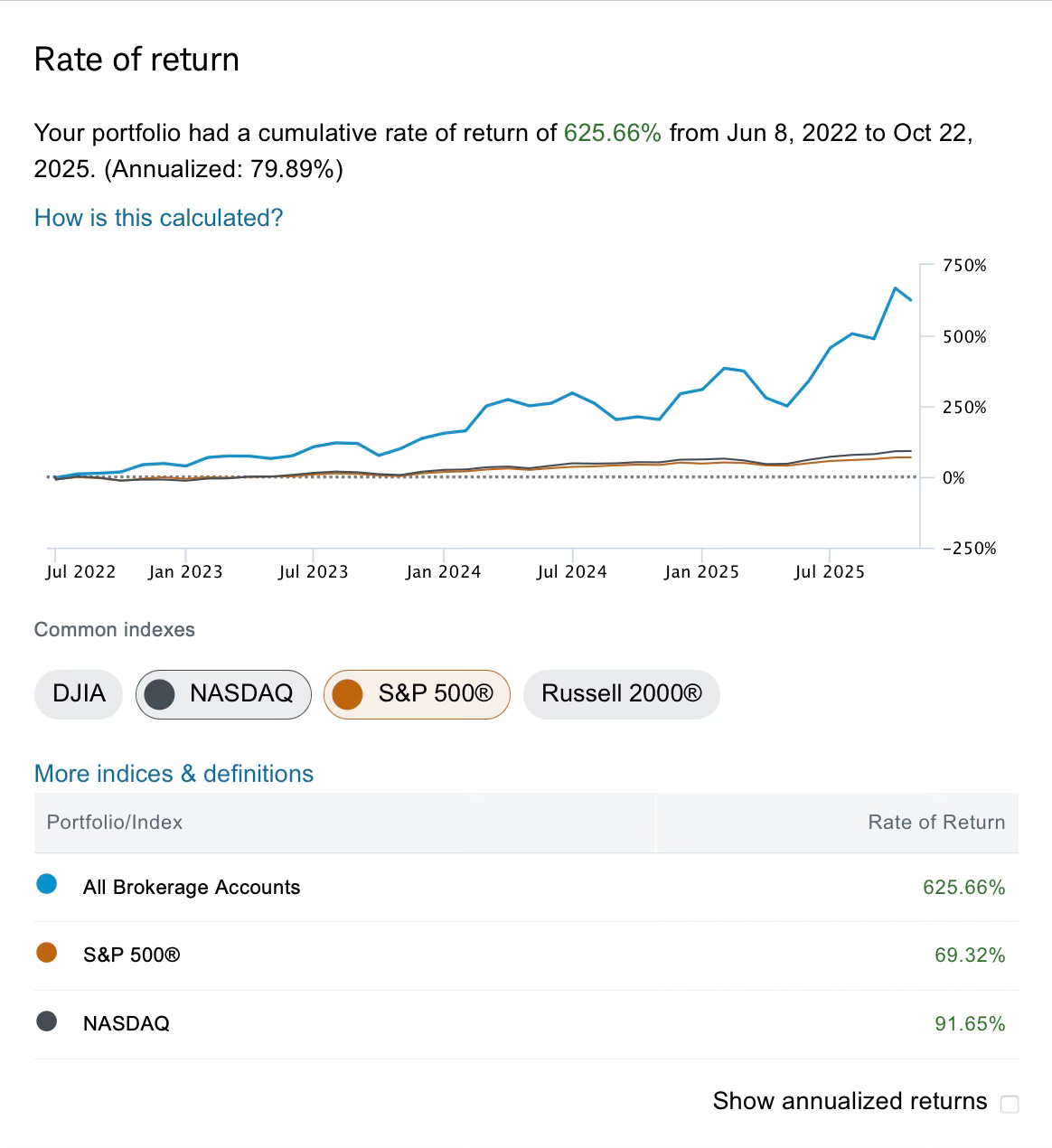

Also you should subscribe because I’m honest, while everyone else is posting their excel spreadsheet gains, I post my trades and gains straight from my book. My open book is included in every recap. When I execute a trade you can see the size in the volume on the option chain. I don’t make trades often but when I do they come with a deep insight on the how and why. Aside from that, I’ve posted all my real returns from day 1 where I’ve outperformed the market by almost 9x as of today October 23,2025 since I began writing this substack in June of 2022 as you can see below. I’m not perfect I do occasionally lose too as you can see below, but I always manage to learn from my mistakes and right the ship quickly. We went through a really rough patch when I started writing before the great 2023 we just had but I always managed to find trades that worked utilizing my own method of digging through the options data to find the trending names that I share with you all daily.

Aside from all the above, the community alone that has been built around this substack is incredible. You will get a welcome email when you sign up, it includes access to a discord server where you have some of the biggest names on Twitter along with many finance professionals bouncing ideas in multiple channels. There are over 2,000+ active daily users and it has become one of the best corners of finance on the internet. Lots of the people you know off fintwit are in there. You can ask questions from some of the best traders around. You can watch what they’re doing as they post their trades, you can discuss specific companies in their specific channels, and it is quickly growing with new members daily. The link to the discord is in the welcome email when you sign up.

As I said earlier, for those who seek even more, there are 5 live channels in the discord that is for those who choose that option when they’re subscribing here upon checkout. It provides everything you get in the recap but in real time for the active trader who wants to capture moves as the options data is coming in. There is a live feed, a discussion area for 320 or so members, and a live trades tab where everyone posts what they’re taking. Options move quick and while I do get the recap out mid day, this is live and gives you access immediately so you can enter trades right away. It’s around $10/day and if accessing this data live with that community cannot help you generate that back many times over, you’re in the wrong hobby. The discussion in there is top notch if you’re looking for a very serious community to take your trading to the next level, if not there are plenty of trading channels within the discord that all the other members discuss trades in, just without access to the live data.

Overall you’re gaining access to over 100 trades a month that I highlight individually, along with nearly 3,000 unusual options trades a month to pick from added to the database. On weekends you get a deeper dive into a best idea that I highlight based off charts and option flow. Whether you’re an active trader or a passive investor, understanding trends on what big money is doing in the markets matters. Options flow dictates the moves you see, big funds position themselves in trades through the options market and nobody highlights the trades the way that I do. I’m constantly adding new functionality and I am light years ahead of where I was when this began 3.5 years ago in terms of user experience and it’s getting better by the month.

In the end there is a free trial, give it a go, you have nothing to lose.